Growth is conditioned by the accumulation of capital and its articulation with technical progress. This is an essential factor in understanding the growth profiles of developed countries. But this is not enough if the institutions are not integrated both in financing and in the behavior of the labor market. Demography, too, has a strong explanatory power.

Cultural diversity sheds light on the emergence of growth more than expected.

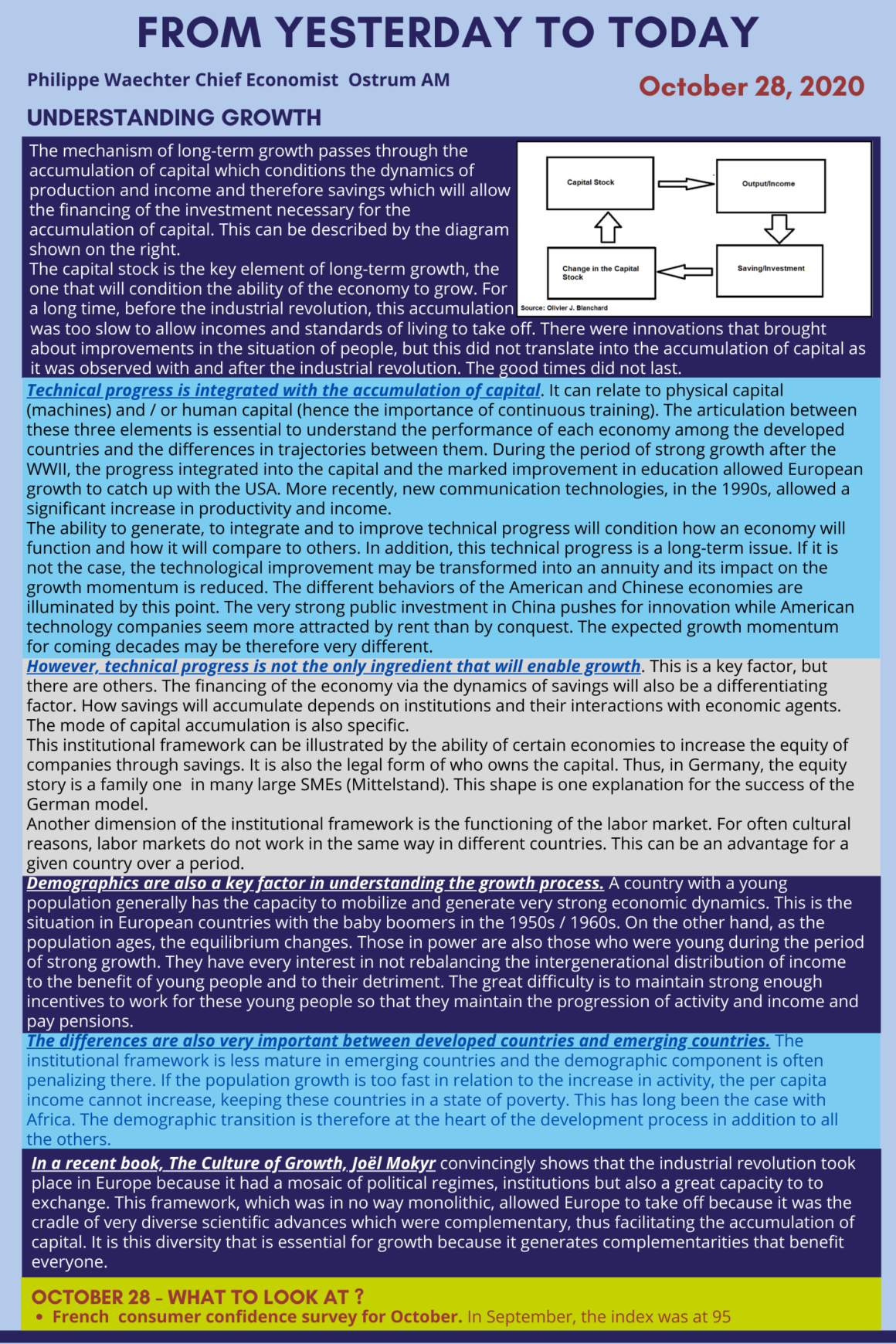

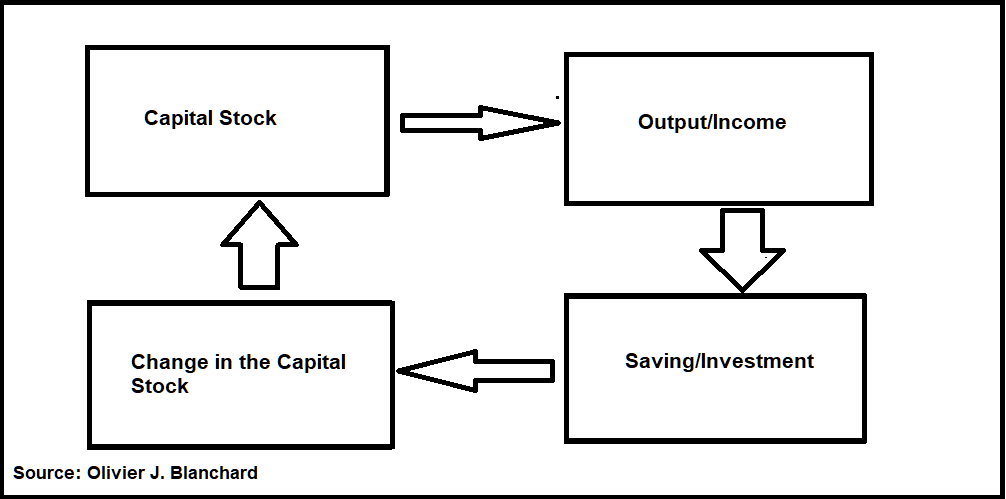

The mechanism of long-term growth passes through the accumulation of capital which conditions the dynamics of production and income and therefore savings which will allow the financing of the investment necessary for the accumulation of capital. This can be described by the diagram shown on the right.

The capital stock is the key element of long-term growth, the one that will condition the ability of the economy to grow. For a long time, before the industrial revolution, this accumulation was too slow to allow incomes and standards of living to take off. There were innovations that brought about improvements in the situation of people, but this did not translate into the accumulation of capital as it was observed with and after the industrial revolution. The good times did not last.

Technical progress is integrated with the accumulation of capital. It can relate to physical capital (machines) and / or human capital (hence the importance of continuous training). The articulation between these three elements is essential to understand the performance of each economy among the developed countries and the differences in trajectories between them. During the period of strong growth after the WWII, the progress integrated into the capital and the marked improvement in education allowed European growth to catch up with the USA. More recently, new communication technologies, in the 1990s, allowed a significant increase in productivity and income.

The ability to generate, to integrate and to improve technical progress will condition how an economy will function and how it will compare to others. In addition, this technical progress is a long-term issue. If it is not the case, the technological improvement may be transformed into an annuity and its impact on the growth momentum is reduced. The different behaviors of the American and Chinese economies are illuminated by this point. The very strong public investment in China pushes for innovation while American technology companies seem more attracted by rent than by conquest. The expected growth momentum for coming decades may be therefore very different.

However, technical progress is not the only ingredient that will enable growth. This is a key factor, but there are others. The financing of the economy via the dynamics of savings will also be a differentiating factor. How savings will accumulate depends on institutions and their interactions with economic agents. The mode of capital accumulation is also specific.

This institutional framework can be illustrated by the ability of certain economies to increase the equity of companies through savings. It is also the legal form of who owns the capital. Thus, in Germany, the equity story is a family one in many large SMEs (Mittelstand). This shape is one explanation for the success of the German model.

Another dimension of the institutional framework is the functioning of the labor market. For often cultural reasons, labor markets do not work in the same way in different countries. This can be an advantage for a given country over a period.

Demographics are also a key factor in understanding the growth process. A country with a young population generally has the capacity to mobilize and generate very strong economic dynamics. This is the situation in European countries with the baby boomers in the 1950s / 1960s. On the other hand, as the population ages, the equilibrium changes. Those in power are also those who were young during the period of strong growth. They have every interest in not rebalancing the intergenerational distribution of income to the benefit of young people and to their detriment. The great difficulty is to maintain strong enough incentives to work for these young people so that they maintain the progression of activity and income and pay pensions.

The differences are also very important between developed countries and emerging countries. The institutional framework is less mature in emerging countries and the demographic component is often penalizing there. If the population growth is too fast in relation to the increase in activity, the per capita income cannot increase, keeping these countries in a state of poverty. This has long been the case with Africa. The demographic transition is therefore at the heart of the development process in addition to all the others.

In a recent book, The Culture of Growth, Joël Mokyr convincingly shows that the industrial revolution took place in Europe because it had a mosaic of political regimes, institutions but also a great capacity to to exchange. This framework, which was in no way monolithic, allowed Europe to take off because it was the cradle of very diverse scientific advances which were complementary, thus facilitating the accumulation of capital. It is this diversity that is essential for growth because it generates complementarities that benefit everyone.

________________________________________________

This post is also in infographic that can be downloaded