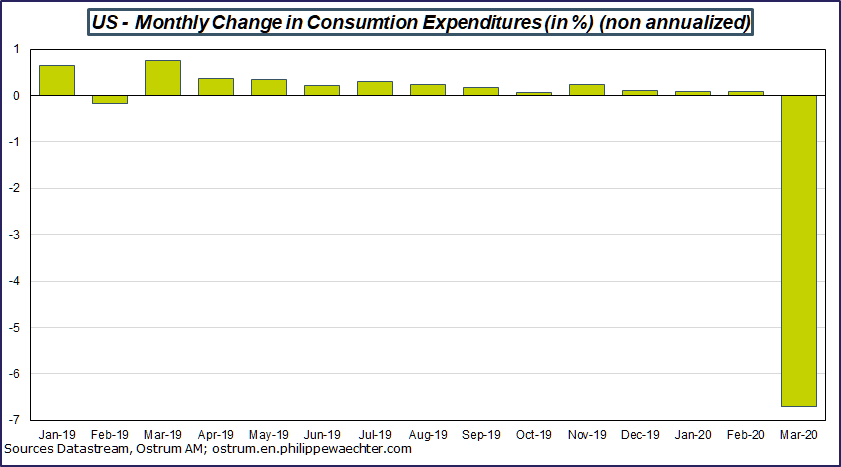

March was devastating for the US economy with a 6.7% drop in consumer spending. The measure of the decline in activity will increase in the second quarter. The breaks noted in surveys are really observed in April. The very expansionary policy will not reverse the trend due to the unprecedented magnitude of the contractions observed. The recession in 2020 will be very large.

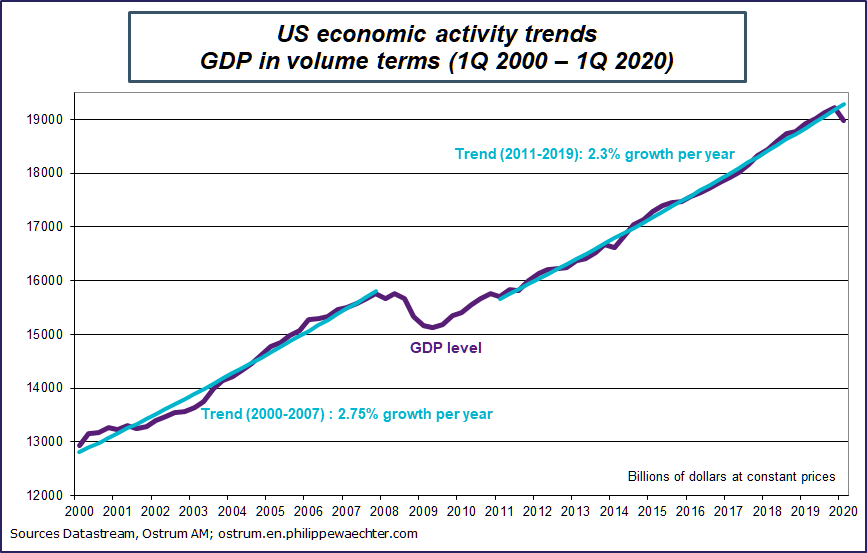

US GDP in the first quarter contracted by -1.2% (-4.8% annualized). Over one year, the GDP only increased by 0.3%. The carry over growth for 2020 at the end of the first quarter is negative at -0.45%.

The measure of this contraction in GDP can be compared to that of -2.16% (non annualized) recorded in the last quarter of 2008 just after the Lehman shock. We should expect a contraction of GDP for 2020 between -4.5% and -6%.

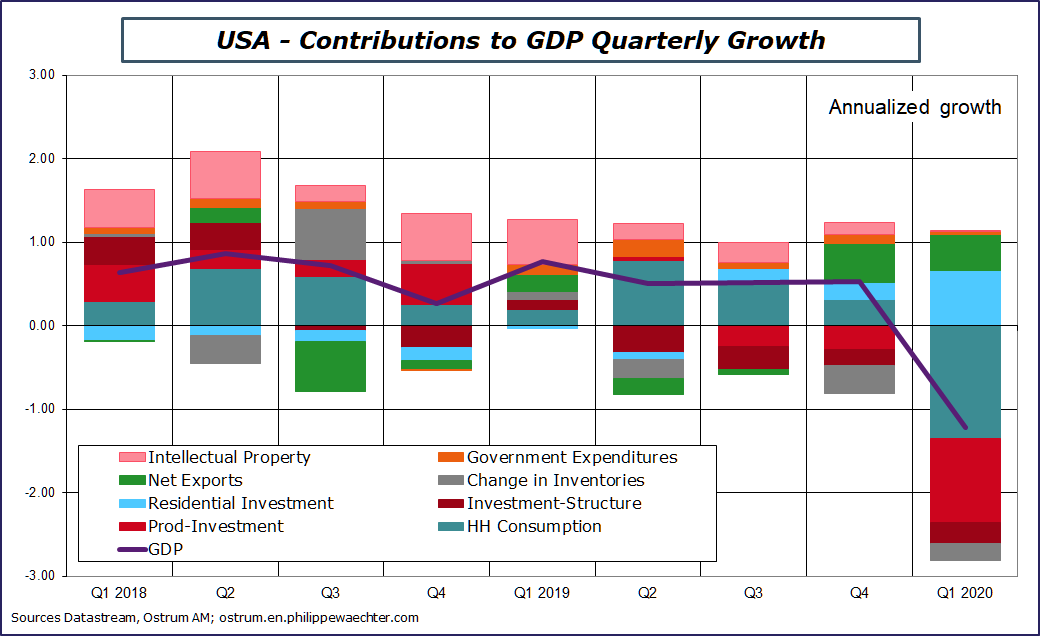

Consumers’ expenditures in March have penalized the American activity. Household spending fell -1.9% in the first quarter but fell -6.7% in the month of March alone. It had increased in January and February. It is, in March, that the more severe pattern of the pandemic contagion took place but also the spectacular adjustment of the labor market, that explain the poor performance of the economy in the first quarter. Productive business investment is also falling sharply and for similar reasons. The increased uncertainty has resulted in a rapid decline in capital spending. Government spending was neutral over the quarter. Inventories have a limited negative contribution and foreign trade has a positive contribution. The fall in imports (weaker domestic demand) was greater than that in exports.

Annex

Consumption fell mainly in March in phase with the appearance of the Covid-19 in the USA and the strong adjustment of the labor market.