GDP growth momentum in the US, Germany and France. Japanese industrial activity, IFO in Germany and Climat des Affaires in France.

Coronavirus and Markit Surveys

Highlights

GDP estimates for the fourth quarter in the US (27), in Germany (25) and in France (28)

The US remains the strongest of the three with a robust starting point for 2020. The carry-over growth for 2020 at the end of 2019 is 0.8% in the US (a magnitude close to that of 2019) while it is at 0% in Germany and 0.1% in France. The effort to be done to have a decent growth on average in 2020 will be more important in Europe than in the US.

Figures will show details of all estimates: corporate profit in the US, decomposition of the demand in Germany and economic agents ratio in France (corporate margin, purchasing power, saving rate)

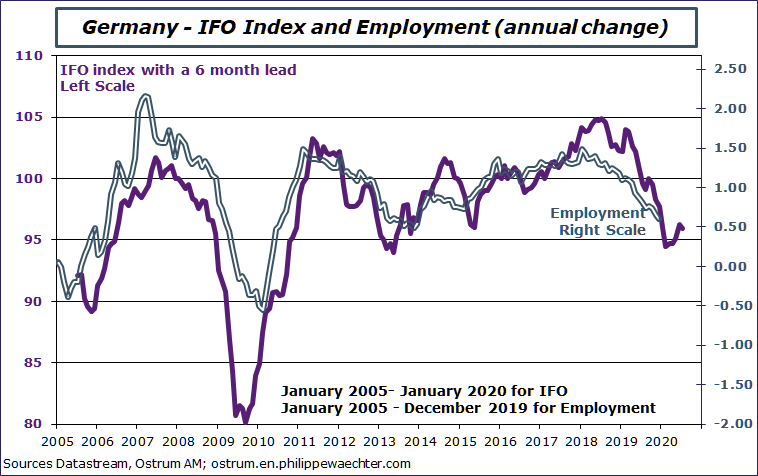

IFO for February (24) and employment for January (28) in Germany

Recent corporate surveys are non-homogenous for February. The ZEW survey shows a rapid deterioration in the two components (current situation and expectations) while in the Markit survey shows an improvement (even if it remains in negative territory) of the manufacturing index. The IFO will probably be marginally lower.

Employment in January will continue to adjust downward. It’s a lag variable.

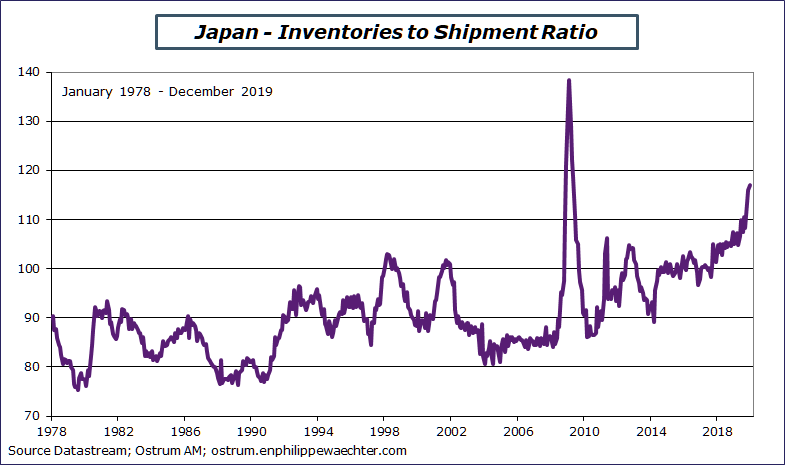

Japanese activity in the industrial sector for January (28).

Japan is converging to a recession. The industrial activity dropped dramatically at the end of 2019 while demand crashed. As a consequence, inventories increases at a very rapid pace. In coming weeks, as demand will remain moderate, companies will reduce their inventories before restarting production. That’s key for a recession.

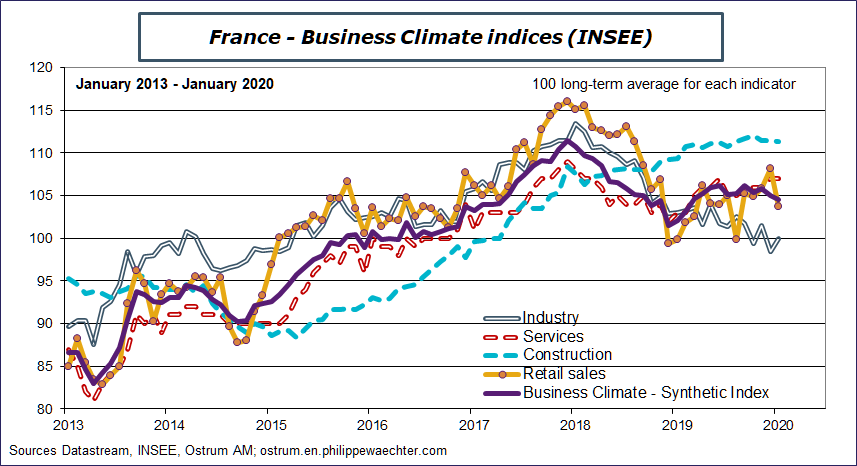

French Climat des Affaires for February (25) and consumer confidence (26)

The French Markit survey has shown a weakness in the industrial sector. It will be confirmed by the INSEE survey even if the Climat des Affaires index remains above its historical average.

Other statistics:

Chicago Fed National Activity Index (CFNAI), the best short-term gauge of the US economy will be released on Feb.24. Inflation in many Euro Area countries will be out for February: Spain (27, France, Italy and Germany (28). US consumer confidence survey from the Conference Board (27), it will notably show the household behavior on the labor market, Chinese PMI for February on February 29. Households income and expenditures in January in the US with the PCE inflation rate (28). New Home Sales in the US for January (26) and Case Shiller index for December (25). Italian surveys on corporate and households confidence for February (27)

Detailed Discussion

GDP for the fourth quarter US (27), Germany (25) France (28)

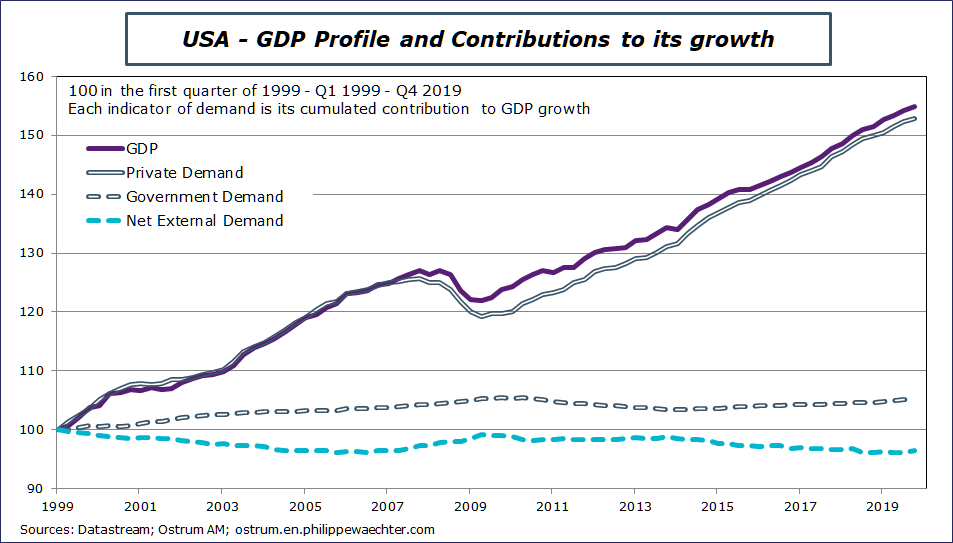

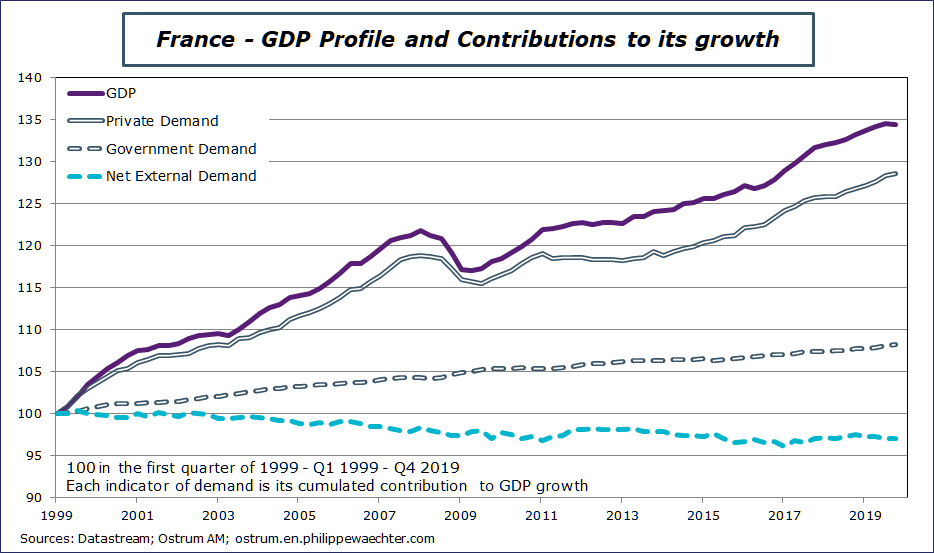

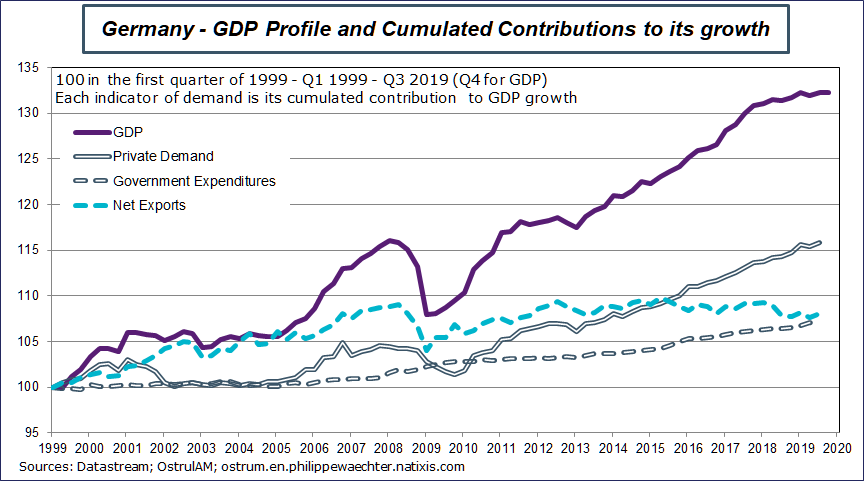

The 3 graphs on the right show the sources of GDP growth in the three countries. They are based at 100 in 1999 (the initial graph was done on the euro area which was launched in 1999). Demand has three components: private, public and external. Each is calculated as a cumulated contribution to growth. The sum of the three add up to the GDP level.

The three graphs show that the growth framework is country dependent.

In the US, the private demand follows exactly the same pattern than the GDP. As public expenditures have a positive contribution, the next exports’ contribution is therefore negative by construction. We have an illustration of the importance of the private sector momentum in the US economy (HH consumption expenditures represented 69% of GDP in 2018).

France is close to the US dynamics with a strong dependence on private demand. But the public expenditures’ contribution is higher and the net exports’ contribution less negative than in the US.

The most interesting case in Germany. The three contributions are positive. For an extended period at the beginning of the euro area the most important contribution came from net exports while the private demand followed a slower dynamic. That was the period where Germany did structural adjustments notably on its labor market. The interesting point is the recent change in the German economy dynamics. The external trade has now a lower contribution than private demand and is clearly the source of the recent GDP growth slowdown. The German model is changing as its private demand is now the most important contributor to growth. This will continue.

The US GDP second estimate for the fourth quarter will be released on Thursday the 27th. The first estimate was at 2.1% at annual rate and the 2019 growth is at 2.3%. The carry over growth at the end of 2019 for 2020 is 0.8%.

In Germany, the detailed GDP will be released on Tuesday the 25th. The first GDP estimate was at 0.11% at annual rate. 2019 is at 0.6% and the carry over for 2020 at the end of 2019 is just 0.06%.

France will release its new estimate and detailed data (corporate margin, saving rate) on GDP on Friday 28. The first estimate was at -0.3% at annual rate, growth rat for 2019 at 1.2% and carry over at 0.1%

IFO for February (24) and employment for December (28) in Germany

Recent corporate surveys are on a stronger trend. This can be seen on the IFO until January (see graph) but also on the PMI Markit index for the manufacturing sector (in February). The IFO index for February will be interesting as uncertainty has deeply increased with the coronavirus crisis. This has been seen on the ZEW survey for February. The average index (between current conditions and expectations) dropped from +8.6 in January to -3.5 in February. We expect a slightly lower IFO.

The employment figure will be released for January (28). The adjustment seen on the graph is not over and probably the annual change in employment will continue to slow at the end of 2019.

Japanese activity in the industrial sector for January (28).

During the last quarter of 2019, the GDP dropped dramatically at a -6.3% pace at annual rate. This was linked with the VAT rate hike decided for last October. This has led to a deep drop in households’ expenditures. One consequence was a rapid slowdown in the industrial production (-15% at annual rate between September and December 2019).

The lower production and the weaker demand have led to accumulation of inventories. The surge in inventories to shipment ratio is a real source of concern. Companies will first reduce their inventories before producing more. But the process will take time as demand will be limited. After the VAT rate hike in April 2014, households’ demand has been weak for long. That’s why we expect a recession in Japan.

French Climat des Affaires for February (25) and consumer confidence (26)

The corporate survey has been strong for months but the contagion from the weak global environment has started. We see on the graph that the industrial index is on its historical average and the PMI index for the manufacturing sector is contracting in February for the first time since July. The Climat des Affaires will probably be marginally weaker in February but still above its historical average at 100. The HH confidence index will remain above its historical average.

What to keep in mind from last week ?

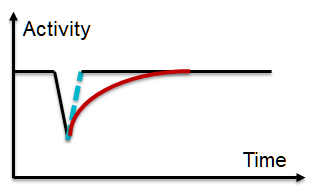

The coronavirus is more persistent and more severe than expected

The epidemic is usually perceived as having a V-Shape impact on the economic activity. This mimics what has happened with the SARS in 2002 and 2003. This scenario can be represented by the blue dotted line on the graph. The impact is important but temporary and with a very limited persistent effect. At the same time, it is believed that central banks may help in the case of a different scenario. This is probably the reason of the upward trend on equity markets.

But can it work this way when there are 600 cases of coronavirus in South Korea provoking a country alert level. Can it work this way when 11 towns in Italy are in quarantine? Can it work this way when the reference is China at the beginning of the 2000’s with limited interactions with the rest of the world? Now China is a global player with a major role in most value chains. If corporate activity stops in China, the impact will be global as companies elsewhere in the world will not be able to produce as they can’t replace spontaneously the Chinese component of their production line. This negative spillover effect can be seen in the very low level of the Baltic Dry Index (freight cost) and by the drop in the number of containers arriving in Europe. Boats cannot leave Chinese ports and at the same time, non Chinese boats arriving in China are no longer able to deliver their containers because people do not work and because inventories are already at a high level.

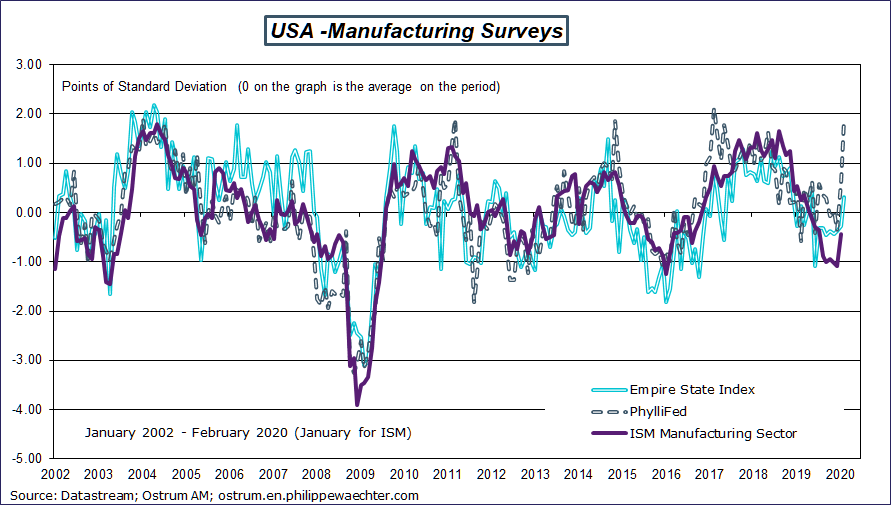

The contagion effect to the global economy will go through this channel leading to arbitrage that will be favorable to the US at least in the short run. This is my interpretation of the jump seen in both indices from NY Fed and Phyli Fed (this latter is at an historical high).

The impact could therefore be much like the red curve in the first graph. It will take time to converge to the previous trend even if rapid progresses are made in finding a vaccine. The current epidemic has started to create shock that reduce the possibility of an homogenous dynamics. This is a supply shock and therefore, monetary policy will not be able to manage it. A drop in interest rate would push up demand, but supply cannot increase in the short run because workers in many places in China can’t go working. They will not return to their factories before the second week of March.

It’s the same with a proactive fiscal policy that would boost domestic demand. Therefore, don’t count on the Fed, the ECB or other central banks to be a source of solution. Their sole role is to limit companies’ bankruptcy. It’s important but it is just a medicine to stay alive before a recovery associated with a vaccine or the disappearance of the disease.

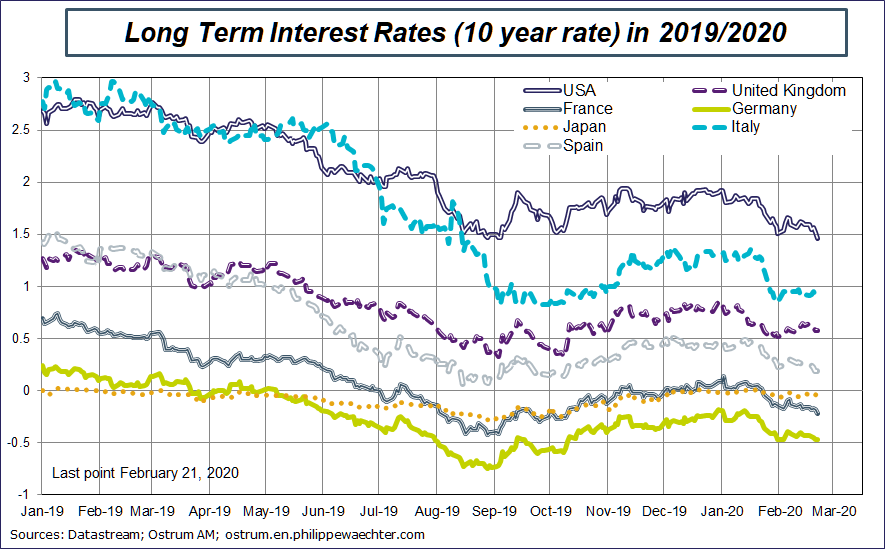

Fixed income investors have understood that pushing rate on the downside.

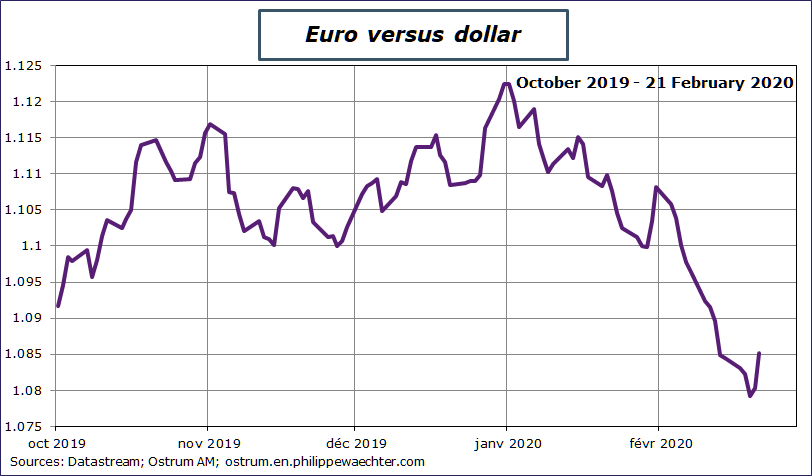

One consequence of this epidemic is a stronger US dollar

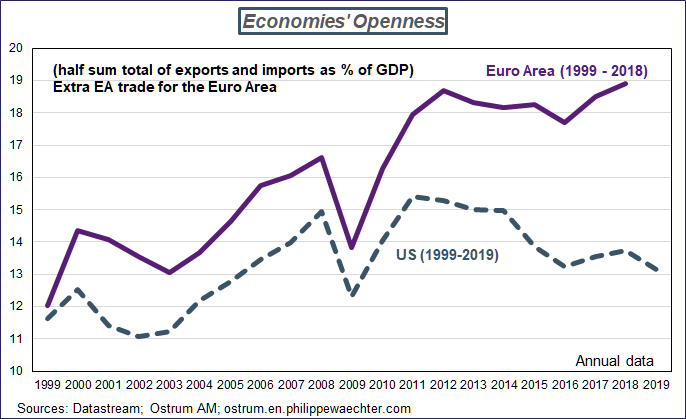

The dollar has been strong since the beginning of the epidemic. The first reason is the safe heaven effect of the greenback. The US appear safer than any other place. But it is not enough. The main reason is the closedness of the US economy compared to the Euro area. This means more autonomy in its growth process when compared to other countries and notably the EA.

The second graph shows the degree of openness of both economies. The US openness is quite stable through time while the Euro Area under the German impulse the degree of openness is at 19%. The capacity to grow alone is weaker in the Euro Area than in the US. In the case of a coronavirus contagion, the US may be perceived as quite immunized when it is not the case in Europe.

The possibility of a more autonomous growth in the Euro Area has not been reinforced by the failure to find an agreement on the European budget. It’s a drama for Europe as it shows that the European cooperation is a dead end.

It means that in the current situation, when you cannot bet on China, the natural candidate is the US, not Europe. That’s a shame

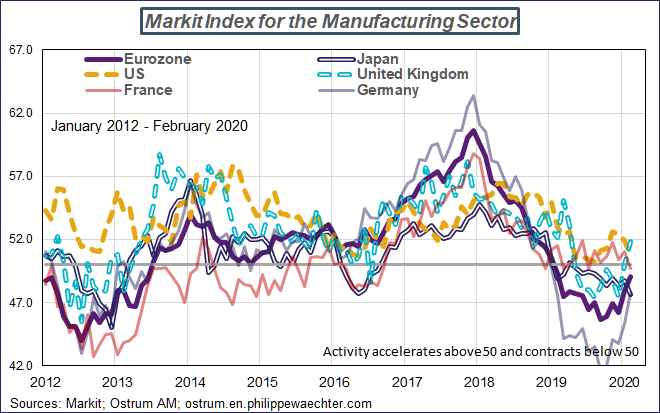

The Markit survey for February – Flash estimates in the US, Japan, UK, Euro Area, Germany and France

Looking at the graph, one can perceive a kind of stabilization. But we can’t be sure of this as New Exports orders are weaker everywhere (systematically below the 50 threshold) while domestic orders were strong. We believe that this situation, and what we said earlier on the global trade, will lead in a foreseeable future to a risk of recession. The constraint from outside will limit the capacity to grow and the possibility to recover. In the long run, there will be new factories but in the short run, every country is conditioned to a Chinese economy that will run way below 5% this year. The impact will be stronger than the -0.1% expected by the IMF.

The strong UK index is the end of short term uncertainty. It will come back soon.

The detailed document is available here