When our grandchildren study economics one day, will they systematically have to add a dummy variable* to their econometric equations for the period covering the Trump administration? Will the US economy over this period have something of a “special status” due to Trump’s and Congress’ decisions? This question is worth raising in light of moves to cut taxes and raise spending, with the ensuing effects on the appalling US public deficit.

The state of public finances is the trickiest of questions. The sustainable rise in the public deficit seems to show that the economy is undergoing a severe recession, yet this is far from true as Janet Yellen took the economy to full employment (see analysis from Jason Furman). So economic stimulus moves from the White House and Congress raise very real questions on the rationale behind this policy. Governments do not embark on economic stimulus programs when the country is running on full employment, otherwise major long term imbalances are created, which are bad news for all concerned.

Projections on the budget by independent nonpartisan institution the Congressional Budget Office (CBO) outline forecasts for the next ten years and provide some insight that can leave spectators speechless.

The public deficit is set to come to $1,008 billion in 2020 as compared with 665 for 2017, reflecting an increase of more than 50% in the space of three years. Deficit figures in these projections never fall below the 1,000 billion mark and the average comes out at 4.9% between 2018 and 2028 with figures varying very little from this average. In these projections, public debt held by the public, which is a very limited measurement of state debt, is leaning towards 100% out to 2028, returning to levels unseen since the end of the Second World War. The worrying aspect is that this figure is increasing very quickly at a time when the economy is growing close to its potential rate.

And so this begs the question – what leeway would the US have to deal with a recession? With a deficit of this extent while the economy is growing, the US would not have the wherewithal to act if it were to face a negative shock. And herein lies the real challenge as financial imbalances and questions of liquidity remain at the very center of concerns. With the deficit projected by the CBO, the US would not be able to implement a similar policy to Barack Obama’s approach in 2009.

This long-lasting deterioration in public finance is primarily due to the tax cut program (read here for more details). This tax relief policy will primarily benefit American citizens with the highest incomes, who will enjoy considerable tax relief. Meanwhile tax for those with the lowest incomes (first three quantiles) will increase throughout the duration of the tax program (see here). The increase in income after tax will be significant for those with extremely high incomes (last centile, or even last five centiles).

So the government is raising its debt to improve the outcome for a select few as ultimately this additional debt will improve the situation for the richest to the detriment of the lowest income brackets.

Public debt is being used primarily to drive up income for the richest Americans and this concept of equality is difficult to adhere to and even more difficult to support.

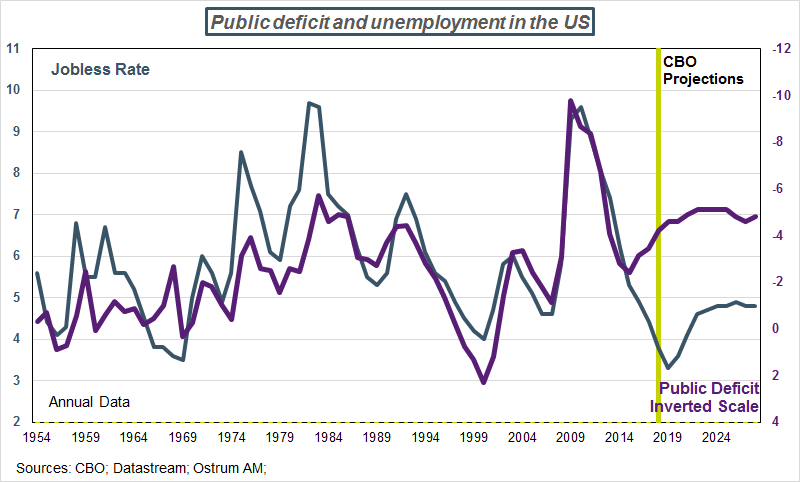

Severe deteriorations in public finance have previously been a result of recessions in 1982/1983 and 2008/2009. A severe and long-term shock weakens the economy and leads to an increase in the public deficit, which is all perfectly normal, due to declining tax revenue and an increase in spending in order to limit the risks for the economy. Conversely, when the economy is running at full speed it can generate a surplus, as was the case in 2000. In other words the public finance profile has been very dependent on the economic cycle right throughout the postwar period.

But the correlation between public deficit and unemployment comes to a halt after 2017. Since Trump’s implemented his policies, the public deficit has no longer mirrored the economic situation. Projections from the CBO reflect a high deficit on a long-term basis, yet the economy is not undergoing a recession-type shock. The CBO is not expecting a recession, but rather decisions made by the White House and Congress are pushing the deficit into severely negative territory on a long-lasting basis.

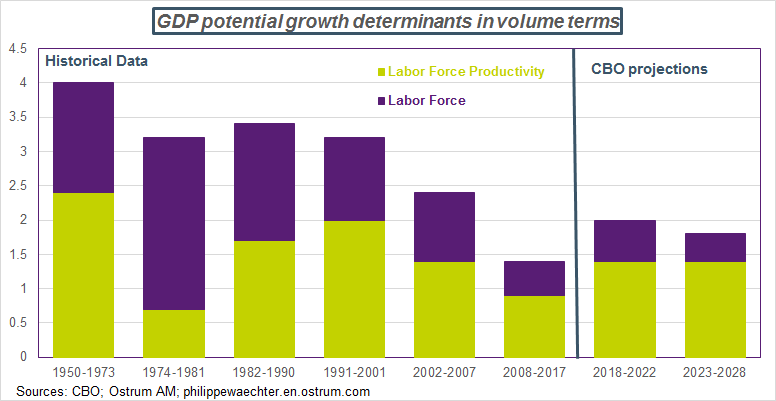

The CBO thinks that the stimulus effects from the budget will be short-lived with a substantial impact in 2019 and 2020, after which time, growth is expected to fall below its potential rate before converging back towards potential growth at the end of the forecast period. Growth expected between 2021 and 2028 is only on average 1.7% per year while the potential growth rate will be 1.9% on average.

Projections across the board by CBO and other bodies show that there will be a lower effect on the growth profile than expected. The hefty programs rolled out by the White House will not boost GDP in the long-term.

The CBO projects that potential growth will be limited by a more sluggish increase in the working population along with more limited productivity growth. So if one of these two metrics does not surge sharply and sustainably, then GDP trend growth cannot increase. In the short term, we can witness positive effects on activity from measures that drive demand, but this mechanism does not work in the medium and long term.

The White House’s approach will force the Fed to intervene more quickly and take a stronger stance than generally expected to counterbalance current intrepid fiscal policy. There will be at least four rate hikes from the Fed this year and this trend will continue next year, leading to a flatter yield curve and a dent for economic activity.

The White House is forcing the Fed’s hand and compelling it to normalize monetary policy more swiftly. This will automatically drive up the rate on the dollar. The Fed must not allow imbalances to take root: this would be bad news for the US economy – particularly for its external dimensions.

The last point worth mentioning is investor confidence. My biggest concern is that the White House is creating debt to finance tax cuts which will only benefit the richest, and I don’t believe in the trickle-down theory which is a theory in name only. It suggests that when the rich become richer, there are benefits for the economy as a whole, but this has obviously never worked, otherwise the US economy would be in a very enviable position in light of income distribution imbalances since the mid-1980s (see here). So this is primarily a microeconomic advantage with no macroeconomic gain, and the private benefit for a small minority carries a high and long-lasting public cost that is not sustainable in the long term. What will investors think and how can they trust this kind of strategy? Well may we wonder. This situation may prompt investors to steer clear of US assets, while from a domestic political standpoint, we may also ask what Americans’ reaction will be.

The US economy saw moderate growth during the Obama administration, but imbalances did not worsen. Under Trump, political decisions are set to trigger severe and long-lasting disequilibrium within the economy and American society at a time when the world economy has shifted towards China. We are seeing a new world order and I’m not sure that the US economy is making the right moves to address it, with fast-growing public debt, held largely by foreign investors, and benefiting just a small few. Is this really a good idea?

_______________________________________________________

* In econometric estimates, a dummy variable cancels out the effects of a temporary factor.

Philippe Waechter's blog My french blog