This is my weekly column for www.forbes.fr. Here You can find the original in French

Since the financial crisis in 2008, trend growth has slowed down sharply across western countries.

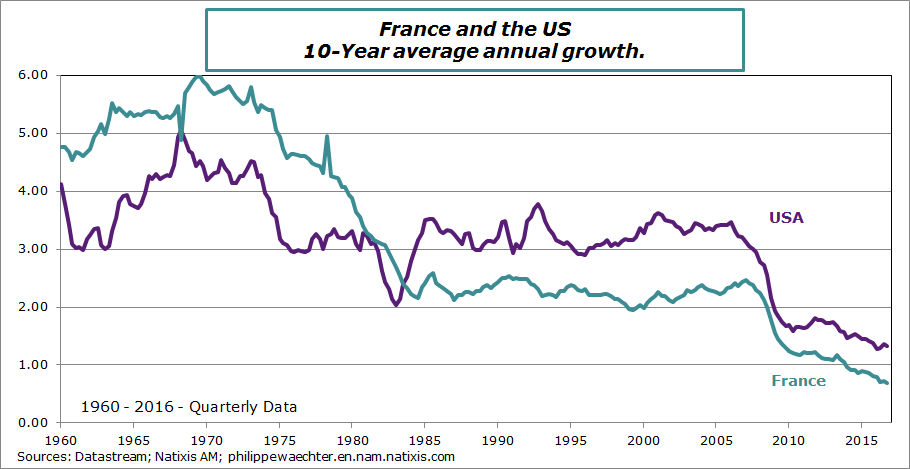

The chart below tracks 10-year average annual growth in the US and France since 1960. In the 1960s and 1970s, French growth was very robust and considerably outstripped figures in the US, as France enjoyed a phase of catching up on growth as compared to the United States. In the mid-70s, this “catch-up” momentum came to a halt, productivity gains declined and growth slowed sharply to reach a steady trend of around 2%. US growth was slightly higher on average and displayed a more stable pace with a trajectory of around 3% until 2007.

Since the 2008 financial crisis, trend growth has faltered in both countries, and currently stands at slightly over 1% in the US (1.3% on average over 10 years at end-2016) and slightly under 1% in France (0.7% at end-2016). A large proportion of this decline can be attributed to the deep recession that took place between fall 2008 and spring 2009. However, even if we set aside this period, trend growth is still weaker than before the crisis. Average annual growth in the US has stood at 2.1% since hitting a low in 2Q 2009, while in France this figure is 1.1%, which is still well below figures enjoyed pre-crisis.

Economists analyze this downturn in growth but cannot agree on the factors that triggered this trend. This is unfortunate, as economic policy recommendations to deal with the situation hinge on the ability to identify the driving forces behind it. There are three types of economic explanations.

The first explanation (Kenneth Rogoff) attributes this weak growth to the macroeconomic adjustment in the aftermath of a severe financial crisis. The crisis is the result of a build-up of private debt on a specific asset (real estate). The outbreak of the crisis was followed by a very long period of adjustment due to the tensions triggered by this accumulation, with the State intervening to cushion the shocks triggered by the crisis by issuing public debt. The State therefore bears part of the overall adjustment and the crisis is carried as a shared burden and spread out over time. Carmen Reinhart and Kenneth Rogoff (“This time is different – Eight centuries of financial folly” Princeton University Press 2009) explain that it takes six to ten years to recover from a crisis. If this analysis is correct, then there is no point worrying about high public debt as it is simply a way of cushioning these shocks. Desperately trying to cut it back means taking the risk of restricting and limiting adjustments that are under way and therefore hampering growth.

The second argument (Larry Summers) suggests that the period of slow growth reflects the accumulation of past imbalances and the inability to recover from this situation spontaneously. The economy is characterized by excessive savings, an ageing population, high private debt and inadequate investment. We see these features across all industrialized countries to a greater or lesser extent. Insufficient demand leads to sluggish growth and lower incentive for corporate investment. The solution to this situation involves active economic policy aimed at shoring up internal demand. This includes proactive fiscal policy and accommodative monetary policy in the long term. This scenario also leads to low inflation and obviously low interest rates over a long stretch of time. Excess savings must be cut back and investment encouraged in order to foster productivity gains and growth. In this analysis, public investment has an important role to play in buoying private investment. Cutting back public spending would be the worst option as it would push demand down even further, and hence reduce incentive to invest. Growth would then be dented in the long term.

The third approach (Olivier Blanchard) is based on the role of pessimistic projections and can be used to add to the previous explanation. It has been observed that all downgrades to growth projections lead to a reduction in spending, therefore hindering growth. In other words, the gloomy environment created by downgrades to already pedestrian growth prompts caution among the various economic players. They expect the future to be tougher for both business and employment, and therefore adjust their behavior by opting to spend less. The origins of this explanation can be observed in the restrictive policy witnessed in Europe in 2011-2013. Restrictive fiscal policy measures fuelled pessimism and prompted households and businesses to bolster their savings, or at least cut back their spending as a precautionary measure. A return to more stable and more clear economic policy reduces uncertainty and can trigger an improvement in growth, at least in the short term. This is probably what we are seeing currently in the Eurozone. The role of fiscal policy is also key in this case: at the very least it must be neutral, while a more proactive approach fuels more optimistic projections and promotes a return to growth.

These three interpretations of the economic cycle are not complementary but they all feature the key role of macroeconomic adjustment via fiscal policy. The restrictive policy experience was not beneficial at the start of the current decade in the Eurozone. It did not lead to a stabilization in public debt and did not set off robust growth momentum either.

If we apply these approaches to France, it looks like there is no need to take drastic steps to cut back public debt, which has played a key role in the macroeconomic adjustment that is perhaps not yet entirely complete. Adopting an excessively restrictive fiscal strategy means taking the risk of failing to fuel demand and being stuck with slow-moving growth. Against this backdrop, implementing structural reforms does not seem to be the way forward either, as structural reforms mean changing the rules of the game. Generally, this triggers revenue increases for those who benefit from the reform, but decreases for those who are penalized by it. This suggests that structural reform must always take place when growth is robust as everyone is willing to take the risk of implementing change. Trying to implement structural reforms when growth is weak involves the risk that the various economic players each stick to their guns as they do not want to lose the advantages they hold. So the combination of restrictive policy and structural reform is not the right way to get back onto the path to growth on a lasting basis. Businesses and households must overhaul their behavior in a context of lower demand. Who will take the risk of investing against this backdrop?

In view of the factors outlined, it is vital to take the risk of investing and it is important to create incentives for the private sector via public investment in order to drive robust momentum. This is the instrument that will enable fiscal policy to be effective and push private investment up. Once growth is on the up again, it will be much more straightforward to implement structural reforms if they are necessary.

This is a major challenge for France as the presidential elections draw near. It is vital to bear in mind the various dimensions of the French economic cycle and avoid dogmatic attitudes if the country’s economy is to be set on the right track for the next five years.

Philippe Waechter's blog My french blog