This month marks Emmanuel Macron’s first anniversary as President. It is too soon to make a full assessment of his presidency, as he has already said himself that he wants to be judged on the full five-year term, but it is also too early to make that call because the very positive economic outlook overall could skew our analysis somewhat. Business indicators in France followed trends in the euro area, displaying a robust performance followed by a downturn.

The latest example of this is this year’s first quarter growth figure, which slowed to 0.3% in France and 0.4% in the euro area, after the country posted showings in line with its European neighbors in 4Q 2017 at 0.7%. Business leader surveys also reveal similar findings.

Economic policy still to show its mettle

It is still too early to sift out the effects of the government’s economic policy from the impact of the overall economic context, and in this respect, 2018 budget performances will provide a useful benchmark. The budget deficit came out at 2.6% in 2017, falling below the infamous 3% mark for the first time since 2007, primarily as a result of growth picking up from 1.1% to 2% between 2016 and 2017. Growth is expected to come out at 2% in 2018, flat vs. 2017, so it is government policy that will shape public finances this year and the public deficit will act as a good gauge of policymakers’ achievements.

However, there is one thing that has most definitely changed over the past year – the way the international community talks about France and its President, both investors and others. International spectators are more interested in the country, reflecting on the one hand the arrival of this newcomer bursting onto the world political stage, and on the other his active international involvement, particularly in promoting Europe.

The world context is changing

We have seen some reforms during the President’s first year in office, but it is too soon to assess their effectiveness. However, we can judge how relevant they are by setting them against the backdrop of changes to world economic momentum: the world is changing fast and reforms must keep pace with these changes in order to be truly effective.

There have been three key shifts in world economic trends i.e. a new political order, a radical geographical change in the output profile and the onset of a new technological revolution, so economic policy must be assessed on the basis of these three factors.

New political order

Firstly, we have seen a major political upheaval with Donald Trump’s arrival at the White House, the Brexit referendum in the UK and populist wins in central Europe and more recently in Italy. This political watershed looks a lot like the breakpoint witnessed in the early 1980s with the arrival of Reagan, Thatcher, Mitterrand and Kohl, which heralded a new era after the tough times following on from the first oil shock, slowing growth and increasing unemployment. At the time, the new political landscape led to swift deregulation of financial activities, setting the stage for the globalization that has characterized the past 30 years.

Political change witnessed over the past two years is partly the result of globalization but also of the way the crisis was managed.

Looking to globalization, income trends for the middle classes in developed markets were dictated by income momentum in emerging countries, particularly China and India, as reflected in Branko Milanovic’s famous elephant graph.

Meanwhile, the crisis that took place from 2008 onwards also led to more sluggish growth and more restricted income momentum for the middle classes across most developed markets. These factors were the trigger for the new political choices of recent years.

These choices are the opposite of the path taken in the early 1980s…this time, it is not the beginnings of globalization or open markets that we are witnessing, but rather a shift to look inwards, with decreased coordination across the globe. Brexit is the embodiment of this phenomenon and Trump’s outlook on the world economy also perfectly fits with this trend.

Macron and this new equilibrium

With Macron’s election, France did not undergo this kind of political change, but while the economy may remain global, the rules have definitely changed and this is the message underlying the new political order. Today’s tendency is towards decreased cooperation, so each country must be more self-sufficient in fostering growth and cannot afford to wait for impetus from the rest of the world. Countries can no longer wait for the rest of the world to pick up the pace in order to boost their own performances.

On this new world stage, economies must be able to create their own momentum and find the wherewithal to adapt swiftly to address changes in the environment.

This will require two factors;

Firstly, economies need effective and innovative productive wealth in order to generate productivity gains, and in this respect, Emmanuel Macron’s publicly expressed aim to support private investment by means of public expenditure is a positive move. This will create requirements on the quality of capital: investment in France is high, but it lacks innovation, which weakens and drags down production as a whole, so public investment can create both obligations and incentives to encourage more bold and daring innovation.

The public investment program outlined a few months ago by Jean Pisani Ferry is a step in the right direction, with past experience showing that public investment that focuses on research and production creates a virtuous cycle shoring up economic momentum.

Secondly, a more adaptable labor market is required in order to adapt swiftly to address changes in the economic cycle, as well as streamlining and simplifying resource reallocation between business sectors right throughout the cycle. This is a vital pre-requisite for fostering self-sustaining growth.

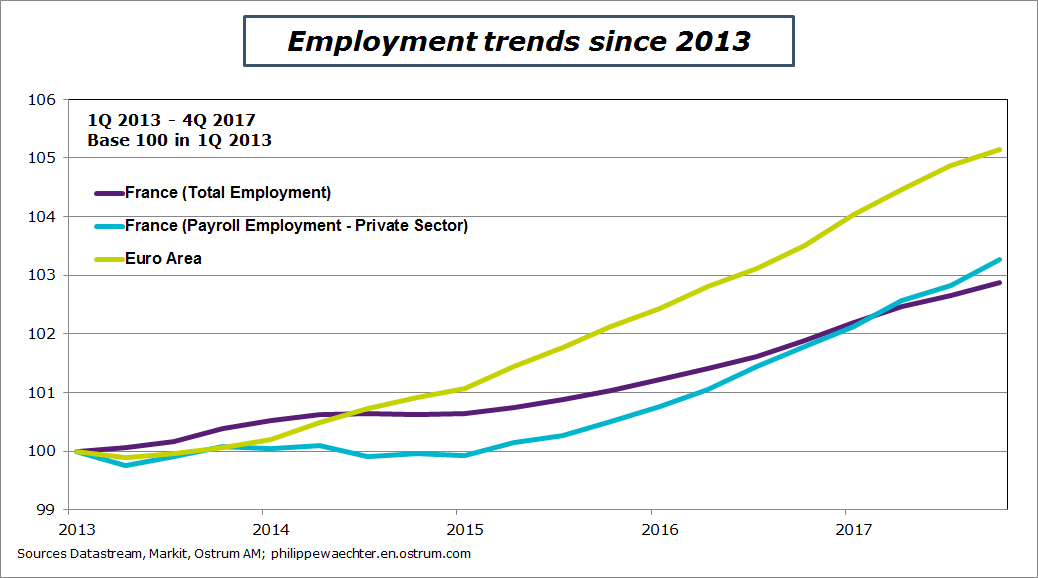

France lags behind in this area. When the cycle takes an uptick, the French job market is slow to recover, as shown in the chart below, which compares France to the euro area and its cycle upturn in the first quarter of 2013. Employment improved quickly in the euro area, but not in France, particularly in the private sector. This shows that labor market momentum is not robust enough to drive and perpetuate growth. This means shocks can be absorbed when the cycle slumps, but when the economy recovers, employment momentum is inadequate. This is particularly worrying as potential growth in developed countries is now weaker than before, so it is vital to quickly find a way to fuel this growth.

This adaptability has been enshrined in labor market legislation and government decrees in France, and should lead to improved ability to adapt to changes in business conditions. However, this enhanced responsiveness must also go alongside moves to review training programs, otherwise it will fail, as excessive flexibility leads to uncertainty for employees. New labor market legislation makes the French economy more nimble and enables it to react more quickly when faced with any sign of expansion, so we can expect better allocation of labor and a more efficient production process.

Armed with the ability to react more quickly to change, the French economy’s growth process becomes more self-sustaining and is more able to generate its own impetus.

The world has changed and this must be taken on board across the various aspects of production: this transformation seems to be under way in France in my opinion.

But this is only the first part of the reshuffling of the world economic cards.

To be followed…

Philippe Waechter's blog My french blog