This post is available in pdf format Federal Reserve – My monday Column

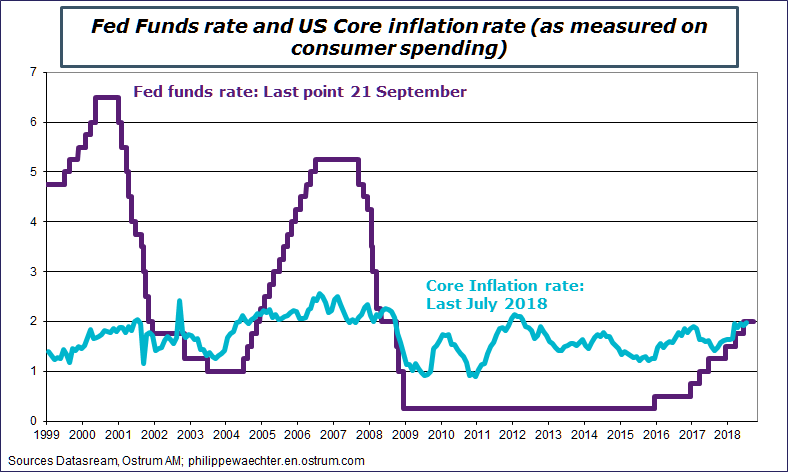

The Federal Reserve meets on September 25 and 26, and a 25bps hike to the fed funds rate is expected, putting the effective rate in a range of between 2% and 2.25%, with another hike expected in December. The Fed now seems to agree on these four monetary tightening moves for 2018, so the next big question is 2019. During the latest update of economic and financial projections from the members of the Federal Open Markets Committee (FOMC) in June, three interest rate hikes were expected in 2019. How can we get a clearer idea of what’s to come?

Four interest rates are now confirmed by the Fed. I had mentioned this scenario at the start of the year due to the White House’s implementation of expansionary fiscal policy and I have not changed my mind: the hike to the fed funds rate is just a way to iron out the imbalances caused by this policy that seeks to fuel domestic demand.

This domestic momentum reflects the impact of two factors: the first is the direct effect of tax cuts and rising public spending, and we can see the positive effects of this twofold approach for demand; the other component is trade policy that aims to use domestic production to replace imports, thereby sharply driving up demand for companies’ goods and services.

So the White House has adopted a two-pronged approach: on the one hand it bolsters domestic demand and the other it directs this additional demand towards US companies rather than imports.

This internal momentum will have at least two direct consequences: the first is the risk of inflation because demand is strong and because of higher import duties.

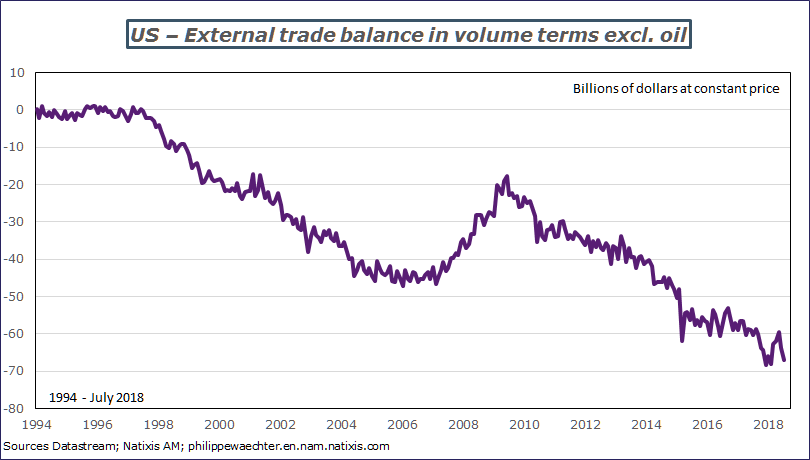

On the first aspect, stronger demand for US companies’ goods and services will push prices up. The 20% import duties on washing machines have already pushed prices for these goods up 16.4%. The other factor is that driving up domestic demand would lead to a deterioration in the US external deficit, as demand rises instantaneously, but it takes time to build factories, so imports increase in the meantime, as shown in the chart opposite.

What should the Fed do?

The Fed must not let either of these two imbalances develop. Monetary policy is not clearly restrictive. The expected fed funds hike this week would finally push the figure above the core inflation rate for the first time since 2008, but monetary policy will not become restrictive, even after the hike expected in December – at best it will be neutral.

The White House will not suddenly change its policy trend and so we should expect domestic demand to remain robust, with the Fed then having to maintain and heighten its stringent approach.

If fiscal policy remains very accommodative with domestic demand driving GDP growth above potential growth on a sustainable basis, then the policy mix will require a more stringent monetary policy component in order to avoid the emergence of long-lasting imbalance, which is why I think that US monetary policy will continue to tighten in 2019.

What will the consequences be?

I think that the US dollar will continue to rise as a result of the Fed’s policy. This is a way of restricting tensions on US output and avoiding the risk of the situation escalating.

This means that the situation will remain fairly tough in emerging countries, particularly those that have dollar-denominated debt and have already hit the headlines this year.

What could potentially change this scenario?

The White House losing the midterm elections on November 6. For now, we are seeing greater rallying efforts from Democrat voters than from Republicans, although this does not necessarily mean that they will take the house: it is too early to make this kind of assumption. But a defeat for Trump and the Republicans would trigger a negative shock for the dollar. Neither can we expect US actions to normalize and move towards a more orthodox strategy. The White House is ready to do whatever it takes to keep production in the US, even if this means taking a non-cooperative stance with the rest of the world.

Duties on $200bn in Chinese goods come into force today, what should we make of that?

There are two points to bear in mind.

1 – 60% of products exported from China to the US are exported by non-Chinese companies, primarily American and European, and this means two things:

- Chinese companies are not as badly affected by US measures as we might think,

- It takes longer for prices to adjust than we would expect. Taxes on products imported from China are added to the initial price, which remains unchanged for the moment, so consumers are paying a steep price for Trump’s measures.

2 – China decided to fight back by reducing border tariffs on trade with non-US partners, which creates some common ground between China and these other countries, and this may push back against the US offensive. Each country is tallying up its list of allies during these tense times on the trade front, and the stakes are high for world trade and hence world growth. This world set-up is a bit like a wheel, with the US in the center and a country at the end of each spoke.

This is telling reflection of the US’ preference for bilateral relationships, but what happens if all these isolated countries join forces and cooperate to the detriment of the US?

It is a shame that Europe is not leading the initiative and playing its role here.

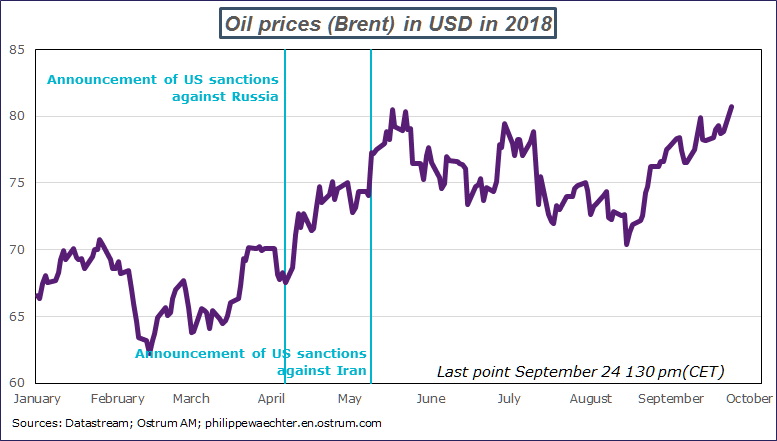

Why did oil prices move above the $80 mark this weekend?

OPEC producers stated that they would control and maintain oil output while not clearly making up for the drop in Iranian production following US sanctions: the output shortfall for Iran is now estimated at 1.5 million barrels per day.

Meanwhile, Venezuelan production continues to decline, with production plummeting more than 35% yoy in August.

This declining supply is no longer offset by rising output from the US, which means prices are on the up and we are beginning to hear talk about prices hitting $100/bbl again.

Is Brexit over?

The situation is extremely complex for Theresa May as European leaders met in Salzburg in Austria last week and rejected the UK prime minister’s Chequers proposal. A number of questions remain unresolved, such as the Northern Ireland border issue. The Good Friday agreement with the Republic of Ireland established lasting peace in the country and no-one wants to jeopardize this situation or see a hard border set up again. Yet Northern Ireland still remains part of the UK and will therefore leave the EU after Brexit, requiring an economic border between the North and the Republic, which remains in the EU. This situation has been a subject of conversation for months, but a solution is yet to be found.

The UK wants to keep the pressure on to reach a deal, but its proposals involve the EU making the lion’s share of concessions, which is intolerable and this approach has rightly been rejected by the European Commission.

The chances of the UK crashing out of the EU without a deal are increasing. This would be a dreadful situation for the UK, as its system has been extensively shaped by European law, which would then cease to apply. This means, among other numerous examples, that UK aircraft could not fly over or land in Europe if an agreement is not reached. Failure to reach a deal would be devastating for the the country.