4 points to keep in mind after the ECB meeting

1 – The forward guidance has changed. In the press release the possibility of lower interest rates has been erased (see here). It’s a real change in the ECB communication. Draghi said that this was linked to the fact that the risk of deflation is now null.

BUT the ECB president said that it was not a change or the announcement of a change in the ECB monetary strategy.

The inflation rate is still too low (relative to the ECB target at 2%) to be consistent with higher interest rates. A tapering of the QE operation has not been discussed according to Draghi.

In other words no one must overinterpret the change in the ECB communication. Te central bank will continue to purchase assets at least until December 2017 (EUR 60bn per month). It could go beyond this date if long term expectations on inflation do not converge to 2%.. Draghi also said that interest rates will remain low long after the end of the QE.

2 – The ECB is more confident in the economic momentum. He said growth was stronger and was impressed by the pace of jobs creation in the Eurozone (+4.8 millions jobs since the beginning of 2013). On the economic activity, risks are balanced.

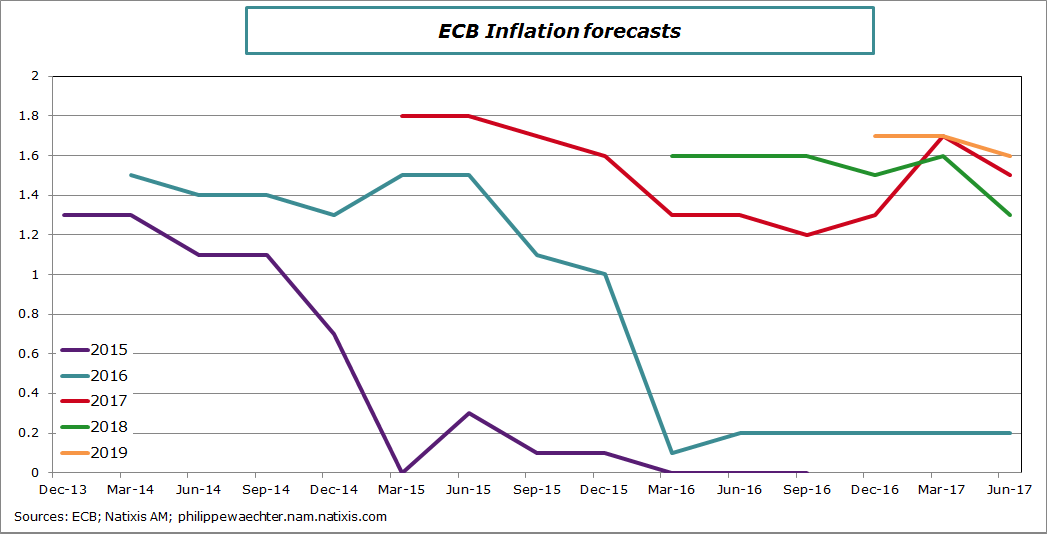

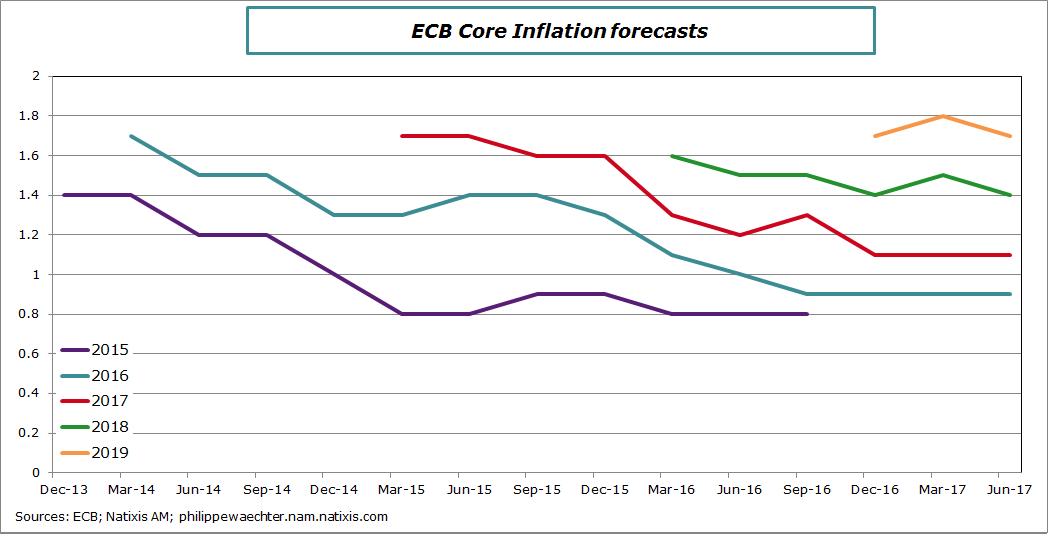

This is not the case yet on inflation. On this point, the ECB has revised down its forecasts. The ECB says that the volatility seen recently on the inflation rate profile came exclusively from the oil price. The core inflation rate has been stable for years circa 0.9%. The accommodative monetary policy and the strength of the business cycle are key to expect a higher core inflation rate in coming years. The wage rate profile will be important on this point as wages will increase with a lore robust business cycle. For the moment this is not the case as the inflation rate is still way below the ECB target at 2%.

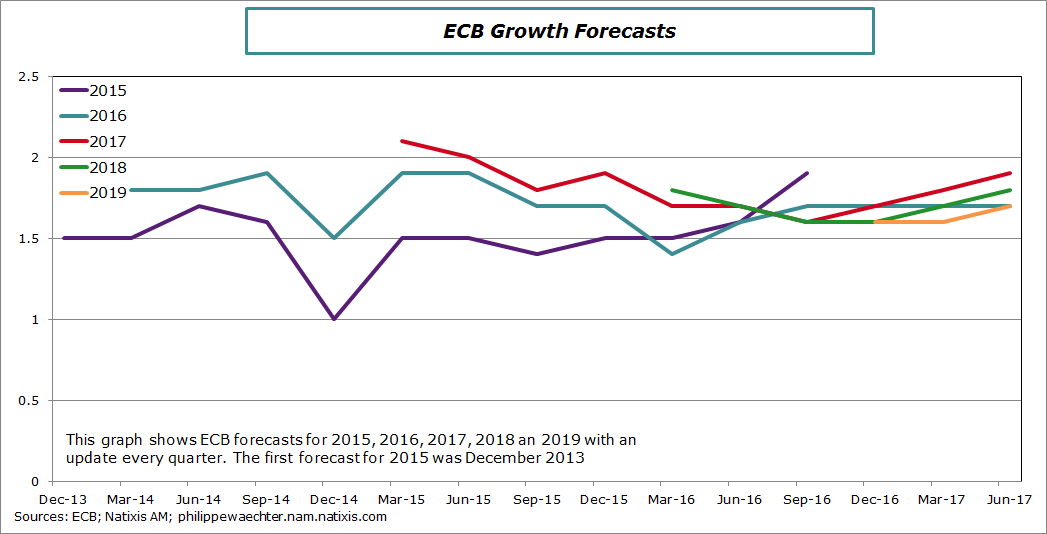

3 – The ECB has updated its forecasts. The growth rate will pick this year at 1.9% before receding at 1.8% in 2018 and 1.7% in 2019. Since the first quarter of this year my forecast is 2% in 2017 and in 2018.

The inflation rate is revised downward. For 2017 it was 1.7% last March it is 1.5% this June. For 2018 it is now expected at 1.3% versus 1.6% in March. It is still far from the 2% target. My forecasts are 1.2% in 2017 and 1.5% in 2018.

The core inflation rate is relatively stable. It is expected at 1.1% in 2017 and 1.4% in 2018. My forecasts are 0.9% and 1.4% respectively.

If we follow the ECB statement saying that the trigger for monetary policy change is a stable inflation rate at 2% then the ECB will remain accommodate at least until 2019.

4 – My expectations on the ECB is that the QE will continue in 2018. As the business cycle is gaining strength we can expect EUR 40bn in the first half and EUR 20bn in the second half of 2018. With a strong business cycle we can expect a small hike in the deposit rate but not before the second half of 2018. The refi rate will remain at 0% at least until the end of 2018.

Philippe Waechter's blog My french blog