This is my weekly column for Forbes.fr. The French version is available here

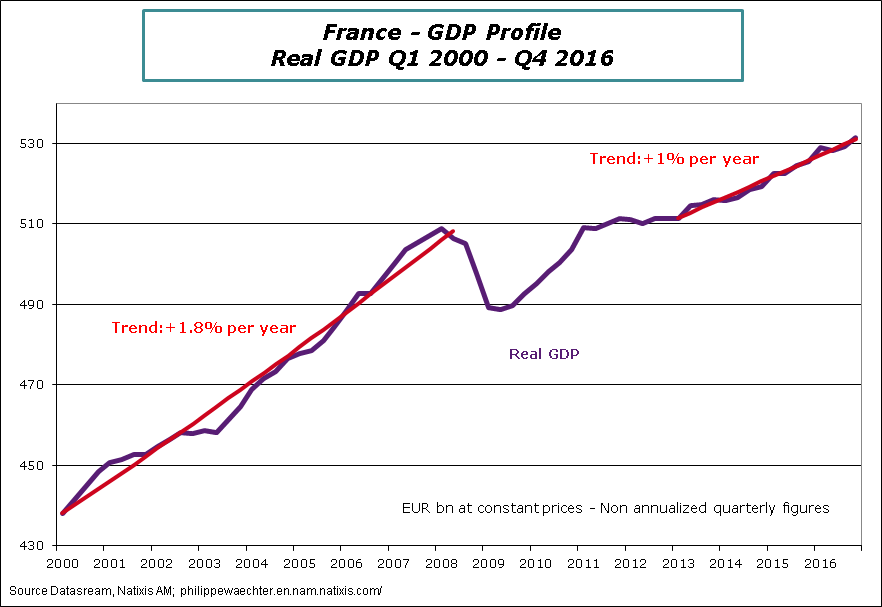

The new French president will have to deal with an economy that is growing at a spontaneous rate of close to 1%, which is the average figure observed since the start of 2013. The new leader’s challenge will be to break with this trend on a sustainable basis, in order to create enough jobs to cut back unemployment and generate additional revenues to finance the social welfare system more effectively and more comprehensively.

Each candidate is of course fairly optimistic on the projected growth profile, expecting the average figure to be slightly under 2% in 2021/2022: in the space of five years, the new president therefore thinks that he/she could almost double the French economy’s growth rate. This is highly ambitious.

Judging by the growth profiles expected by the various candidates, the financial crisis, which has been going on for almost 10 years, will only have had a temporary impact as the economy could converge towards its pre-crisis trend by the end of the president’s forthcoming five-year term. This analysis is mistaken: the French economy has been permanently marked by this crisis. Like most western economies, it has suffered severe and persistent shocks that hampered its growth momentum. The US, the UK and other countries are witnessing a similar situation. Sluggish growth is not an exclusively French phenomenon and other countries are also taking a long time to find a way to return to pre-crisis growth levels.

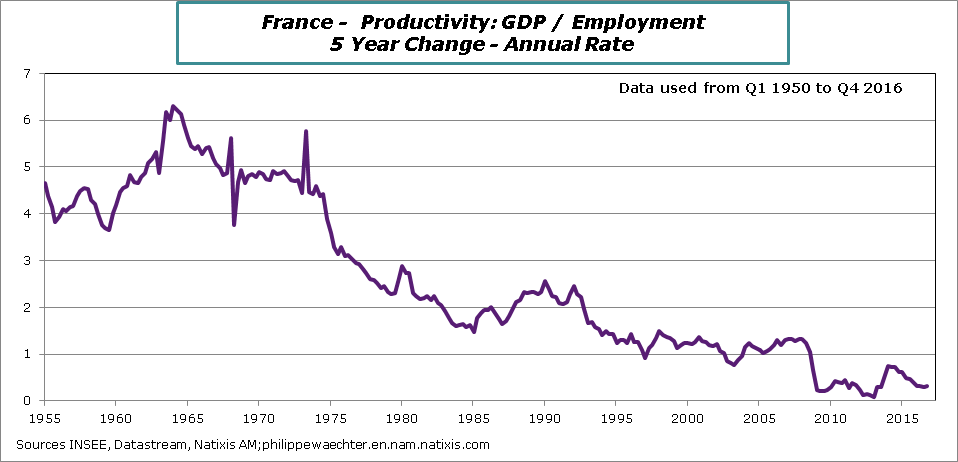

In view of French economic figures, candidates’ projections display considerable determination on their part, as the economy is not spontaneously converging towards 2%. The GDP per job indicator is relevant in this respect. This productivity measurement is important, as growth can be expressed as the sum of productivity gains and employment growth. Productivity that is growing too slowly does not allow for sturdy expansion of GDP.

This productivity measurement is gradually falling in France as well as in most western countries. The chart presentation is based on average growth over five years in order to rule out excessive short-term fluctuations and therefore allow the underlying trend to emerge. At the end of 2016, this indicator gained less than 0.5% over the previous five years. This is well below what we saw in the past, and there was a definite shift in trend since the start of the crisis. Up until 2007, productivity was increasing by slightly more than 1% each year.

These productivity gains reflect the French economy’s ability to create a surplus that can be allocated across jobs, reduction in working hours or revenues (for the employee and/or the company). This surplus is now very low and if productivity does not make it back onto a more solid trend, business leaders are unlikely to up job creation as the surplus created by productivity gains would be insufficient.

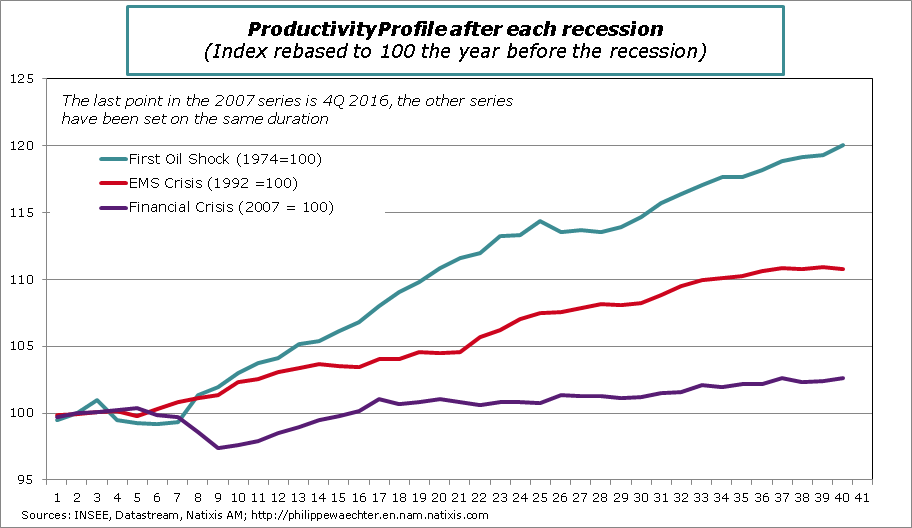

Looking at things from another perspective, this productivity profile looks very different to what we observed at the end of previous recessions. On the chart above, we can see the productivity profile after the recession triggered by the first oil shock, then the profile observed at the time of the European Monetary System crisis and finally the situation since 2007. After 1974 and after 1992, GDP per capita swiftly got back on an uptrend, but this is in no way the case for the current cycle.

This chart shows that the French economy is no longer able to grow spontaneously at a very fast pace. The improvement seen in GDP growth is barely reflected in productivity growth. The French economy’s production structure lacks the ability to recover and return to a robust trend, and this indicates insufficient investment. This probably does not date back to the crisis itself. Before 2007, French economic growth was weak, while world growth was in full swing. In other words, the French economy was barely managing to revisit its average long-term growth while the rest of the world was growing very fast, and the difficulties therefore date back to this period. The 2008/2009 financial crisis merely served to further obstruct this already weak momentum, while reducing incentives to invest.

We can now see that it is not about demand at this stage, but rather that production capacity lacks the ability to grow spontaneously. It was a matter of demand in 2011, 2012 and 2013 when successive governments implemented austerity policies: at the time, a demand-based policy would have underpinned investment and avoided the current situation.

We can definitely see the difficulties that would be triggered if France were to leave the Eurozone. Uncertainty on the new monetary framework would lead to a further delay in investment and a reduction in productivity. The surplus would decline even further and the only solution would be to forge ahead to create the new currency (which would be possible as the Banque de France would directly finance the public deficit if we follow the assistance program for France’s exit from the Eurozone). This would trigger instability and negative momentum for the French economy.

Making it onto a higher growth path would require encouraging private investment in order to renew and modernize production, but this needs some sort of stimulus. The improvement in profitability is not enough to set investment on a more solid path, there also needs to be a source of impetus that can only come from public investment, which operates on a different basis to private investment. It is vital to use this source of growth.

The new president will have to deal with a hefty challenge. The new leader will have to set the French economy on a growth path above the current 1%. However, it will be important to renew the production apparatus significantly in order to improve productivity of the system and give it the scope to grow. As in the past, the best way will be to use public investment. If the French economy does not move past this 1%, then employment and revenue momentum will be insufficient and financing of the social system will be more difficult. This is the key question that will shortly face the new president.

Philippe Waechter's blog My french blog