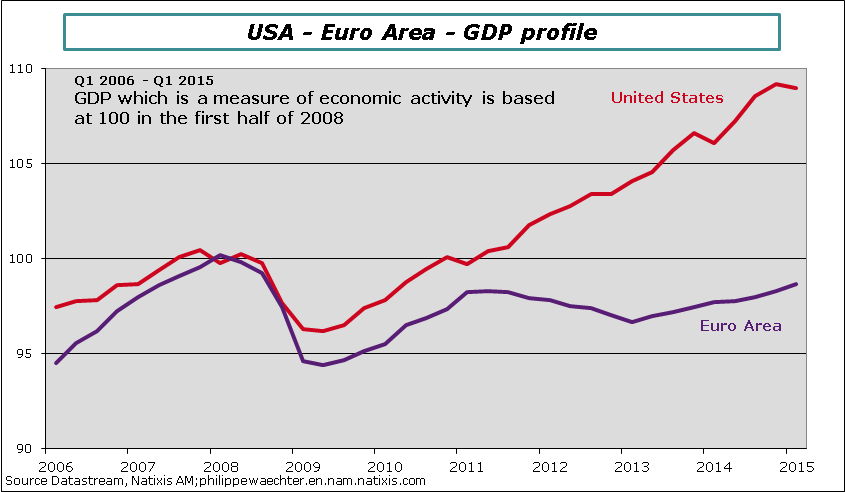

We can first compare the situation at the beginning of 2015 with the level of activity recorded in the first half of 2008. Taking this period as a reference before the break associated with the Lehman crisis, the United-States are significantly doing better than the Eurozone. The former have a GDP which higher by 9% compared to the reference period, while the euro zone is still contracting by -1.3%. There is no doubt the US has done significantly better than the Euro Area. This is what the first graph shows.

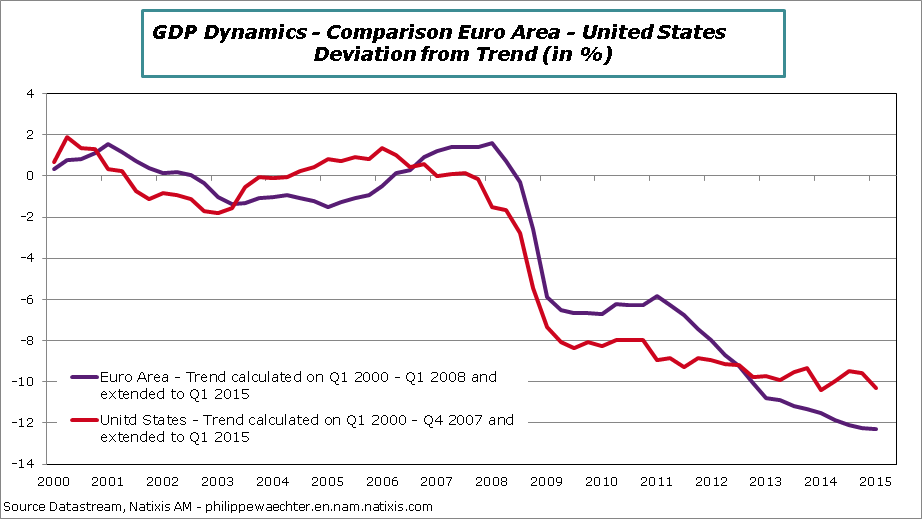

In this case, as shown in the graph below, the results are more mixed. Certainly the US are doing better than the Eurozone but it is not obvious. Given the dynamics that characterized each economy before the crisis, the gap between the two countries is not so important. In relative terms, compared to pre-crisis dynamics, the US does not do much better than the Euro Area. The USA was growing faster before the crisis but their current momentum relative to this trend is not much stronger than what is observed in the Euro Area.

The Lehman’s shock is durable, persistent. Both profiles are not satisfactory even in the USA where the growth trajectory is stronger in absolute value. There is no tendency at all to the convergence to the previous trend.

In the euro zone, without the implementation of austerity policies, from 2011, the profile might have been more robust than that of the USA according to this relative measure.

The long recession, that hit the euro zone as a result of this policy that wanted to rapidly reduce public deficits and to stabilize public debt, is observed by a sharp and persistent breach in 2011. The slow recovery observed since 2013 is not sufficient to stabilize the dynamics of the Eurozone.

In light of this chart, the dynamics of the activity must still be supported by accommodative policies. To imagine that the ECB could stop its current supportive strategy is stupid. At the same time, can the Fed afford to be tougher? Not sure.

The US economies and the Euro Area now have a much lower trajectory than was observed before the crisis.

The difference is significant and should ask whether you consider that it is a natural fit that will ultimately result in fewer jobs, or if it is possible to reverse the trend to promote employment and income?