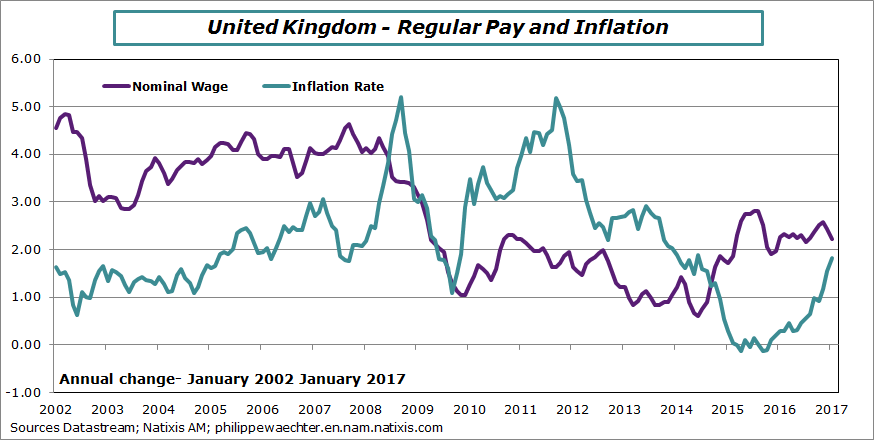

For the English salaryman, the situation is becoming more complex. The higher inflation rate is currently reducing the gap with the nominal wage growth (graph 1). The figure for wages in January shows an increase above 2% while the inflation rate is just a little below 2%.

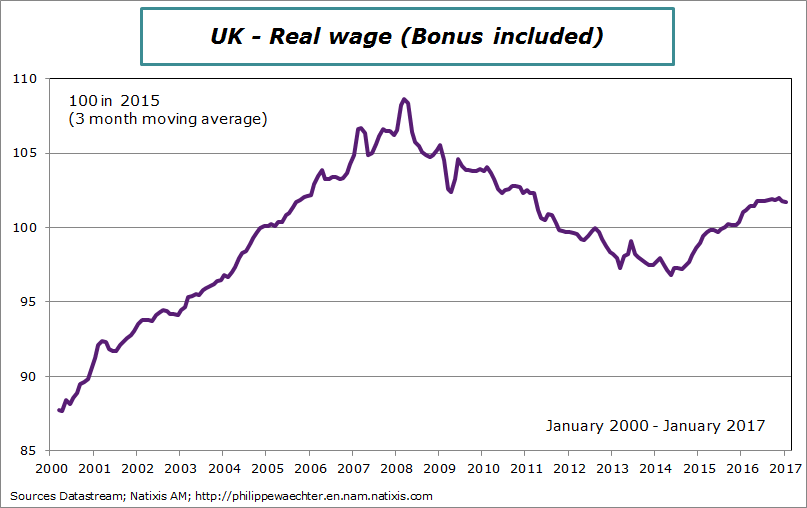

From the end of 2009 to the end of 2014, the purchasing power of wages has dramatically decreased. Real wage is not back to its pre-crisis level. (graph 2)

The Brexit is currently starting will be a persistent negative shock on the economy. The changes in rules for the economic relationship between UK and the European Union will have a persistent negative effect on the economic activity and therefore on the labor market. Nominal wage growth will be limited while the inflation rate will remain high. As a consequence the external negative shock will not be compensated by a strong internal demand.

The situation will be hard to manage in the UK.

Graph 1

Graph 2

Philippe Waechter's blog My french blog