The first quarter of 2016 shows a strong acceleration in the economic activity of the Euro Area. Its growth was 2.2% at annual rate after 1.4% during the last three months of 2015. During the same period, GDP was up by 2.2% in France and 3.2% in Spain (we do not have more details).

The carry over growth for 2016 at the end of the first quarter is 1% for the Euro Area and France and 2% in Spain. This should be consistent with a 1.5%+ growth in the Eurozone and France and to circa 3% in Spain.

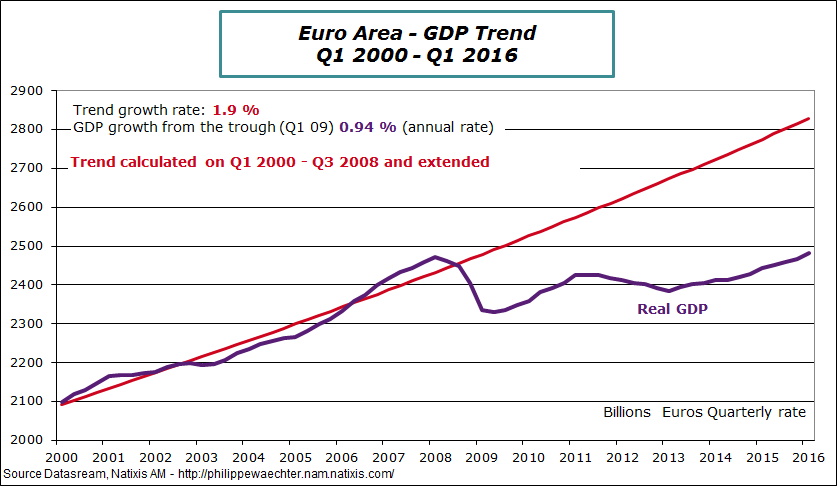

That’s a real improvement because GDP growth was almost 0% on average in the Euro Area from 2011 to 2014. There is a real change in its economic profile (see graphs below). Now, the level of the GDP is above its pre-crisis peak. It has taken almost 8 years for that. It’s too long and has persistent effects on productivity and on potential growth.

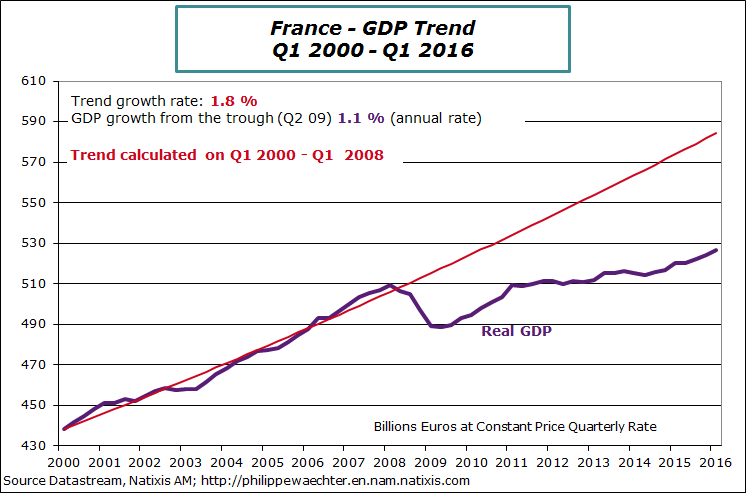

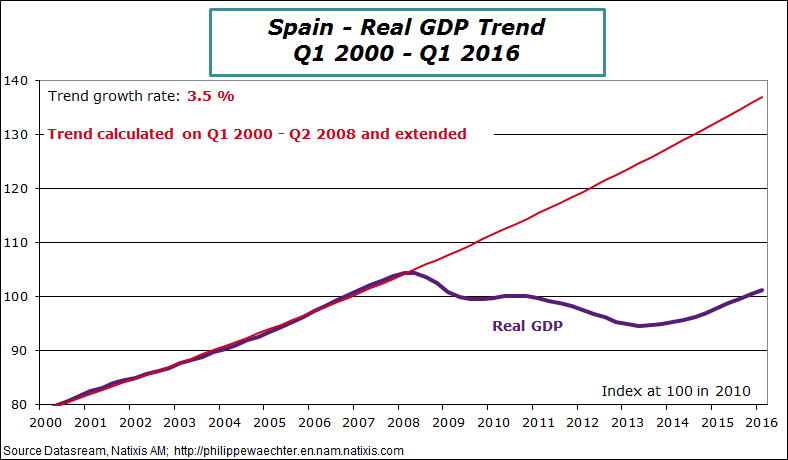

In France, growth was just 0.4% per year from Q1 2011 to Q4 2014, it’s now converging to 1.5%. it’s a real improvement and it will be positive for the labor market dynamics .For Spain, growth numbers were still negative in the second quarter of 2013. Since then the recovery has been strong but GDP is still 3% below its pre-crisis peak.

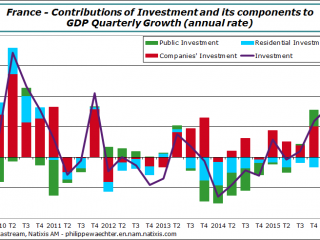

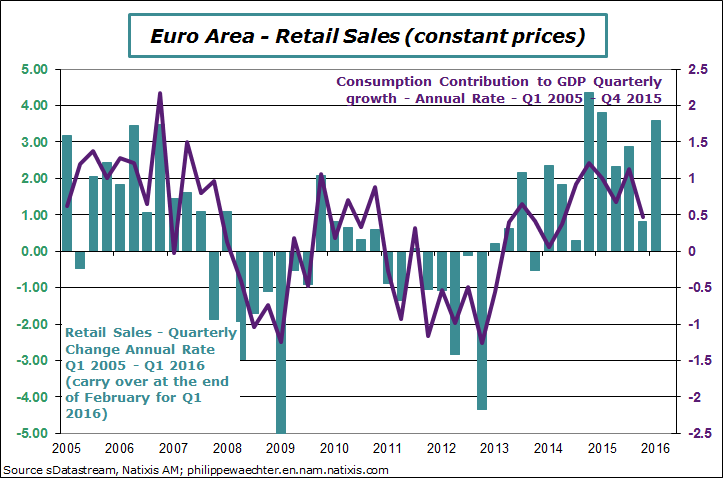

The main source of this recovery is internal demand. We do not have details for the Euro Area and Spain but some for France. It is households’ expenditures and corporate investment that were the main growth drivers in France. We can see that in the two graphs below

The current dynamics of the Eurozone is pulled up by internal demand.

Financial conditions have improved dramatically in recent months (lower interest rates, lower oil price, lower euro exchange rate), there were improvements in economic policy (in France notably in order to improve companies’ margin) and there is a stronger expected demand (linked to consumption). These are the conditions for a stronger investment momentum. That’s what we expect for 2016 and was probably already seen during the first three months of 2016 (as in France).

This momentum gives some autonomy to the Euro Area growth that could converge to a kind of virtuous cycle. This economy would be less dependent on external shocks. That’s a rationale for the ECB strategy. The central bank has tried to put in place conditions for a more autonomous business cycle that could cushion external shocks. That was my perception of the situation in the Euro Area last year but I have had doubts at the beginning of 2016, but may be, at the end, that’s the right way to look at the European outlook. That could be very positive as this could lead to a more sustainable growth trajectory.

The main risk is a blow of uncertainty that could come from the Brexit referendum. Instead, we can be confident in the Euro Area growth momentum.