The world economy has staged a rebound since April’s lockdown, yet the recovery is not complete, and spending in the services industry is lagging very far behind with uncertainties on the pandemic continuing to loom large. This is reflected by households’ moves to save more where possible.

Against this backdrop, the central banks have taken a highly accommodative approach, and uncertainties on the Fed and the US economy are hampering the dollar, while Europe is reaping the benefits of the bloc’s rescue plan.

After the lag was somewhat made up in May and June, this trend could run out of steam and require very active economic policy, with the risk of pushing up structural public deficits and pointing to the possibility that tax hikes will be needed very soon.

So the post-vacation period requires us to look back and update stats and indices published during the summer period. Read on to see the key points I have identified as August gets off to a start.

The following are the main 18 points to bear in mind

Remain alert to the health crisis

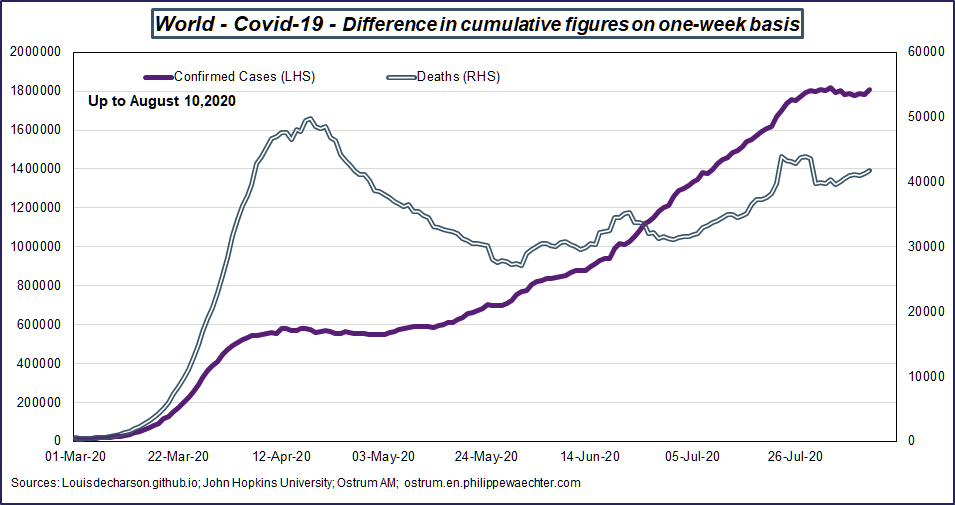

1- Worldwide

Data on confirmed Covid-19 cases worldwide continued to show an increase, but this upward trend turned around in the last week of July. There is a stabilization since this date. Such a change in trend may be similar to what was seen at the end of April when the situation stabilized in Western countries.

One explanation of the recent acceleration followed by this July inflection is the turn-around in the US.

The number of deaths has accelerated until the end of July (the peak is July the 24th). Since then the absolute number is lower and the trend is quite flat.

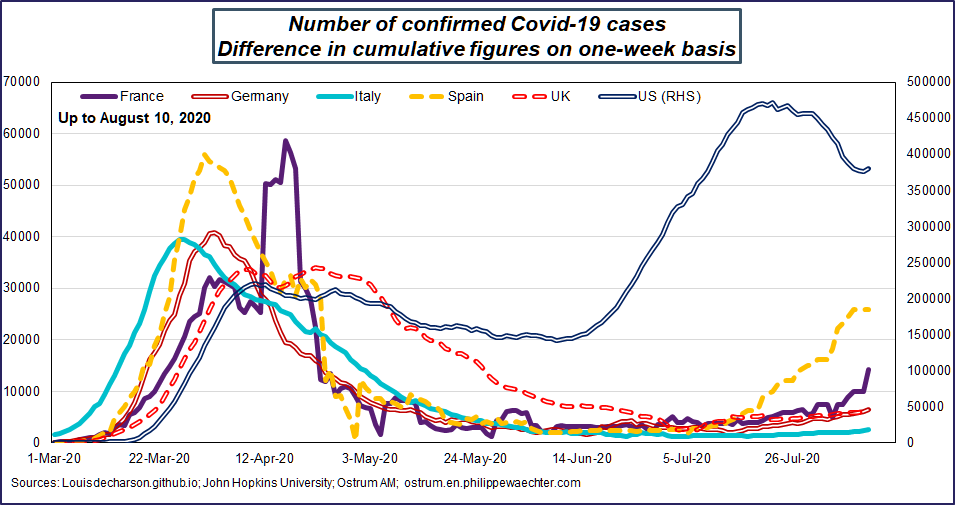

2- By Country

The recent change is the sharp jump in cases in the United States, and we have seen a shift in trend since mid-June, marking a much stronger tendency than at the start of the pandemic. However, the trend has started to slow with fresh lockdown measures in various states, and on the chart we can see a significant downturn since the last week of July.

Trends in Spain are worrying as the pandemic has displayed greater development since mid-July, warranting local lockdown measures in Catalonia and Aragon.

Meanwhile across other European countries, caution is the watchword, notably in France, as there is a slight increase across the board, although total lockdown has not been applied. Care will be required in France to avoid an upsurge in the epidemic at all costs. (The recent surge in France, is not dependent on the number of tests. The number of tests is large now but has not changed dramatically in the last 3 weeks)

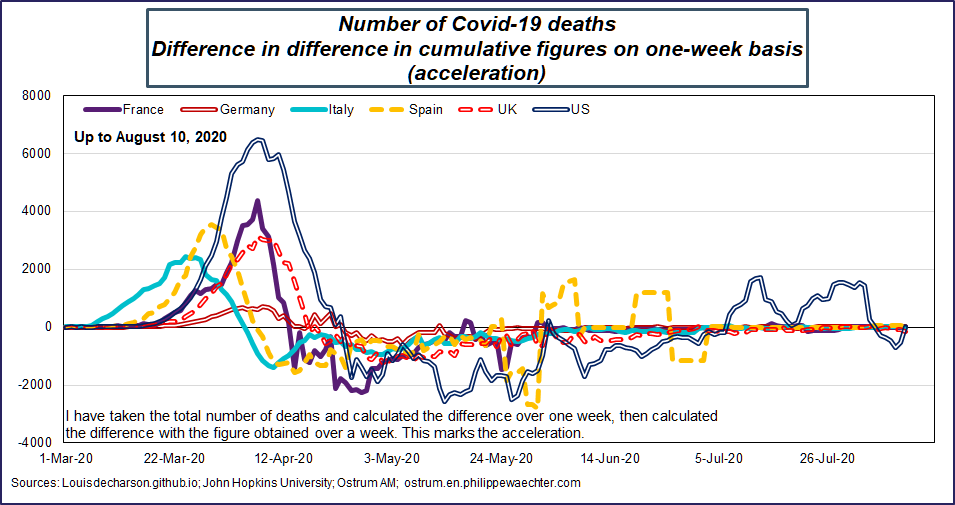

The number of deaths is not rising in any country in Europe and is no longer accelerating in the United States.

Medical care for patients is curbing the pandemic’s fatality rate and this is the key difference as compared with March/April, when the mortality rate followed numbers of confirmed cases with a lag, but still in hefty numbers.

Economic Outlook: shock in 2Q then recovery

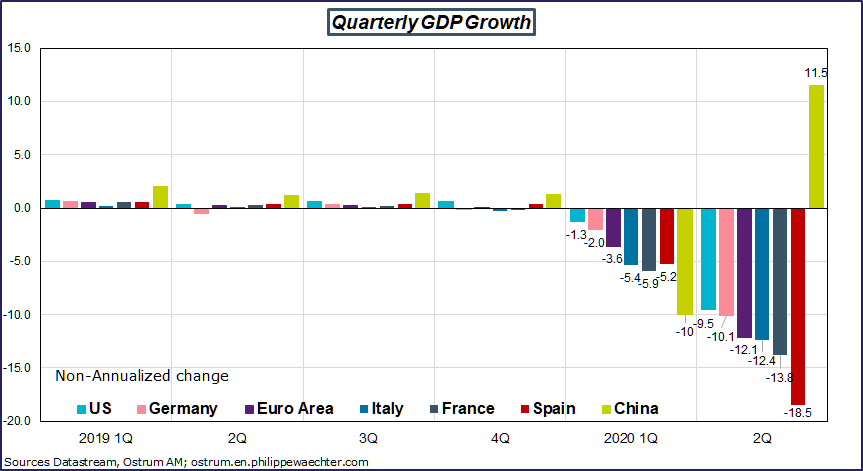

3- Economic activity plummeted in second quarter

China went into lockdown in the first quarter of the year, while in western countries, this move started during March, depending on the country, then in April and partly in May. This variation is reflected in GDP contraction data, with a severe plunge over the first three months of the year in China and moderate elsewhere. The slowdown was much more severe in western markets in the Spring, while China saw a timid recovery. Economic indicators in all western markets collapsed in April, and efforts to catch up in May and June were not sufficient to make up for this decline.

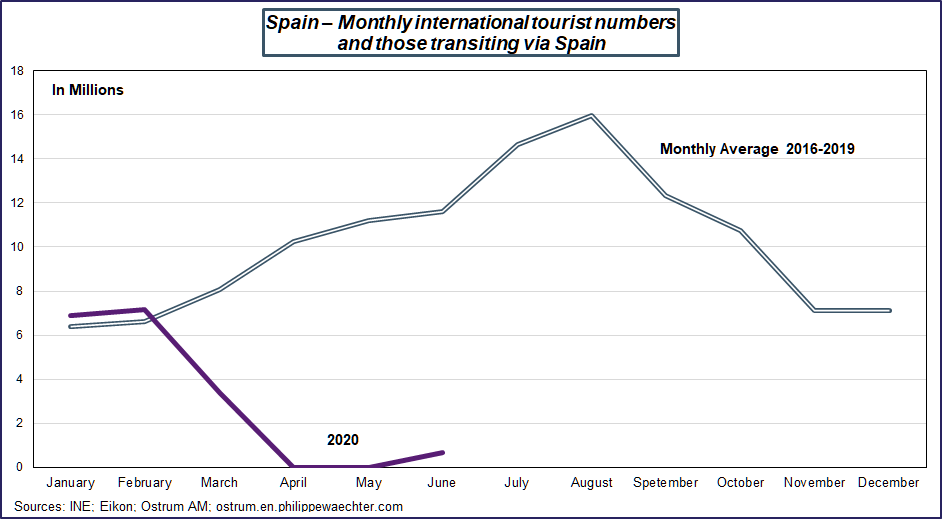

4- The Spanish economy was very hard hit and tumbled 18.5%, partly as a result of the deterioration in tourism, which accounts for around 12% of the country’s GDP: tourist numbers were zero in April and May (lockdown), while June saw only a moderate uptick. Trends in 2020 are entirely incomparable with figures seen over recent years, and the country has suffered massive lost revenues. Renewed restrictions will also have a stark effect on the economy’s ability to drum up some momentum over the summer.

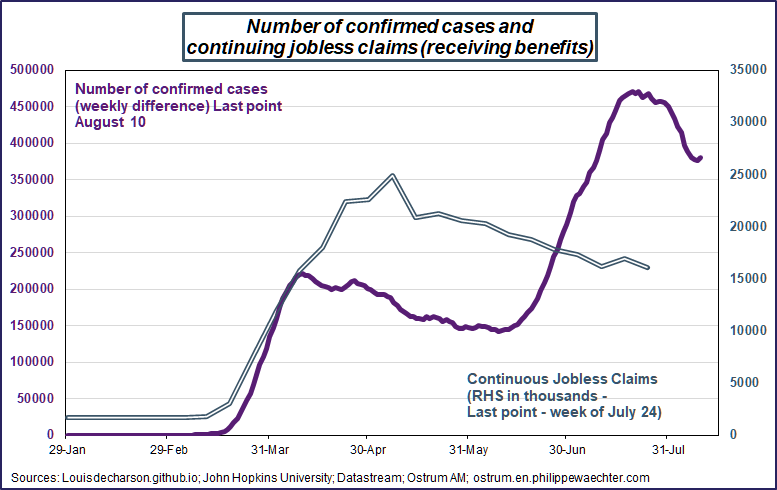

5- In the United States, the increase in the number of confirmed cases and lockdown measures taken will hamper the labor market and also curb the economy’s rebound potential.

In March and April, there was a lag between the number of confirmed cases and trends in jobless numbers. There will probably be an increase in unemployment stats at end-July and the start of August.

This increase in jobless numbers will be particularly damaging for the economy as extra unemployment benefit related to the pandemic (an additional $600 per week) came to an end on July 31 and Congress and the White House have failed to come to an agreement to facilitate the situation for the unemployed. Democrats are keen to pursue current additional benefits, while the Republicans want to cut back this payout to $200 as they feel that current benefits are dissuasive – a theory that has in no way been confirmed by any serious analysis on the matter. Measures that have been taken by President Trump will not solve the equation. The 400$ benefits will be funded for 75% by the federal government and by 25% by local states which where not prepared for that. It will take weeks to put it in place. Another measure is related to lower payroll taxes. This is not a tax cut but the payment will be deferred. At first it will be at the advantage of those who already have a job but will not help the unemployed (as it is a deferred payment). The employment number will depend on the domestic demand momentum and this latter could be low if the benefit mechanism takes time to be designed and put in place. All these measures are still not effective as there is a constitutional issue.

The risk is that a cut in current benefits, at least for August, could lead to a fall in demand and hence inhibit output and employment.

The economy is set to suffer in August and September.

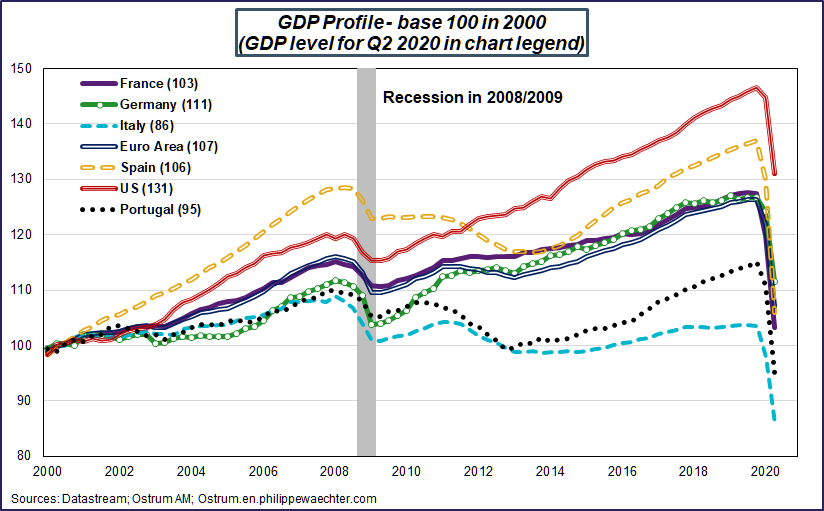

6- GDP for several countries in the euro area is short of figures posted during the great recession, with the euro area 4% below the financial crisis period.

In Portugal and Italy, current figures are vastly lower than in 2000. Italy stands at 86% of its 2000 figure and Germany at 111%, with France at 103% and Spain at 106%. The United States has seen relatively robust and steady growth since the great recession and has only fallen to 131%..

When we look at the chart, we can see the divergence between the US and the euro area after 2011. During the post-crisis recovery, the two profiles ran parallel, and after the roll-out of austerity policies in Europe, growth disappeared and divergence was long-lasting.

The plan hammered out by European leaders at the mid-July summit rules out this risk of austerity, which is a good sign.

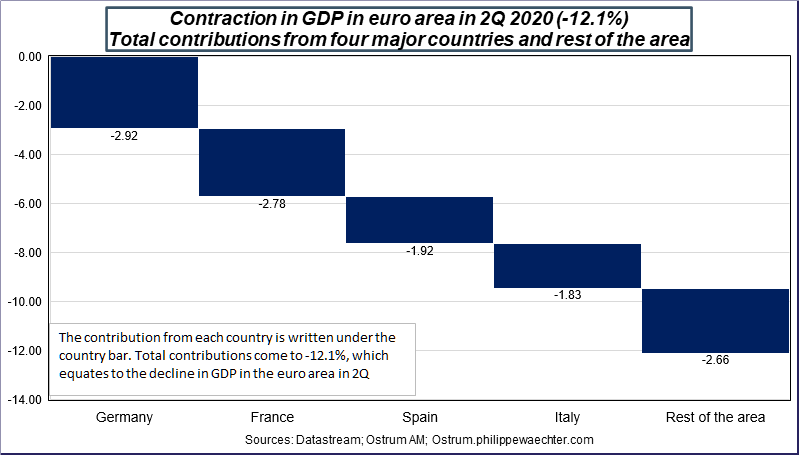

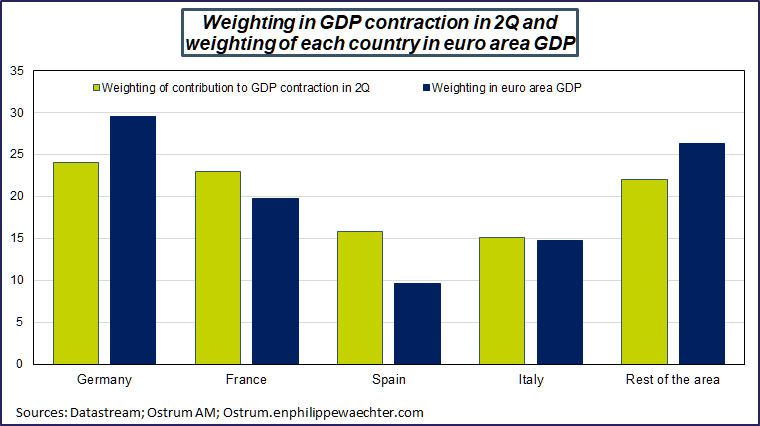

7- The four major euro area countries account for 80% of the GDP decline in 2Q.

Germany and France account for 23-24% of the deterioration in GDP in the euro area, while Italy and Spain are each responsible for around 15%. The remainder of the euro area accounts for 21%.

We note that the weighting of Germany’s contribution is lower than the weighting of its contribution to GDP for the euro area. The opposite is true for France and Spain, and this shows the extent of the turmoil in these two countries, particularly Spain. Conversely, Italy displays similar weightings for the two figures. The rest of the area has a lower contribution to the EA GDP contraction than its weight in the Euro Area GDP. This means that the two weakest economy in 2Q were France and Spain.

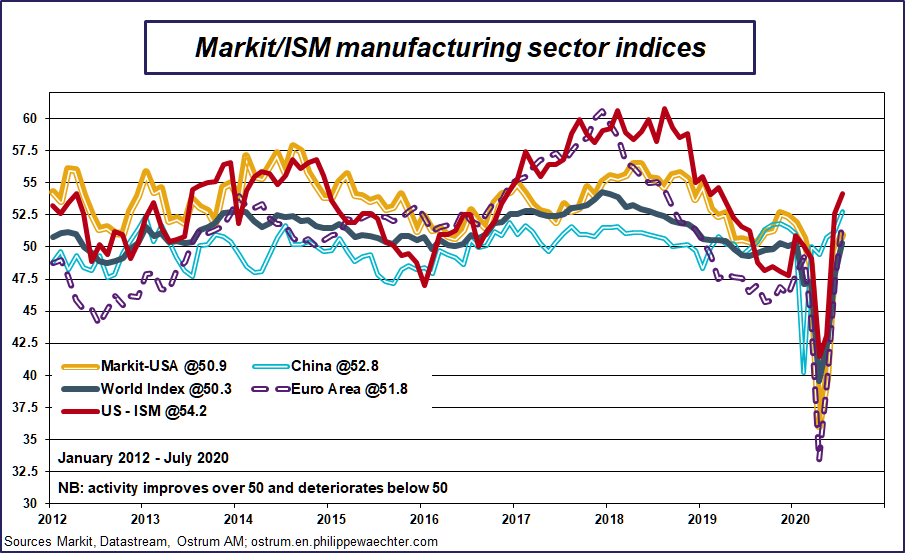

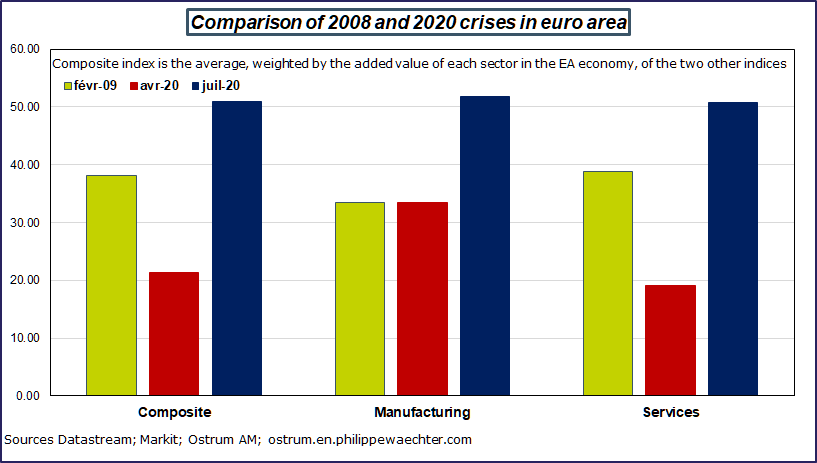

8- Business surveys improve considerably

The plunge during April’s lockdown was followed by a period when activity caught up, and this continued in July. Orders were stronger, bolstering output and pushing up composite indices.

Composite indices in the Markit survey posted similar trends.

In the services sector, activity swiftly picked up the pace again: Markit indices reveal month-on-month trends rather than absolute activity figures, so brushing over figures too quickly can be deceptive.

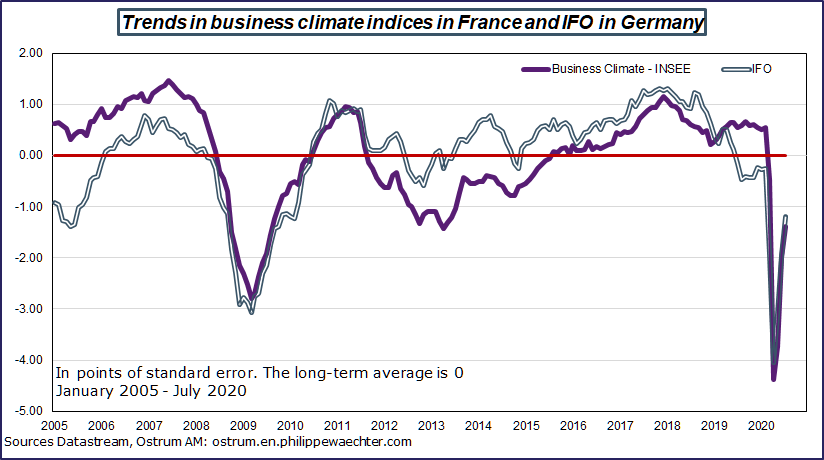

9- The levels of data measured by the INSEE and IFO surveys show that activity has not yet returned to its normal point, which is indicated by 0 on the chart.

We can see here the very specific profile of the lockdown period: time ground to a halt, and the economy then resumed, but now it must be rebuilt on a long-term basis.

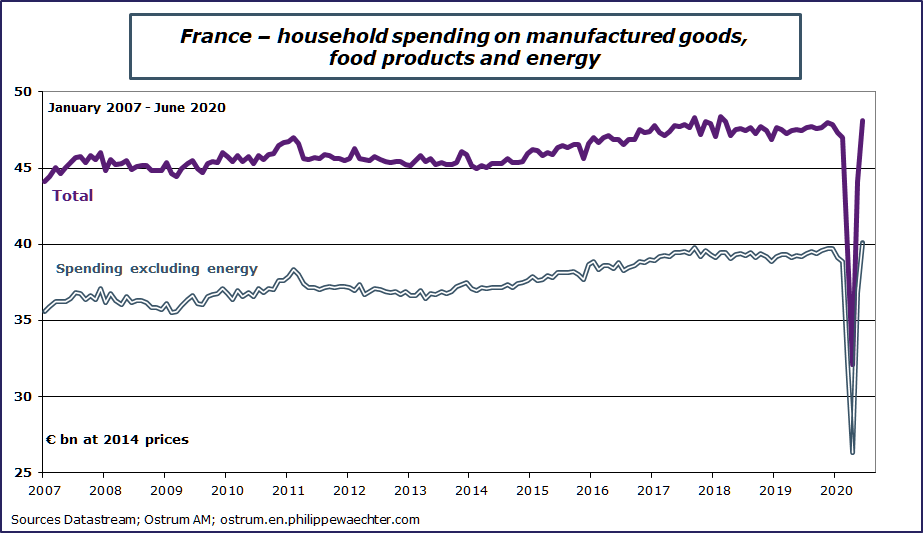

10- Economic activity caught up via consumer spending. Spending on goods in France in June came out above figures recorded before lockdown. This positive trend is set to continue in July on the back of the automotive market, which is driven by various bonuses. However, the situation in this sector will then become more challenging as these bonuses help run down inventories, but demand is then lower and the sector struggles again once this move is complete.

The profile for spending on services is probably more moderate than the trend for goods, as a number of services were only available with a lag, partly or not at all after lockdown ended. This portion of consumer spending will take quite some time to recover. Tourism, restaurants and air travel will not operate normally until the end of the year at the very least.

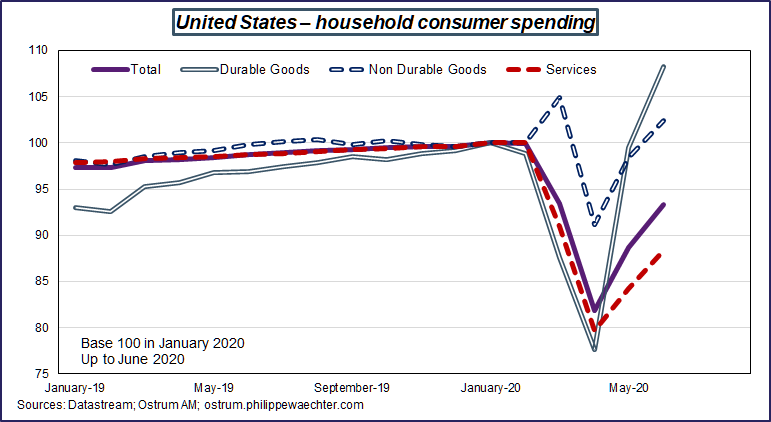

11- This distinction between the profile for spending on goods and services is reflected in the chart on US household spending. The rebound in durable goods was robust in June (vehicles, household equipment) and far outstripped figures at the start of the year, while for services, spending was 12% short of January’s stats.

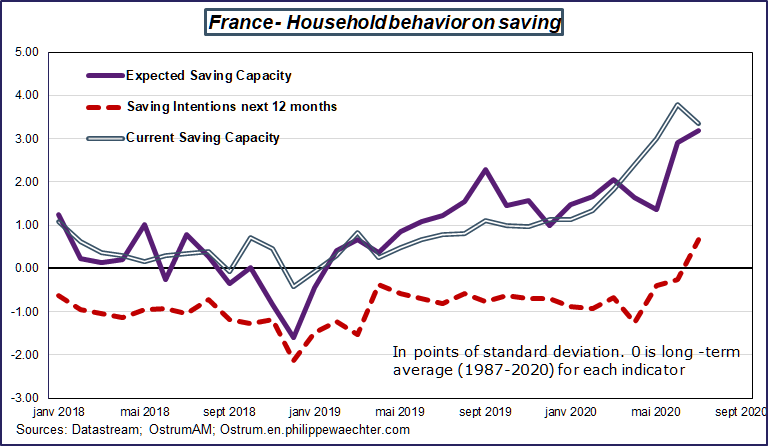

12- However, consumers remain cautious. In the latest INSEE household survey, respondents preferred to focus on saving. The three indicators in the savings survey are above their long-term average (1987-2020) and figures on saving capacity are at an all-time high in June or July. Once consumer spending catches up as outlined above, it is unlikely that spending momentum will speed up, particularly if the health situation becomes worrying.

In the United States, the Conference Board consumer confidence survey reveals that the expectations index is very sluggish and this could also lead to a downturn in consumer spending after the catch-up in the country.

Financial momentum – very low interest rates for a very long time to come

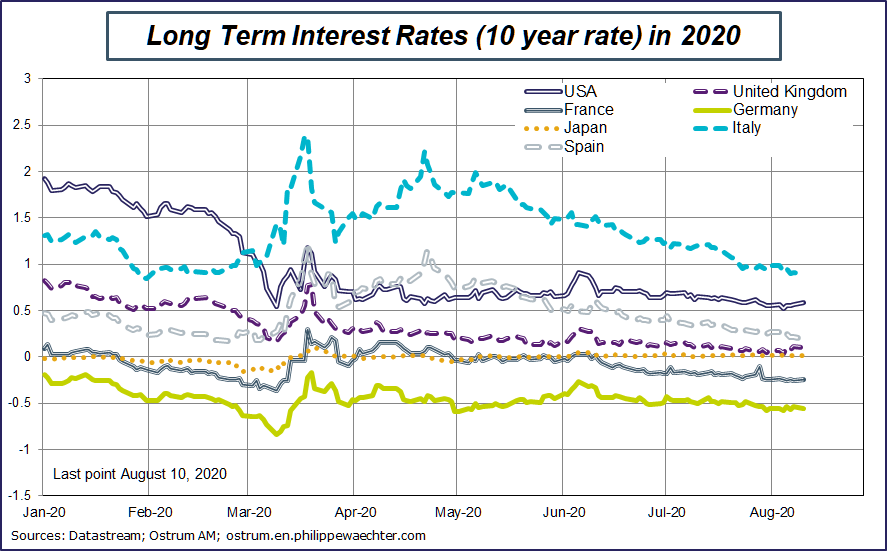

13- Long-term interest rates are still on a downward trend

During their July meetings, the ECB and the Fed reiterated their aim to support the economy, regardless of the cost, so there is no reason for interest rate projections to turn around. The feeling that this possible interventionism will be part of an even longer trend than expected is pushing interest rates down, while inflation forecasts also remain limited. The surge in jobless numbers in the main developed countries means that there will be no upward pressure on wages, and so inflation will remain low over the months ahead. There would thus be more a concern of a risk of deflation, as salaries on new work contracts will be lower than existing wages.

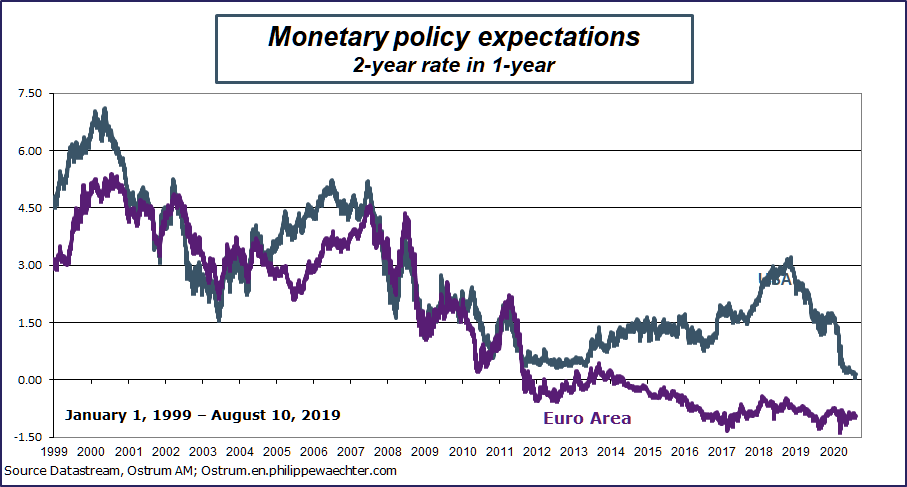

14- The main change in monetary policy projections is visible in the United States.

Projections for yield on 2-year bonds in one year stood at virtually 0% at the start of August, and this is the first time we have witnessed this scenario over the past 20 years. Monetary policy normalization has virtually disappeared from US central bankers’ rhetoric since the start of 2019.

However in the euro area, stability has been the watchword since 2017, reflecting moves made by Mario Draghi when he was president of the ECB and later confirmed by Christine Lagarde when she took over at the helm. Draghi won investor confidence when he indicated that the ECB would do whatever it took to cut back risks in the euro area.

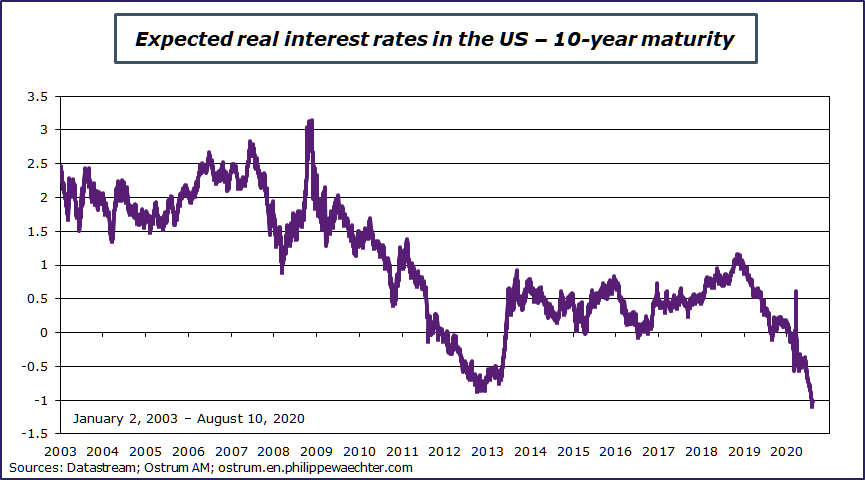

15- This concern is reflected in US 10-year real interest rates.

The real market rate is now below -1%, the first time figures have fallen so low since inflation-linked bonds were issued in the US. This trend reflects concerns on forthcoming economic performances, and on the Fed’s ability to change monetary policy direction over the years ahead.

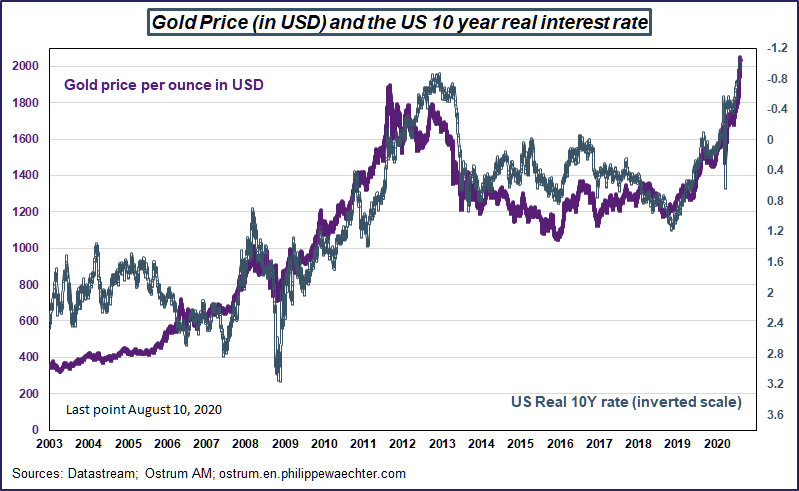

16- This negative perception of the US economy is reflected in an unprecedented rise in gold prices.

Gold price trends are always connected to movements in US real rates, and periods of upswing occur when real rates move towards 0%.

Gold is an asset that carries no yield, and when US real rates are negative it is beneficial to hold the metal.

Rising gold prices merely embody concerns on the situation in the United States and the ensuing negative projections.

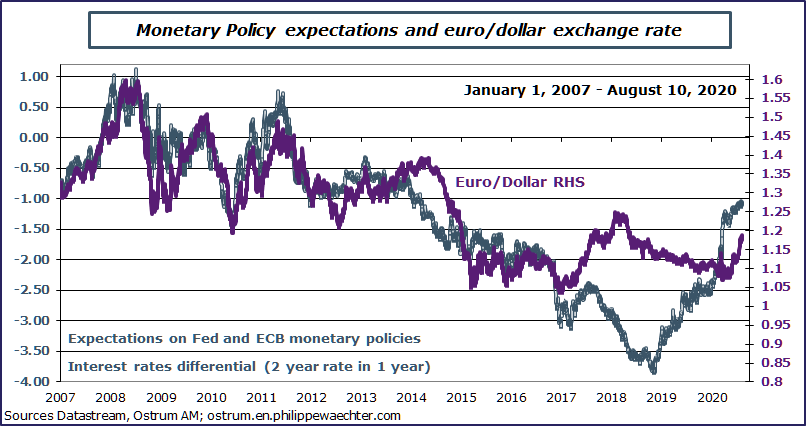

17- The inversion in projections on US monetary policy and European stability provide a good explanation for the dollar’s recent deterioration. The Fed’s headlong rush in the face of the complex situation in the US is denting the dollar, while the European rescue plan is bolstering the solidity of Europe and the euro area.

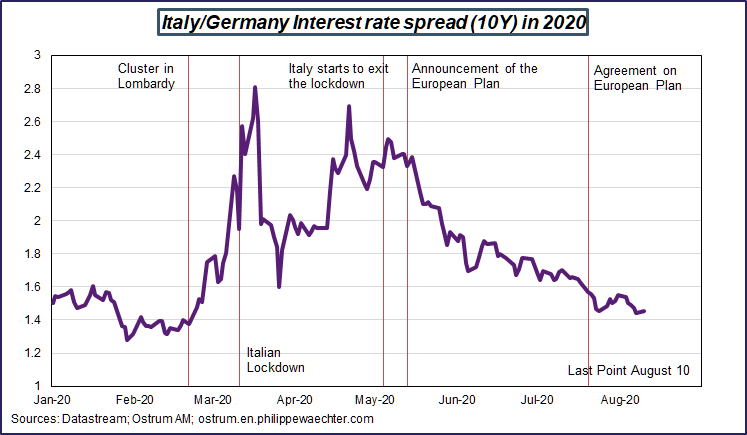

18- The announcement of European measures is a reassuring message on stability in Europe: this is reflected in narrowing yield spreads between Italy and Germany.

The rescue plan reflects a number of points.

Firstly, it provides assurance that Europe will not repeat its mistakes of 2011/2012 and demand austerity policies. The economy is fragile and policies from that period had disastrous effects.

Secondly, it offers a way of driving more self-sustaining growth in Europe at a time when the economic situation across the rest of the world is timid. The United States and China will not be the growth drivers they were in the past, and so it is key to make growth more self-sufficient.

Meanwhile borrowing to provide funding marks a step towards greater fiscal and political federalism. This is also a crucial stage as it cannot fail. If Europe does not draw the benefits of this plan and recover stronger job growth, then anything can happen.