The Catalan question is fascinating as it seems to be driven by purely political considerations, while the economic aspect is not thought to raise any great difficulties: the prevailing view seems to be that it will all fall into place.

Yet economics are at the very heart of this question of independence. Independence is highly unlikely to be a success if it is unable to garner robust economic momentum, at least in the initial years.

There are two points worth looking at in this respect – the final outcome of the Catalan question when a decision is truly taken and applied i.e. when Catalonia is actually independent or when it remains definitively part of the Kingdom of Spain, and, secondly the whole transition period, which is currently filled with uncertainty with the first step involving elections planned by the government for December 21.

The current situation is marked by great uncertainty as we witness a tug of war between the Spanish government and the Catalonian government. On both sides of the fence, huge demonstrations allow both camps to make a show of their strength and influence. Each side is sticking to its guns and does not want to budge one iota.

This long-lasting uncertainty is not good news for Catalonia as it encourages onlookers to batten down the hatches and just wait it out. There will not be any new investment as in the event of independence, the danger is that Catalonia would leave the European Union and hence the euro area, and who would want to take this type of risk? This is why a number of companies, both small and large, as well as banks, are taking their head offices and businesses out of Catalonia when possible (this is easier for the services sector than for industry as there are no factories).

And this is the key point: the Spanish government signed Spain up to the EU. As a new state, Catalonia would no longer be included in this contract and would therefore no longer be part of the EU. The Catalans would no longer have access to the single market or the single currency, and the impact of this would be drastic.

Of course this would not all happen overnight. Catalonia would leave Spain and then leave the EU. There is a strong risk that it would not become part of the EU again quickly as this would require unanimous approval from all countries, which Spain would not give.

The risk for Catalonia is that there would be a sharp drop in GDP per capita as systemic risk means that a new Catalan institutional framework would have to be adopted very quickly, along with a new currency and a new relationship with Catalonia’s current partners… and its European partners primarily support Madrid. None of these issues can be resolved instantaneously, they take time, and this will take its toll as it is a source of confusion and concern.

We understand that no-one wants to take this risk apart from the most fervent supporters of Catalan independence. Investment is set to slow and companies’ exit from Catalonia will not help foster growth. Furthermore, it would take a long time to set up a new currency and for it to gain credibility. We must also factor in the possibility that a number of people who currently live in Catalonia may want to move elsewhere to avoid suffering the full effects of independence. None of these factors point to a seamless transition.

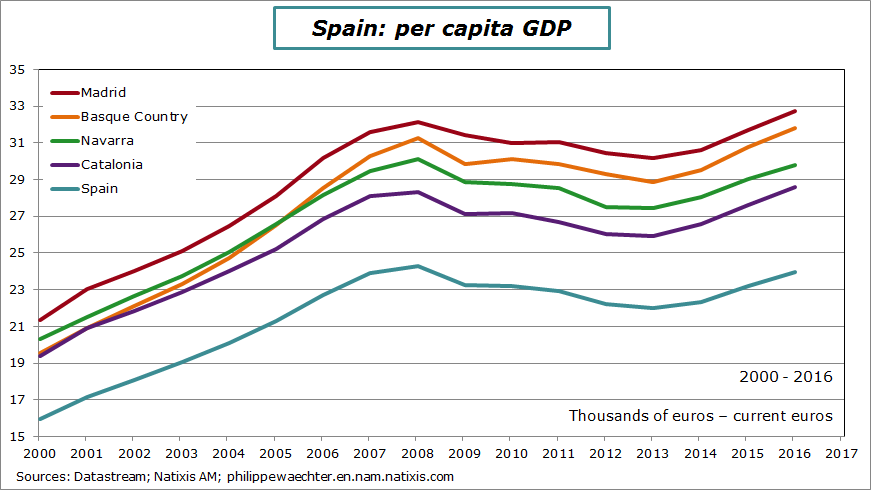

Even if Catalonia remains Spanish in the end, these factors all still apply. Investment that is not made during the period of uncertainty is lost definitively and economic performances in Catalonia will be hampered. The shortfall in GDP per capita between the regions of Madrid, Basque country and Navarra could increase.

Unless European countries warmly welcome an independent Catalonia, which seems to be an unlikely scenario in view of the lackluster reaction from Brussels and the main EU countries, the Catalan economic scenario will be very fragile with a strong risk of a significant decline.

If the final outcome is independence, then exclusion from the single market and the euro area mean that onlookers will not rush to the region, rather international investors, be they in the financial sector or real economy sector players, along with local investors are all waiting to see how things unfold.

This is why the situation will be more difficult for Catalonia relative to the rest of Spain over the months ahead.

This attitude ex ante will permanently dent Catalonia, even if it does not opt for independence in the end.

So it looks like a lose-lose situation for Catalonia, regardless of the final outcome. The extent of the loss will depend on the length of political certainty Spain experiences. The longer it lasts and the higher Catalan risk appears, the less investors will take risks in the Barcelona region and the greater the negative impact of the shock will be.

In the current situation, the scenario and the arguments used by independence supporters look a lot like those put forward by Brexit supporters. The economic equation was never at the heart of the discussions on Brexit, and it is not for Catalonia either. This time, the political stance on independence points the finger at Madrid, while Brexiteers directed their ire at Brussels. Now 18 months after the referendum, there are major questions on the UK situation as negotiations with the EU are not making progress, and the British people have realized that they have too much to lose.

The situation would be more tricky for Catalonia as it is not yet a country and therefore does not have the relevant institutions. Catalonia would also lose its currency. That’s a lot to handle for a Spain that is no longer under Franco’s rule.

Philippe Waechter's blog My french blog