The result of the referendum on Brexit has created two types of uncertainty.

The first is related to the economic momentum. We don’t know if the Brexit will create a fracture in the globalization or if it is just a temporary shock for the world economy even if it is a strong one for the United Kingdom.

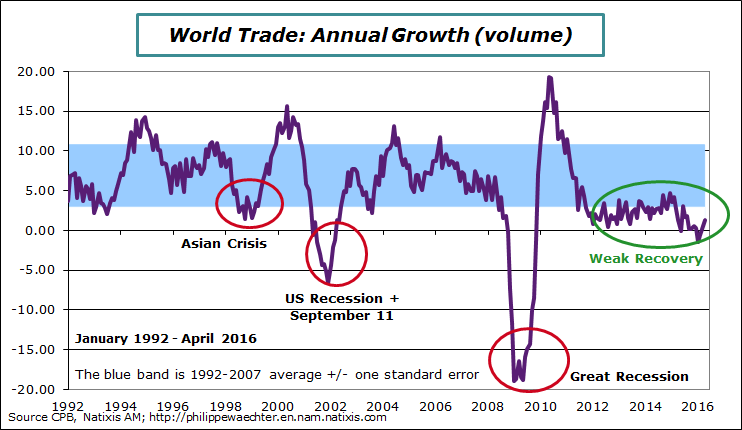

In other words, the fear comes from the fact that the world trade momentum is low, lower than what we used to see before the 2008 crisis. The world has changed with the crisis and is now unable to follow a strong trajectory.

The second type of uncertainty comes from the negotiation between the UK and the European Union. It will take time as there is necessity for the future prime minister to find a majority at the Parliament before being able to start discussions and to make a notification on the article 50. The important point is that it is the parliament which will back the decision to notify. Currently with the actual parliament it would be difficult to find a majority favourable to the “leave”. The question is about the type of strategy that will be adopted. It could be: negotiation first and then notification. That’s what Theresa May has said. As she said that there will be no general elections before 2020, she expects that negotiations will change MP’s mind on the situation. That’s the logic of discussion before notification. But will the be patient enough to allow that?

The strategy could be reversed: a notification first and discussions after. That’s what Andrea Leadsam has in mind. Will she have a majority without general elections? Not sure. Consequences for the UK would be important in that case. With a rapid notification the risk of a shock for the world trade could be higher because negotiations on the Brexit supporters’ side are not prepared yet. It could be a jump in the unknown.

The Bank of England will become more accommodative this summer by lowering its rates. It’s a step to avoid too much volatility on the economy in this period of intense uncertainty

Philippe Waechter's blog My french blog