The impact of the November containment can be made in reference to the break in the 2nd quarter when GDP contracted by -13.8%. A conservative assumption is to take -6% over the last quarter of 2020. In this case, GDP would contract by -10.8% in 2020 and with a rebound in the first quarter of 2021, growth would be around 3.5% in 2021 and the return to the 2019 level would not happen before 2026. The risk over this entire period relates to employment and social systems.

President Macron announced at 8:00 p.m. a new confinement for France throughout the month of November and until December the 1st with the possibility of modifying the terms after 15 days.

The main difference with that of spring 2020 is keeping schools open. There will be no childcare situation for either parent. It was last spring, a situation which had constrained the labor force and which had been penalizing for the activity.

One of President Macron’s goals is for the economy to continue to operate in the strongest possible way. Remote working would be put forward to maintain activity. But that only affects a large third of jobs.

Details will be available on Thursday, including activities that are closing and those that can continue to operate.

What macroeconomic impact?

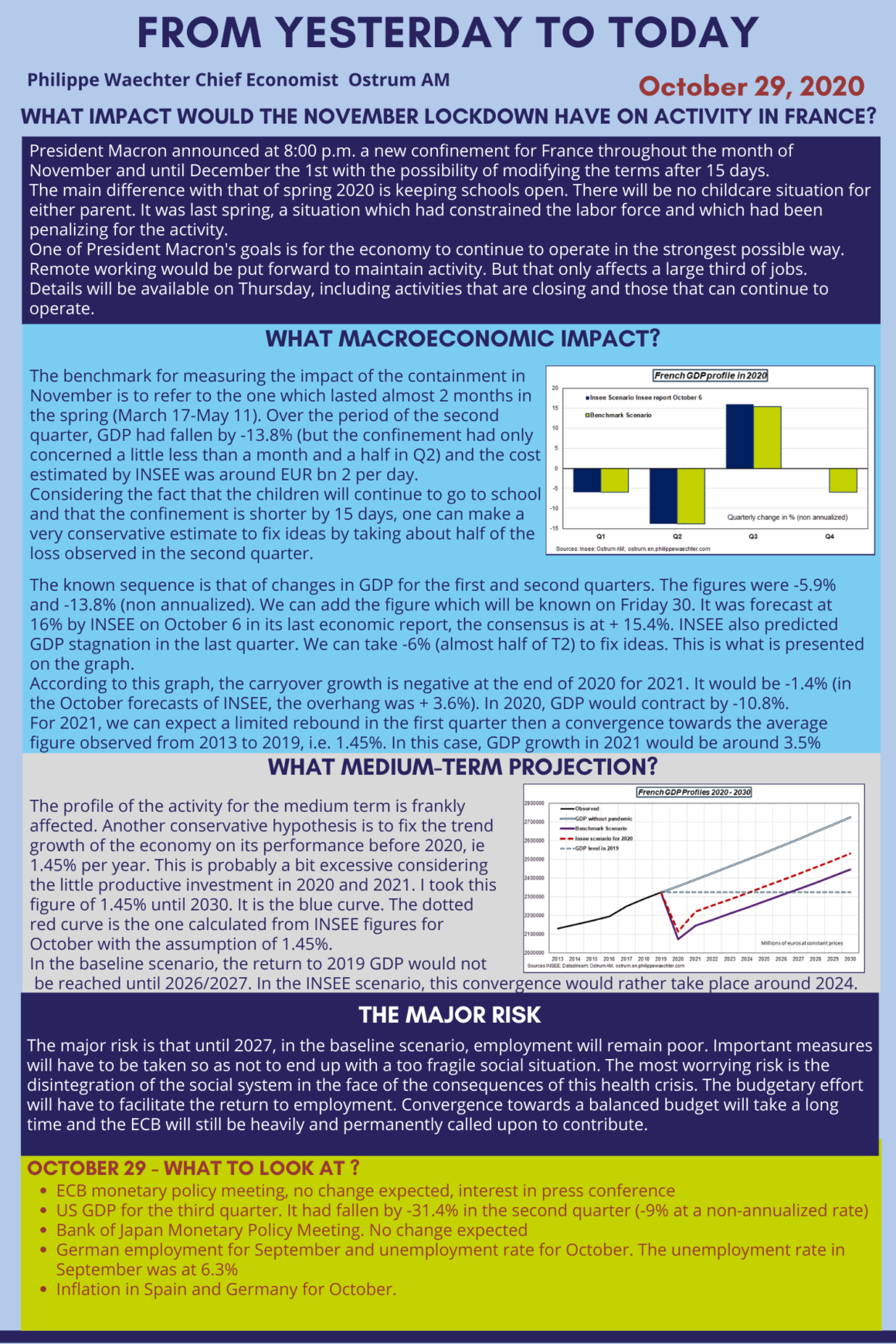

The benchmark for measuring the impact of the containment in November is to refer to the one which lasted almost 2 months in the spring (March 17-May 11). Over the period of the second quarter, GDP had fallen by -13.8% (but the confinement had only concerned a little less than a month and a half in Q2) and the cost estimated by INSEE was around EUR bn 2 per day.

Considering the fact that the children will continue to go to school and that the confinement is shorter by 15 days, one can make a very conservative estimate to fix ideas by taking about half of the loss observed in the second quarter.

The known sequence is that of changes in GDP for the first and second quarters. The figures were -5.9% and -13.8% (non annualized). We can add the figure which will be known on Friday 30. It was forecast at 16% by INSEE on October 6 in its last economic report, the consensus is at + 15.4%. INSEE also predicted GDP stagnation in the last quarter. We can take -6% (almost half of T2) to fix ideas. This is what is presented on the graph.

According to this graph, the carryover growth is negative at the end of 2020 for 2021. It would be -1.4% (in the October forecasts of INSEE, the overhang was + 3.6%). In 2020, GDP would contract by -10.8%.

For 2021, we can expect a limited rebound in the first quarter then a convergence towards the average figure observed from 2013 to 2019, i.e. 1.45%. In this case, GDP growth in 2021 would be around 3.5%

What medium-term projection?

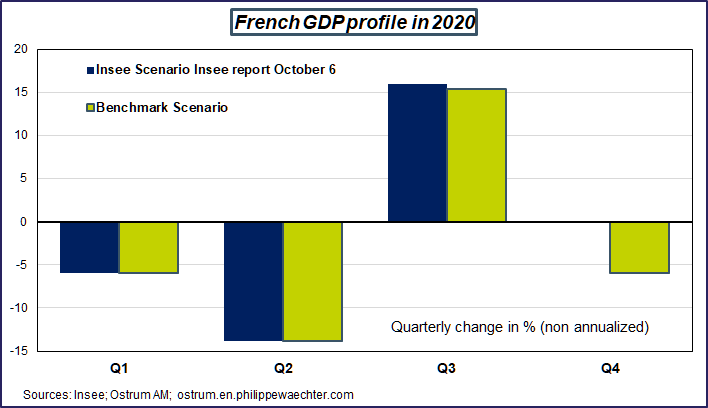

The profile of the activity for the medium term is frankly affected. Another conservative hypothesis is to fix the trend growth of the economy on its performance before 2020, ie 1.45% per year. This is probably a bit excessive considering the little productive investment in 2020 and 2021. I took this figure of 1.45% until 2030. It is the blue curve. The dotted red curve is the one calculated from INSEE figures for October with the assumption of 1.45%.

In the baseline scenario, the return to 2019 GDP would not be reached until 2026/2027. In the INSEE scenario, this convergence would rather take place around 2024.

The major risk

The major risk is that until 2027, in the baseline scenario, employment will remain poor. Important measures will have to be taken so as not to end up with a too fragile social situation. The most worrying risk is the disintegration of the social system in the face of the consequences of this health crisis. The budgetary effort will have to facilitate the return to employment. Convergence towards a balanced budget will take a long time and the ECB will still be heavily and permanently called upon to contribute.

______________________________________________

This infographic is downloadable