The ECB survey shows, at the end of 2015, a new improvement on credit conditions for companies.

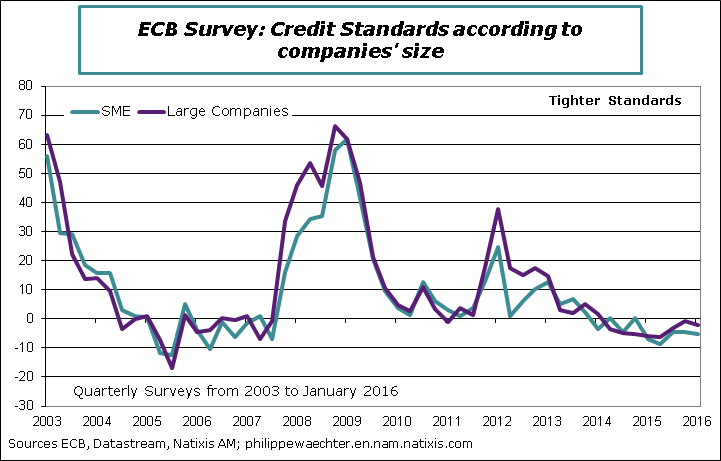

The first point to mention is that credit standards are still accommodative at the turn of the year. Banks are not tightening their behaviour on the credit market. Credit standards are almost at their lowest. That’s what the graph below shows. It’s not the situation encountered in 2009 and 2012.

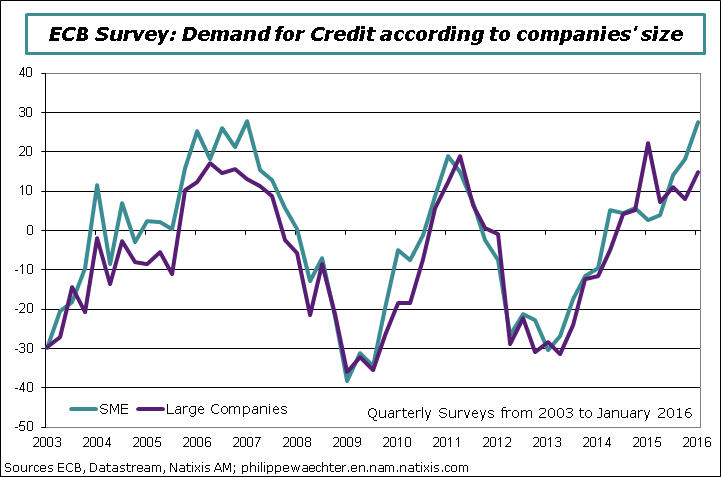

The second question is related to the shape of the demand for credit. There is clearly a upward trend. For Small and Medium Enterprises (SME) and for Large Companies the demand for credit is stronger now and is still improving specifically for SME. It seems to be robust.

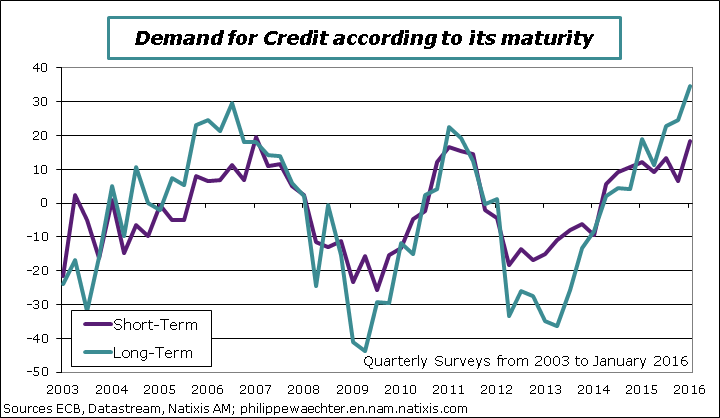

The demand for credit is stronger for longer maturities. This means that the economic horizon for companies is wider and that there is a reduction in uncertainty.

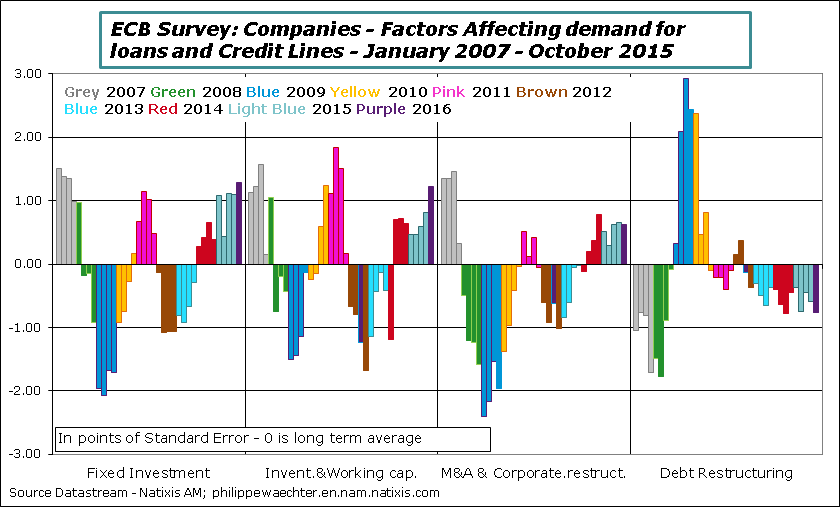

The last question is to know the reason for this stronger demand for credit. On the graph we see that demand for investment is stronger. It is not yet clearly seen on macroeconomic figures of capex but companies now have an eye on investment and that’s positive. The second point is that the need for financing the current activity (Inventories and working capital) is increasing rapidly. This is a way to realize that the business cycle is stronger in the Euro Area.

Signals from the credit market are currently stronger It probably comes from the design of the ECB monetary policy. There are less constraints as there are ample liquidities and interest rates are low for long. And the ECB monetary strategy is easier to read at a long term horizon; that’s pretty good for companies as this reduces uncertainty.

Monetary conditions and improvements on the credit market are necessary conditions for a recovery. That’s an important step but more is needed to boost demand and that’s the role for fiscal policy.

Philippe Waechter's blog My french blog