Is public debt a constraint? Lars P. Syll gave recently an answer by quoting Abba Lerner who, in 1948, made a distinction between private debt and public debt. The first is reflected ultimately in a transfer of an actor of the economy to another to meet his commitments. In this case the debt is actually a constraint for one who is committed to repay.

For public debt indicates Abba Lerner, the question is not posed in the same way as generally residents of the country hold the debt. It’s a debt a country has on itself and it shouldn’t be an issue. Nevertheless there is the question of the intertemporal allocation of resources. A general argument is that a higher public debt could lead to impoverishment of children and grandchildren. This argument is swept by Lerner indicating interests and repayments of the debt will be done in the future to children and grandchildren. This is what has long been observed and still is in Japan, where public debt is majority owned by residents. The level of public debt is circa 240% of GDP and this doesn’t provoke a crisis.

Beyond Japan, the argument developed by the Moldavian-born economist is not always relevant. In some developed countries public debt is now held by a significant proportion of non-residents. Thus the public debt becomes a constraint because there is a transfer between residents and non-residents. In other words, public debt creates the same constraint than for a household who has to repay its debt by a transfer.

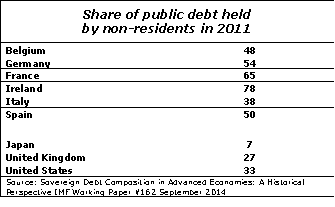

When we look at Euro Area countries and other developed countries we see that there is an important discrepancy in the proportion of non-residents holding the public debt. The table below shows that for the 4 main countries of the Euro Area, the average is close to 50%

This reflects the financial integration of the area and the ability to hold sovereign debt of other member countries in investment structures. Due to the common currency and because flows between euro countries are usually reciprocal, the weight of non-residents is not a constraint. As far as the Eurozone works, this debt and the diversity of its holders are not an issue.

But if there was a risk of a break of the Euro Area it would create a severe adjustment because spontaneously the debt holds by non-residents become an external debt. Moreover a break in the Euro Area would create uncertainty on currencies value. A break in the Euro Area would create two sources of uncertainty: one because a large part of the public debt would become external debt and the other because we will not know the value of the debt due to currency adjustments.

In other words, the public debt is not a constraint in the Euro zone as far as it is a monetary union. It would be even less in the case of Eurobonds with a common fiscal policy. For now, there is already a kind of substitutability between public debt and this is done by the ECB through its various operations (QE).

If this were not the case, if the Eurozone was no longer a monetary union, then the public debt held by non-residents spontaneously become a major constraint in view of the amounts held by non-residents.

In addition, the current situation reflects a great confidence among investors about the country’s ability to repay debt. That is why this monetary union can work. A country that would come out and see its currency depreciate would do well to keep that trust, that is, by paying in the currency of the lender, to possibly find with non-residents the ability to finance again. In other words, the best behavior is to continue the current monetary union and to associate a cooperative fiscal policy in order to increase and to fix integration definitely.