I am thrilled to report to you that our economy

is the best it has ever been

(Trump’s 2020 State of the Union Address)

This sentence starts one the first paragraphs of Donald Trump’s speech on the State of the Union for 2020. For sure, at 3.5% in December, the unemployment rate is at its lowest level since the end of the 60’s. It a really good performance. There is at the same time a strong momentum on the labor market. In 2019, 176 000 were created on average each month and since the beginning of the current business cycle more that 21 millions new jobs have been created.

The business cycle duration has never been so long. The through was in June 2009 and a recession is not in sight at the beginning of February 2020.

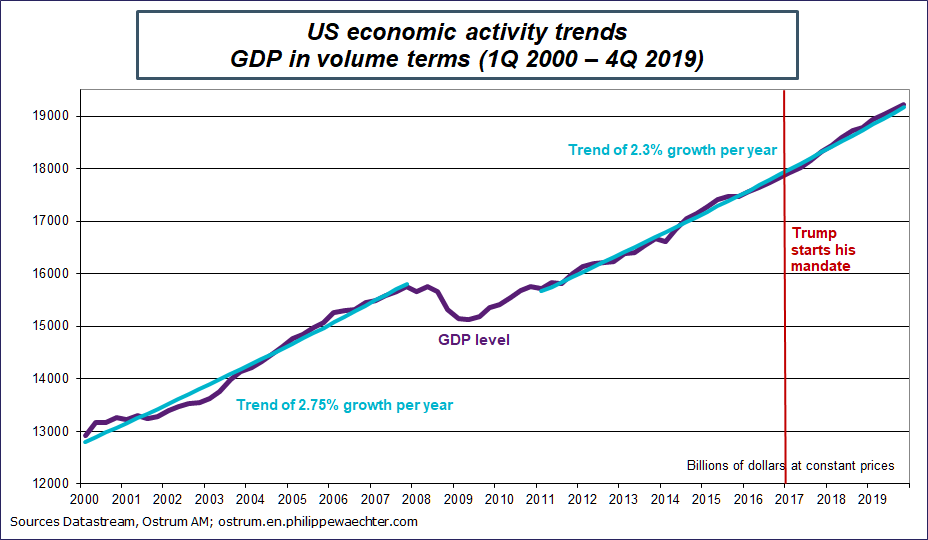

Nevertheless, the current situation doesn’t rely only on the first three year of the current US President. The GDP growth trend has not really changed since Trump is at the White House and the Fed has been very helpful during the period after the great recession

The interesting question is on the reversal of the economic momentum that has been put at the front place in Trump’s speech.

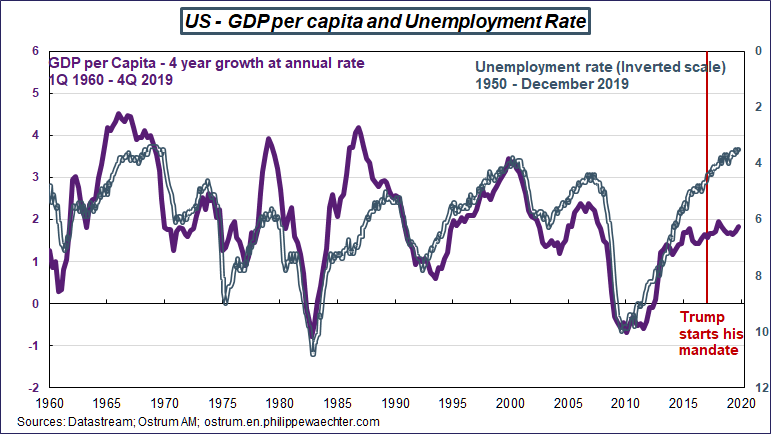

To look at that, I have compared the evolution of the unemployment rate to different economic indicators on a long period of time. As the unemployment rate is almost at its historical low (3.4% at the end of 1968 and the beginning of 1969), the GDP growth rate must have a comparable behavior but…..

I starts the comparison with the GDP per capita in real terms. On the graph, the unemployment rate is in grey and the GDP per capita in purple. In order to limit the volatility of the GDP I have smoothed the time series on 4 years.

We see on the graph that the two indicators profiles are consistent. A high growth and a low unemployment rate can be seen at many moment in time. At the end of the 60’s, the unemployment rate is at 3.4% and the GDP per capital grows in a range of 4 to 5 %. At the end of the 90’s the unemployment rate was around 4% and the GDP per capita was up by more than 3%. In the current period, the GDP per capita grows at a pace which is lower than 2%. For sure, as in every developed country this reflects the low productivity trend.

But we do not see any change in the GDP per capita profile since Trump’s arrival at the White House. The low unemployment rate has not been efficient.

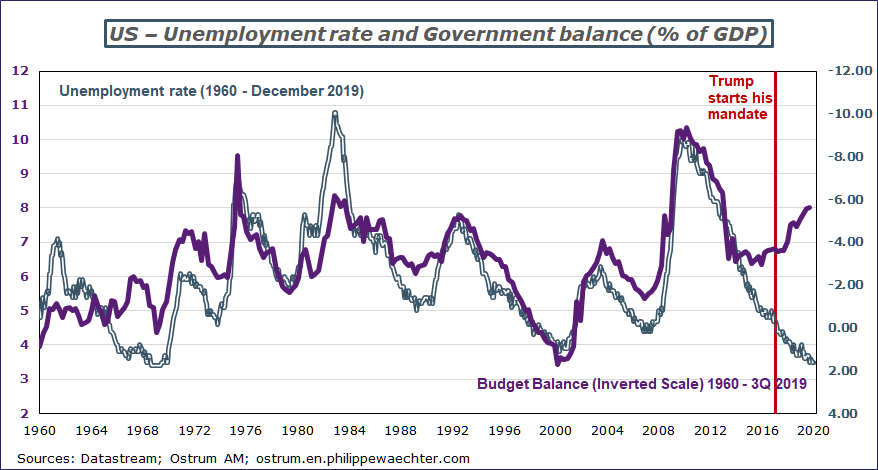

The second graph links the unemployment rate and the public finance balance.

We see that since 1960, the two indicators have consistent profiles. Both are a representation of the business cycle. In the strong part of the cycle, the budget balance can become a surplus and the unemployment rate is low. The only exception is since 2014/2015. The divergence has then started but it has accelerated since Trump launched his fiscal policy in 2018. Now the public deficit converges to 6% while the unemployment rate is at an historical low. Is this pattern the new normal in Trump’s economy. What will happen if the economy plunges into a recession ? Will the public deficit jump to 10/15% of GDP? In 2008 the public deficit converged to more than 9% of GDP and the starting point was -2%. The starting point is now at 6%. Not sure that it shows a strong economy.

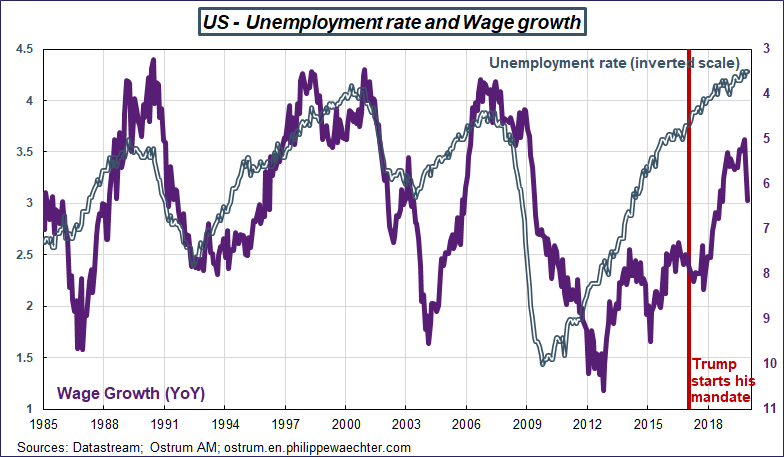

The unemployment rate has not produced a strong growth momentum on wages.

Compared to previous business cycles, the wage growth should have converged to 4.5% per year. It has never been the case in the current situation. Wages were up by 3.5% during last summer but it’s not sufficient to be consistent with previous situations.

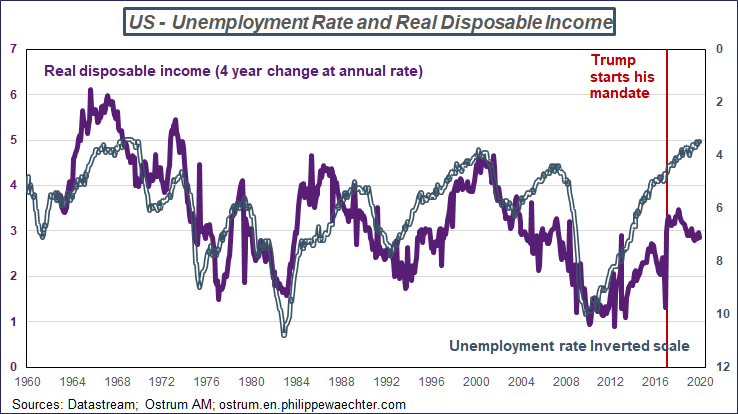

The last graph is on households’ real income. The improvement we could have expected on income when looking at the low unemployment rate is weaker than anticipated.

In fact, and this is normal, the real disposable income has the same profile that the GDP per capita. It grows very slowly and its profile has not improved since Mr Trump is at the White House.

The US economy is robust but, for that, it needs a policy-mix that is usually consistent with an economy in recession. The budget deficit is now close to 6% of GDP and the real fed funds rate is close to 0% while the unemployment rate is at 3.5%. The economy is robust because of this policy mix but all the measures presented do not convince that the US economy is really strong. Taking the unemployment rate as a benchmark, we see that the US economic momentum is much lower than in the past and more than that, the unemployment rate doesn’t seem to represent the business cycle anymore. A kind of fake indicator ? Some economists start thinking at that. As David Blanchflower says in his last book, many of the new jobs are probably not good jobs and they do not add a lot to the economic dynamics.

I am sad to report to you that the US economy is not at its best.