The French government is still expecting a robust recovery for the last three months of 2018 and for 2019. Companies’ surveys for October do not allow such optimism.

The main point is the rapid slowdown in the manufacturing sector. It was the leading sector in 2017 and its dynamics was an important contributor to the strong expansion seen this year. It was a source of impetus for the rest of the economy.

Its current lower momentum is a source of concern. The retail sales sector is weak reflecting question on purchasing power for every French consumer.

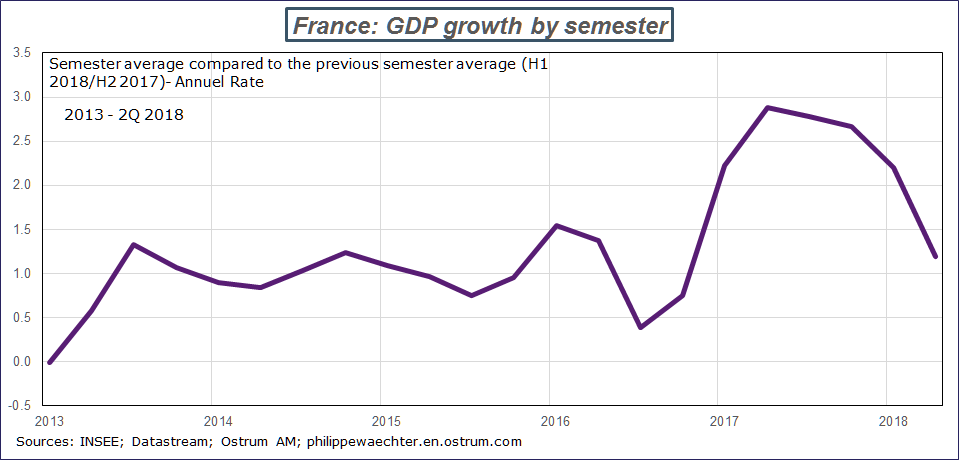

My expectations is that the French economy is back to the trend seen before 2017. It means that the forecast for GDP growth is close to 1.4%. This is consistent with what these surveys say. No strong recovery is expected and the French economy will converge to its potential growth which is lower than 1.5%.

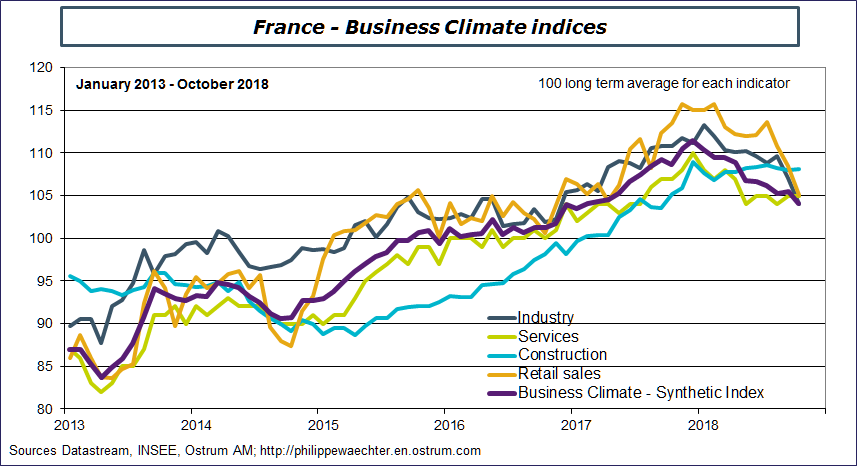

The following graph shows the transitory recovery of 2017.

The INSEE survey by sectors is presented in the following graph. Retail sales and industry are weaker than in a recent past while construction and services remain stable.

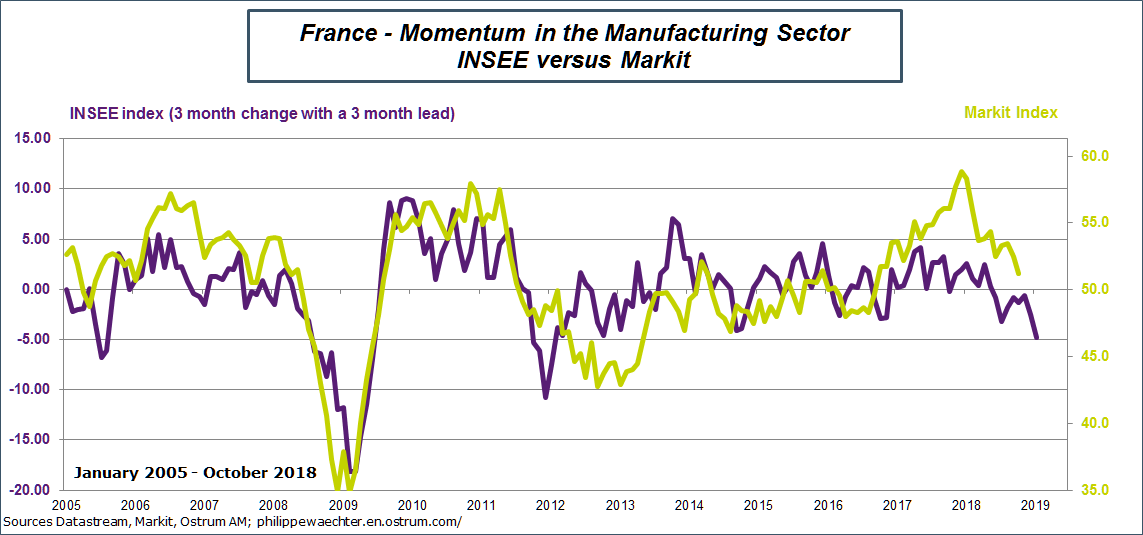

Specifically on the mood perceived in the manufacturing sector we can compare the INSEE and Markit indices for the sector. We see that the peak was attained at the end of 2017 and that the sector faces a serious slowdown. This will be a source of weakness for the service sector and then for the global economy.

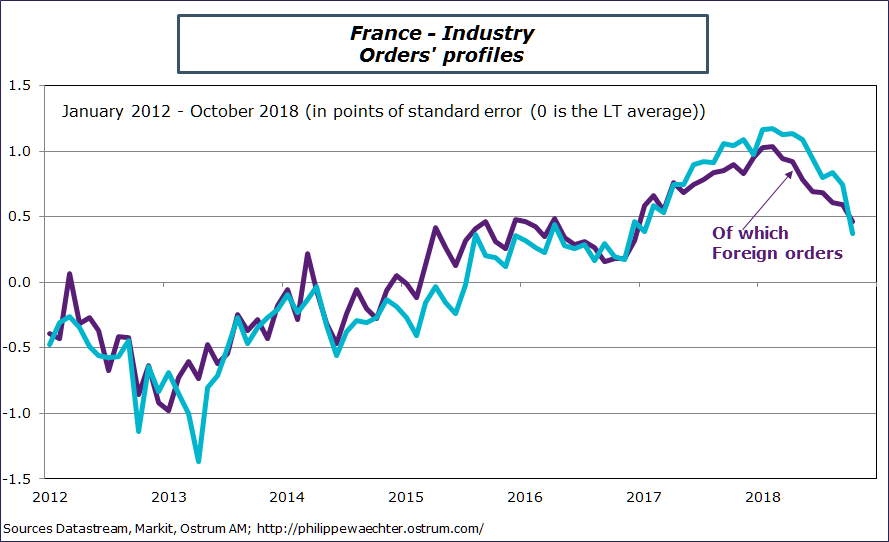

The other point on the manufacturing sector is that orders are now at a low level and this is mainly explained by the French domestic demand. Expected demand that can be read in the quarterly survey (INSEE) for the manufacturing sector shows that companies are expecting a lower level of domestic demand for the next three months after a drop in the current demand.

The government is expecting a strong recovery in demand as fiscal measures will boost purchasing power. This point is not shared by French companies.

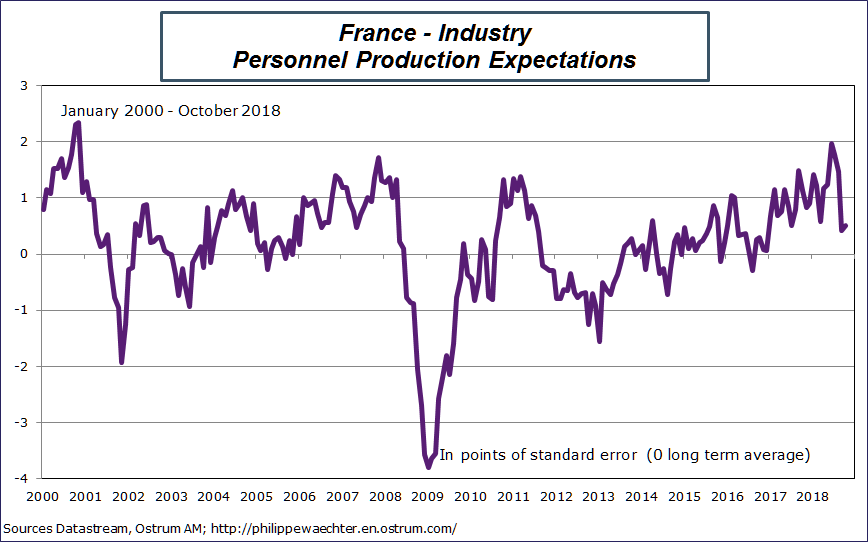

French companies leaders are not as optimistic as they used to be. Their perception of the dynamics of their activity is back to the level seen at the beginning of 2017, before the strong recovery.

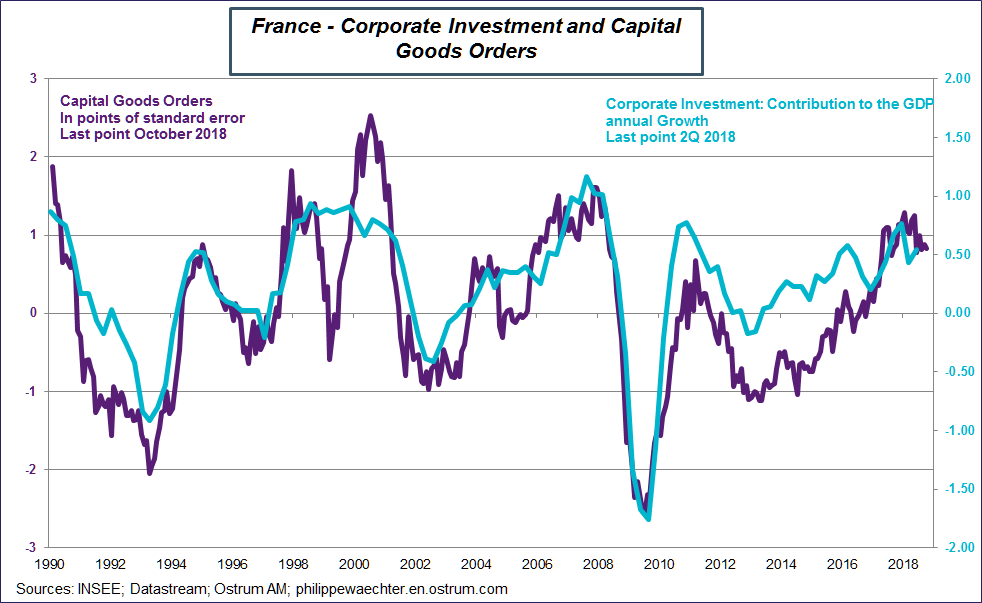

The last point to be mentioned is that corporate investment is expected to have a weaker momentum as capital goods orders falter.

Philippe Waechter's blog My french blog