After the referendum on June. 23, 2016, the British economy has followed a lower profile. This comes from changes in expectations: uncertainty about Brexit rules has created a wait and see behavior and opportunities in other countries have changed people and companies’ mind about investing in the UK.

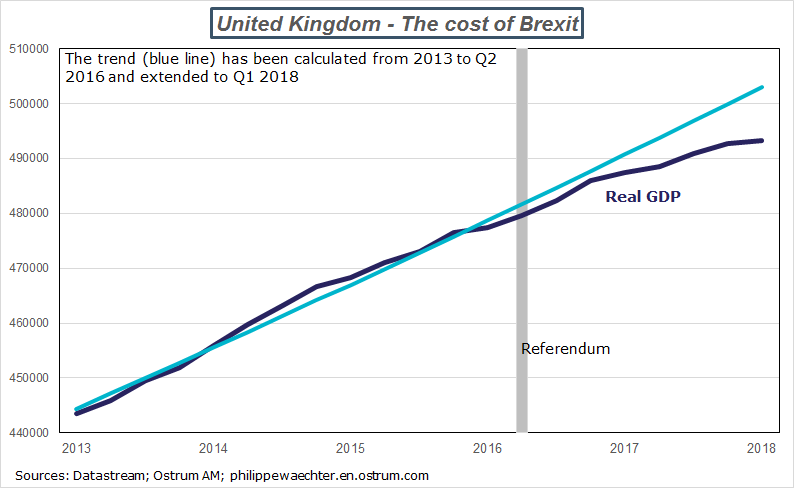

Therefore the economic trend has changed. We can see that in the graph below. The trend from the start of the recovery in 2013 to the second quarter of 2016 has been extended to the first quarter of 2018. There is a widening gap between real GDP measured by the ONS and the pre-Brexit trend. It the cost of Brexit for the UK. We see a real change after the referendum.

After the low growth figure for the first quarter of 2018 (+0.1%), the picture is gloomier.

At least until the end of this year it will continue to increase because the agreement between the UK and the EU must be signed before the end of this year. After this date we will see but I think that the loss will be permanent as investment that has not be done since the referendum will never be done in the future. The gap will continue to widen. The sole possibility to converge to the previous trend would be the cancellation of the Brexit referendum.

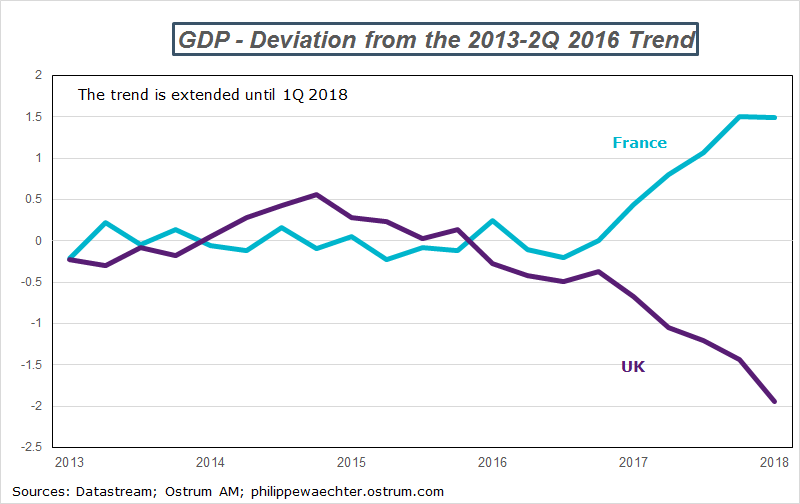

There is also an opportunity cost as there was a boom in European countries in 2017. To measure the disparity between UK and Europe, I have calculated the deviation from the 2013-2Q 2016 trend in France (we have data for the first quarter of 2018) and in the UK.

The analysis is clear: the opportunity cost for the UK is huge. France is 1.5% above its trend and the UK is 2% below. The UK has not taken advantage of the 2017 boom. As far as this picture is true, companies and investors will find advantage to invest in the EU rather than in the UK. This will accentuate the divergence between the EU and the UK at the expense of the British people.

Philippe Waechter's blog My french blog