Public debt is always the source of deep and intense discussions. It’s often the case in France but it’s currently also the case in the USA with republicans’ candidates. Usually, public debt concentrates all the uncertainties and concerns about the future. A too rapid increase of the public debt is often perceived as a persistent deterioration of the future.

Happily this is not that simple

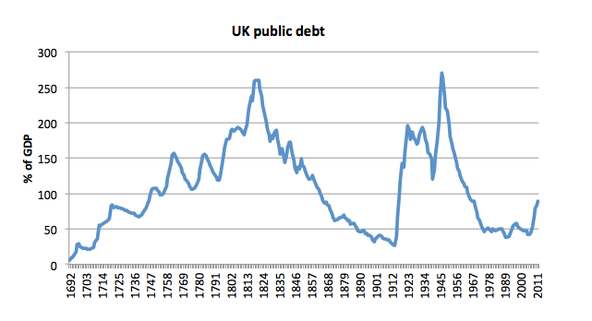

First, public debt in the United Kingdom has been high for numerous years, decades and centuries. It has not prevented UK supremacy on economic and political fields.

It’s not a theoretical question because most of life insurance contracts use public debt as their main asset. How would life insurance behave without public debt?

Public debt is also a way to smooth shocks through time. The graph above shows that increases in public debt has usually been associated with wars (Napoleonic wars, WWI and WWII). It was easier to postpone their financing with debt.

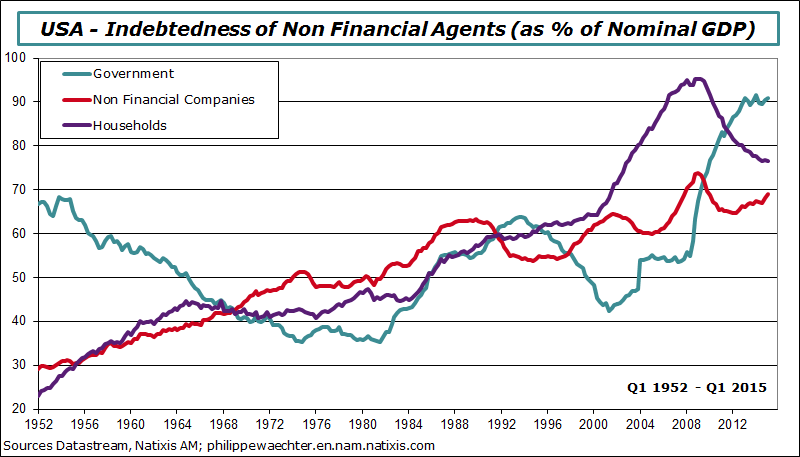

In other periods, in can help transferring an excess of private debt on the government. This latter will be able to amortize it in the long and very long-term and at the same time it will reduce constraints on the private sector.

That’s was the US strategy from 2009 on. The private debt (households and companies) has been reduced and at the same time public debt has increased rapidly. Growth drivers are in the private sector and by this transfer there is a reduction of private sector’s constraints.

Probably, the private debt reduction has not been enough to create a strong US recovery.

Just on remark to start: who will receive in the future the interest paid on life insurance contracts? Our grand children. So that’s not an issue

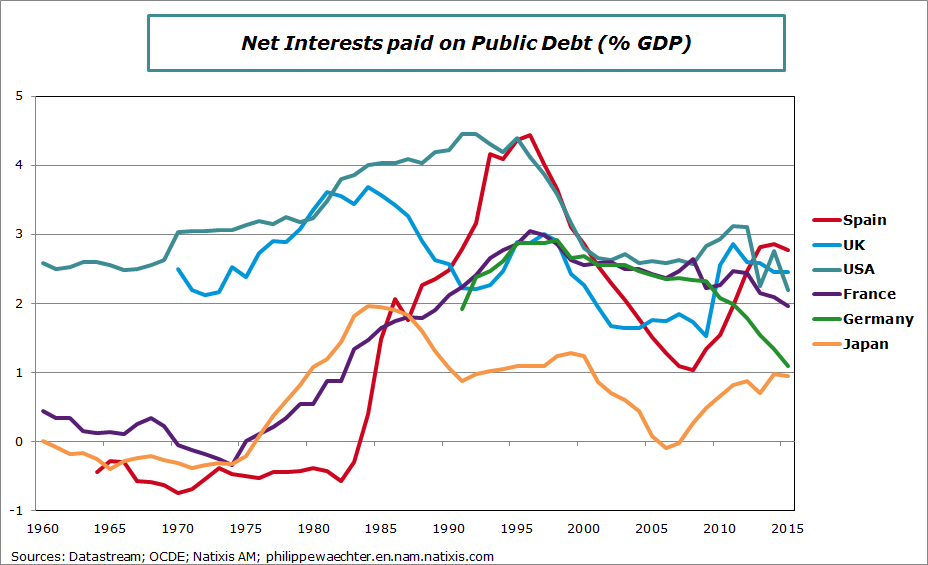

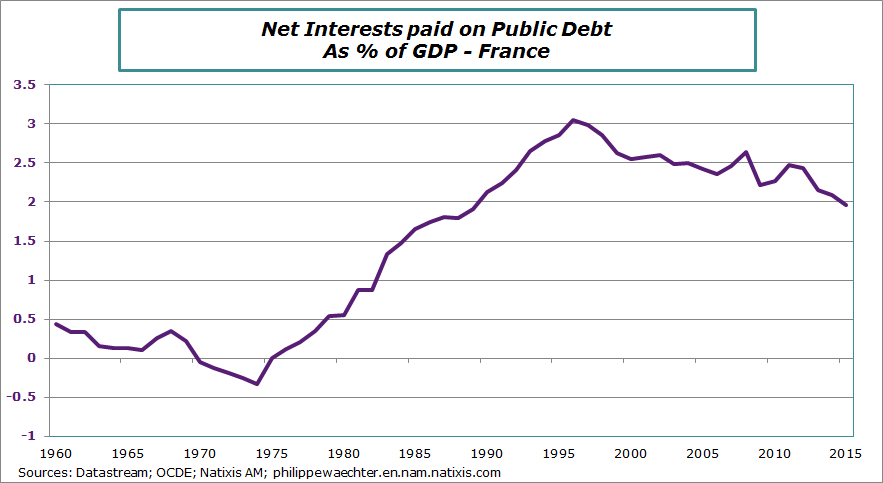

And are interests paid so important?

In France, the amount is back to 1989 level. Lower interest rates have had a strong impact; interests are close to 2% of GDP, 1 point lower than in 1995.

Interest rates will remain low for an extended period and it’s time to take advantage of that. It’s time to invest and to support public investment in order to create an impulse that will allow the economy to jump on a higher trajectory. This will create strong incentives for the private sector to invest. At the end it will help to reduce the debt to GDP ratio by increasing GDP.

Doing nothing and trying to reduce the public debt rapidly as it has been done in the Euro Area after 2011 has been a catastrophe.

The relationship between interests paid and growth is not as simple as some expect it to be.

Philippe Waechter's blog My french blog