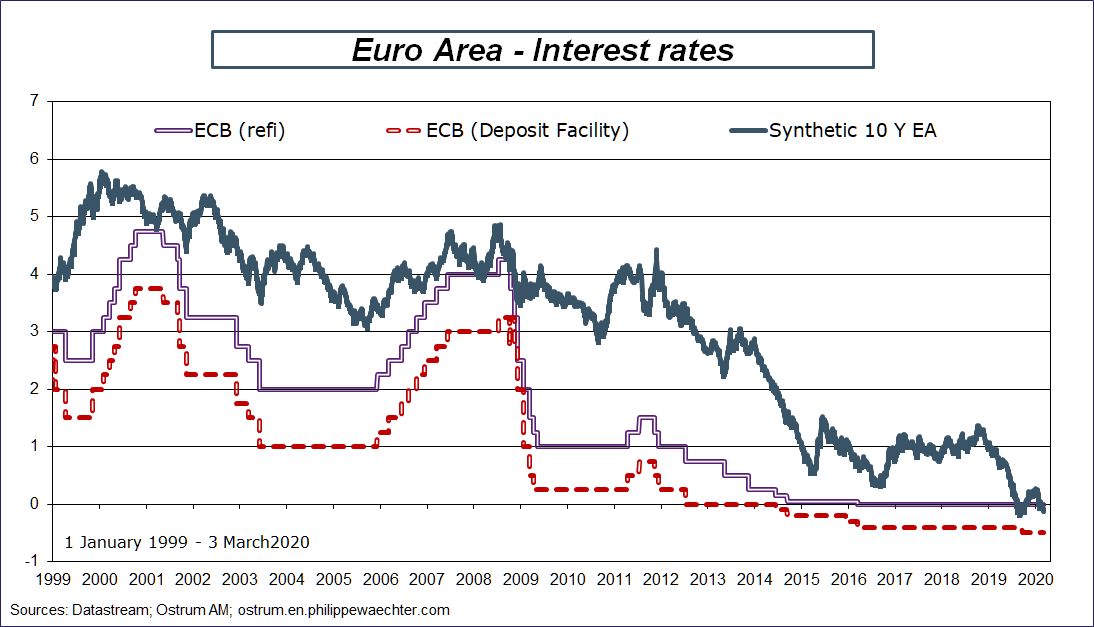

Will the ECB follow the Federal Reserve. Will it slash its main interest rates ? The answer is a clear no. The US 10 year interest rate dropped dramatically in recent days leading to a strong adjustment on Fed’s side. It’s not the case in the Euro Area. The synthetic 10 year interest rate is consistent with the current monetary policy stance.

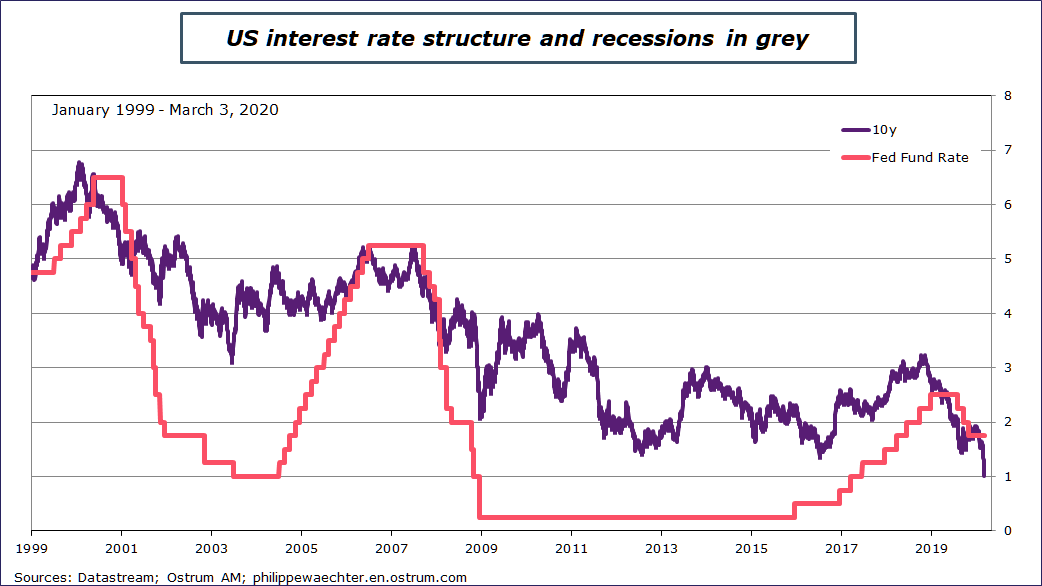

Yesterday, the Fed has reduced its main rate by 50 bp. The fed fund is now in a range that goes from 1% to 1.25%. The main reason was the recent deep drop in all the US interest rates.

Since the beginning of the year the 10 year rate dropped by circa 100 bp. And last week this rate was way below the Fed’s rate as it can be seen on the graph. As I explained it yesterday (here), the Fed’s move was just a way to go back in a range consistent with the US TBonds yield curve. All the rates were below the Fed measure, it was not sustainable and that the reason of the Fed’s move. If the 10 year interest rate continues to slip and goes below 1% the Fed will have again to reduce its rate.

The ECB is not in this situation. Its benchmark rates are already at 0 for the refi rate and at -0.5% for the marginal deposit rate.

The 10 year synthetic rate for the Euro Area is currently between these two rates. Yesterday, 3 March, it was at -0.12%. (This synthetic rate is a weighted average of 10 year rates in the Euro Area. Weights are the size of real GDP of each country in the Euro Area).

We don’t see in the Euro Area the disequilibrium seen in the US between the yield curve and the monetary policy stance. The ECB can maintain its current rate for long. But this doesn’t mean that nothing has to be done but it will not go through lower rates.