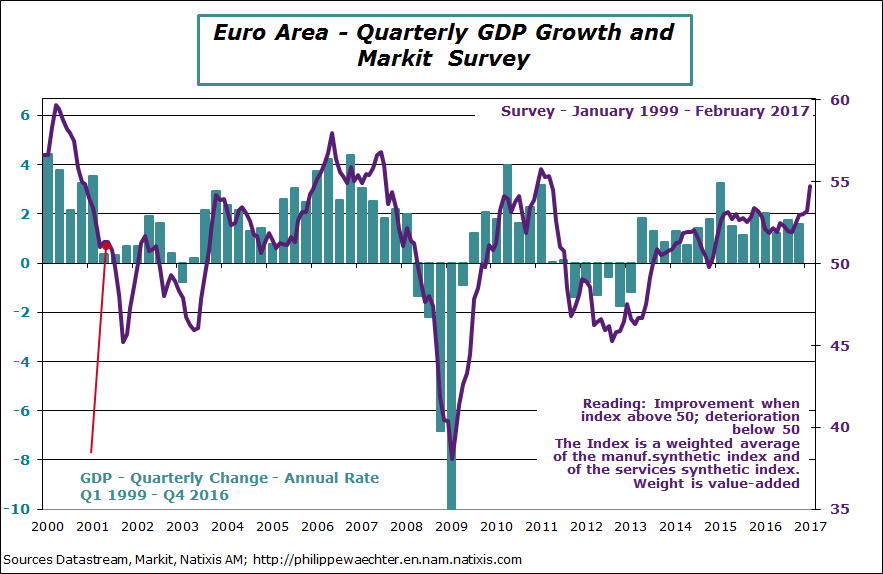

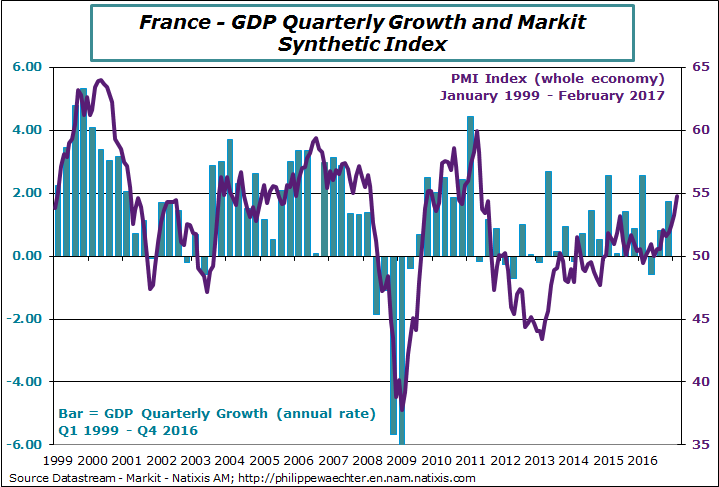

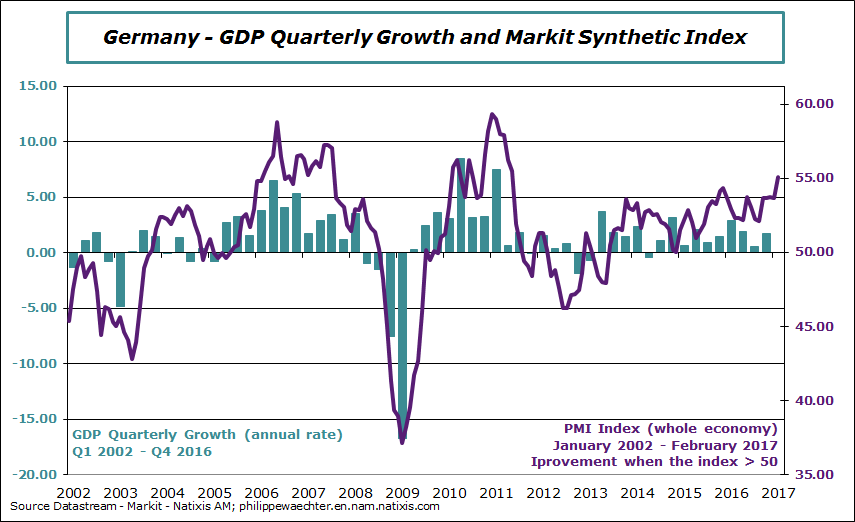

The Eurozone synthetic index of the Markit survey for February 2017 is skyrocketing. Its level is the highest since April 2011. For France and Germany profiles are similar. The French index is back to its May 2011 level and for Germany the comparison is for June 2011.

Therefore the GDP growth for the first quarter may be stronger than expected and for 2017 the figure should be stronger than what is currently forecasted (see here).

Economic policy stances are more stable and more readable since 2014/2015. Fiscal policies are more neutral and the ECB strategy is accommodative and perceived as such for an extended period. As a consequence, companies and households’ behaviors depend more on their own constraints than on hazardous measures taken by governments as it was the case until 2012/2013. Moreover interest rates are very low, financial conditions very accommodative and the oil price is stable at a low level.

There is a need now to continue and the ECB will maintain its current strategy. This will help to amplify the current growth improvement.

The Euro Area index profile suggests that all the other countries (outside France and Germany) are also performing well (We don’t have early estimates for other EA countries). This means that the current impulse will lead to to stronger and more dense trade between EA countries creating the conditions for a more virtuous business cycle. It will be more autonomous and will create more jobs therefore reinforcing the internal demand momentum.

The main risk is on the political side.

The first graph shows, for the Eurozone, the consistency between the Markit synthetic index and the GDP quarterly growth. The spike of the index in February is spectacular. This should lead to a higher GDP growth figure for the first quarter.

This consistency is also seen in France. The acceleration seen in the index should allow a more stable GDP quarterly growth than the seemingly randomly distributed growth figure seen since 2011.

In Germany the profile is robust and should be associated with stronger growth figures.

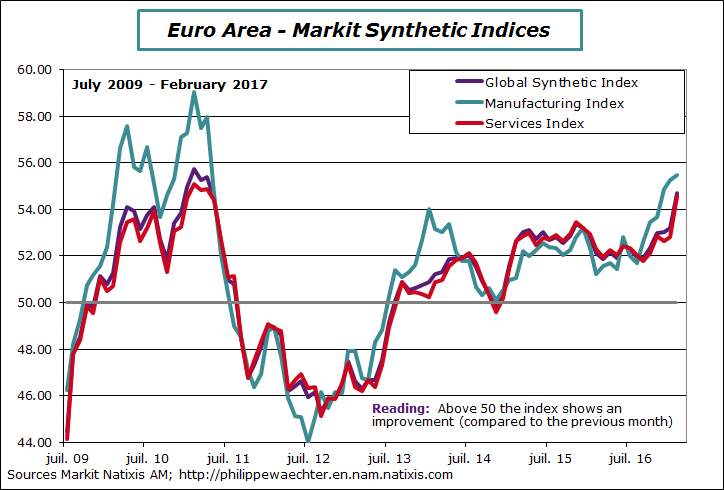

Details show that both sectors, manufacturing and services, are dramatically on the upside. This consistency is also seen in Germany where the manufacturing index is at its highest since May 2011. For France Services are very strong while the manufacturing index is strong but weaker than in January.

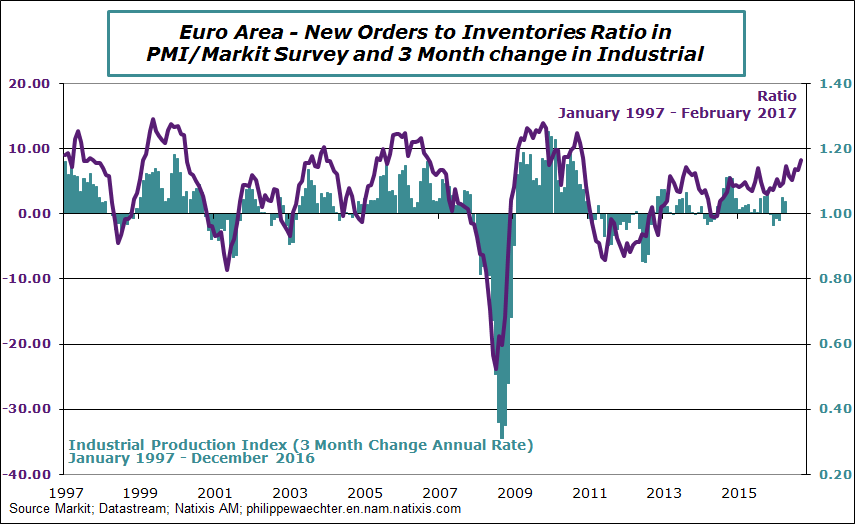

The New Orders Index is at its highest and the ratio of New Orders to Inventories is at its highest since April 2011. The industrial production index should increase rapidly in coming months. It was already robust in Q4 2016 and this will continue in 2017.

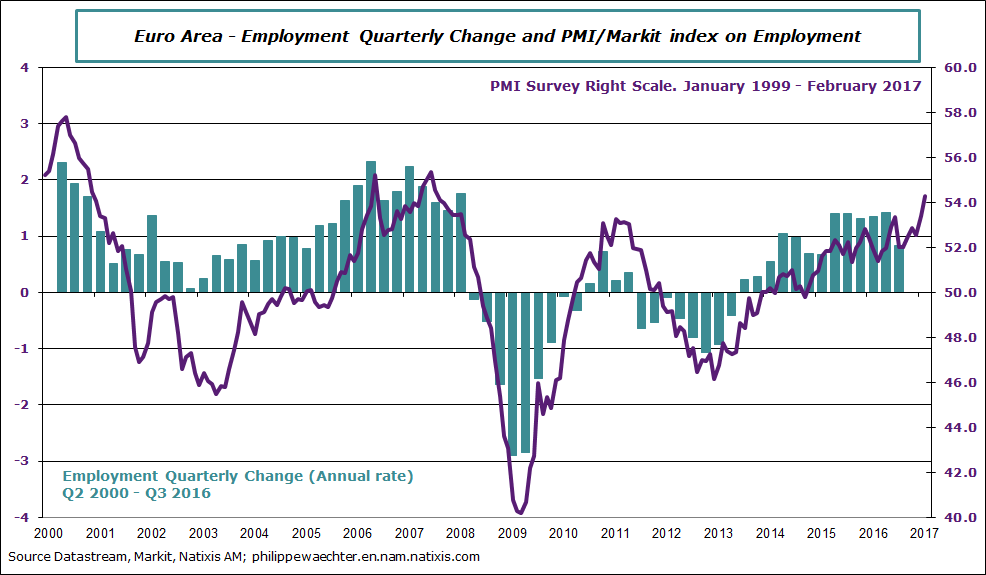

The employment index is clearly on the upside, at its highest level since August 2007. That’s an important part of the virtuous business cycle.

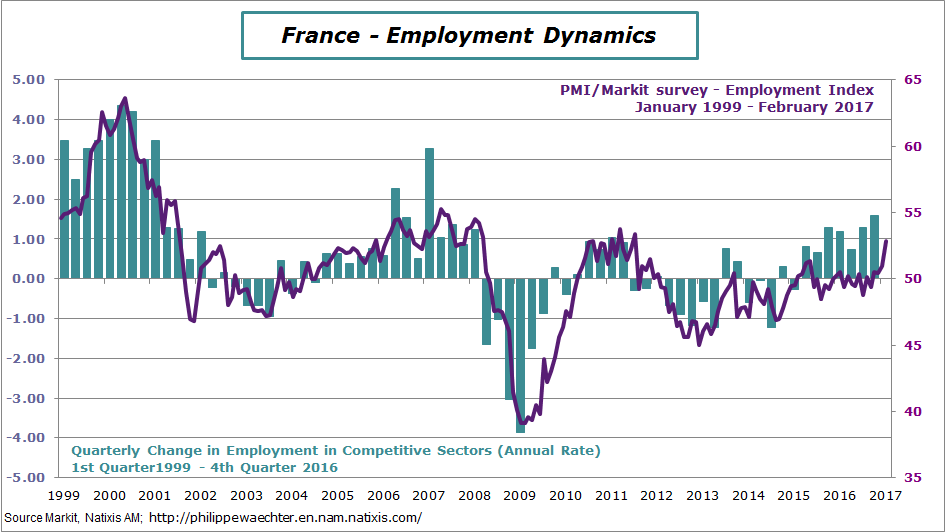

It’s also the case in France with a real improvement on the labor market for months.

There are nominal pressures, but this linked to the oil price and temporary. Therefore this mustn’t change the ECB strategy.

Philippe Waechter's blog My french blog