The resumption of growth in the euro zone, beyond the second lockdown, will be more dependent than in the past on the dynamics of its internal demand. The world is less cooperative, each zone seeks to have the fastest growth, even if it means having an import substitution policy (China). The free trade agreement signed this weekend in Asia accentuates this risk of non-cooperation and non-coordination. Joe Biden’s arrival at the White House will not reverse this trend.

Growth will therefore depend on private demand and economic policy. The first is currently in a rather deflationary framework and the second is essentially fiscal policy as monetary policy is now conditioned by government choices.

The health crisis has caused major upheavals in the global economy. The Eurozone was not spared with very high volatility in its economic activity. Eight months after the economy shutdown to limit the spread of the virus, three questions arise. What are the immediate risks weighing on activity and employment, what is the impact of these upheavals on the economic policies’ equilibrium? Finally, macroeconomic adjustment is modified durably, to the benefit of more inflation.

The first question on immediate risks relates to 3 points: the first is the risk of deflation, the second relates to the lack of momentum from the rest of the world and the third point will focus on the issue of persistence.

In the short term the risk is deflation ….

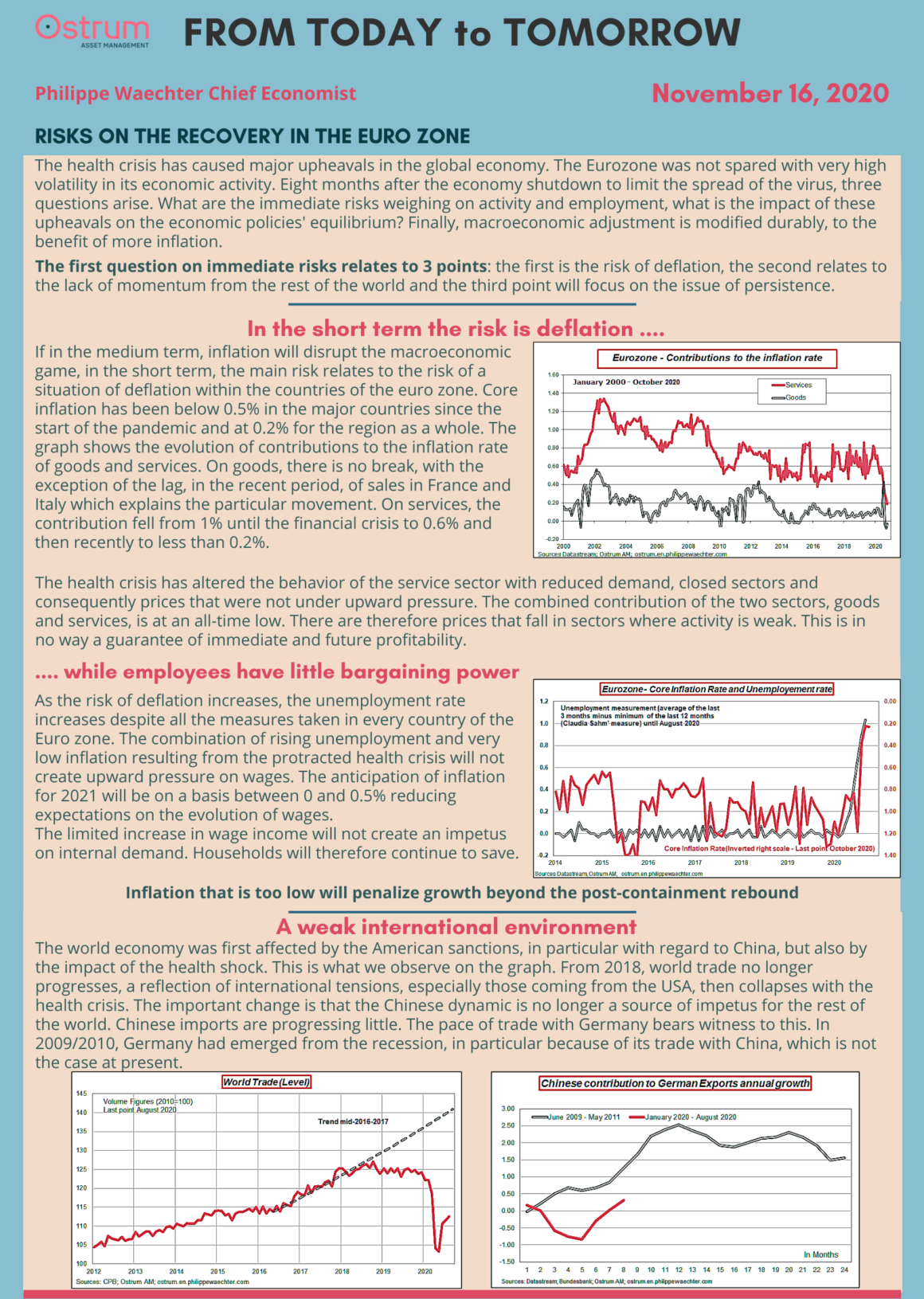

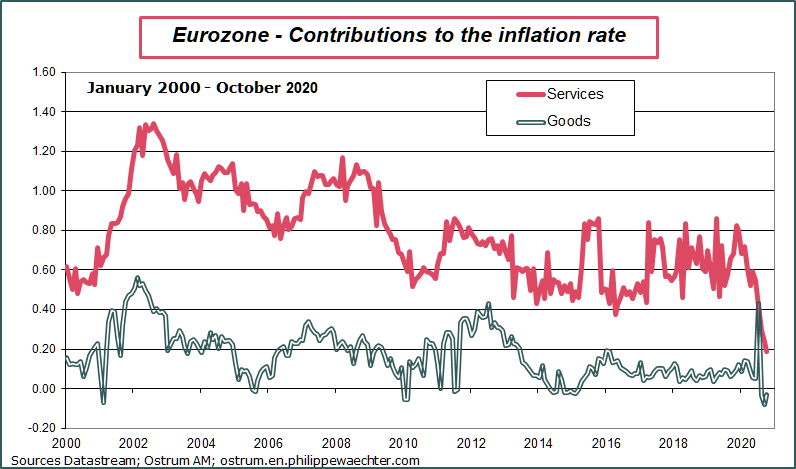

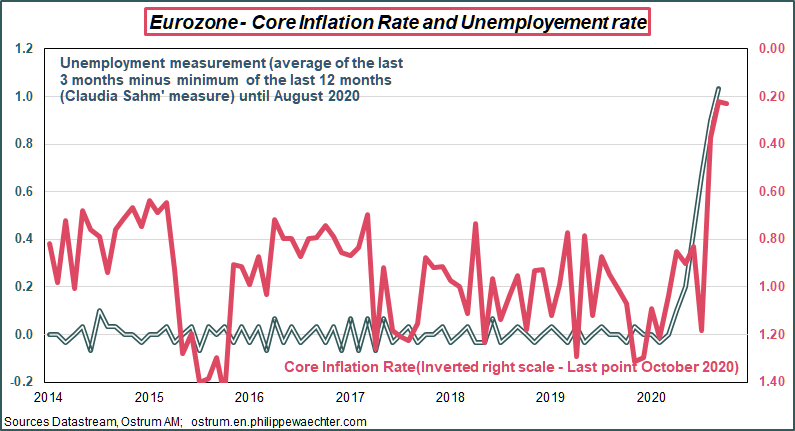

If in the medium term, inflation will disrupt the macroeconomic game, in the short term, the main risk relates to the risk of a situation of deflation within the countries of the euro zone. Core inflation has been below 0.5% in the major countries since the start of the pandemic and at 0.2% for the region as a whole. The graph shows the evolution of contributions to the inflation rate of goods and services. On goods, there is no break, with the exception of the lag, in the recent period, of sales in France and Italy which explains the particular movement. On services, the contribution fell from 1% until the financial crisis to 0.6% and then recently to less than 0.2%.

The health crisis has altered the behavior of the service sector with reduced demand, closed sectors and consequently prices that were not under upward pressure. The combined contribution of the two sectors, goods and services, is at an all-time low. There are therefore prices that fall in sectors where activity is weak. This is in no way a guarantee of immediate and future profitability.

…. while employees have little bargaining power

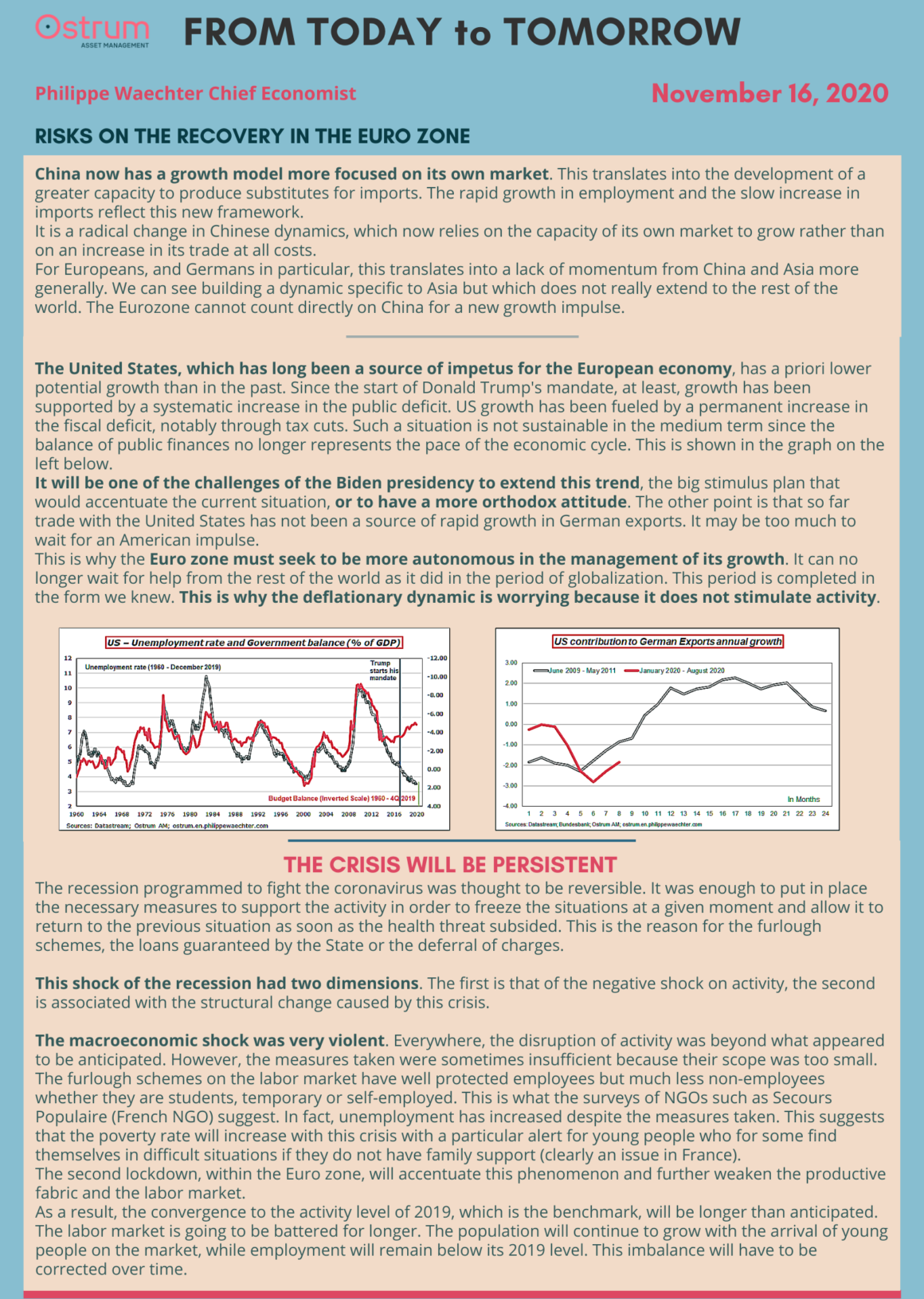

As the risk of deflation increases, the unemployment rate increases despite all the measures taken in every country of the Euro zone. The combination of rising unemployment and very low inflation resulting from the protracted health crisis will not create upward pressure on wages. The anticipation of inflation for 2021 will be on a basis between 0 and 0.5% reducing expectations on the evolution of wages.

The limited increase in wage income will not create an impetus on internal demand. Households will therefore continue to save.

Inflation that is too low will penalize growth beyond the post-containment rebound

A weak international environment

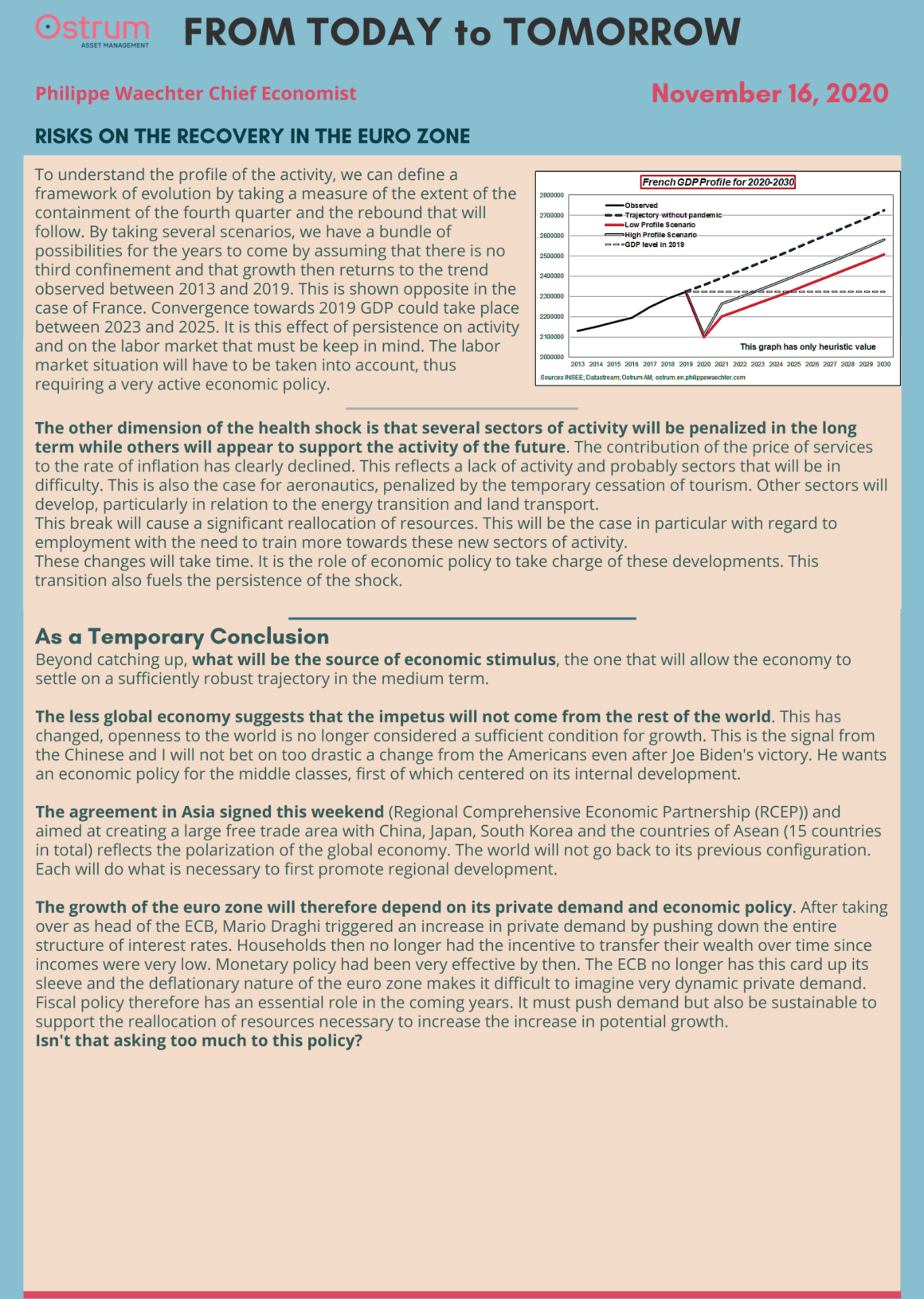

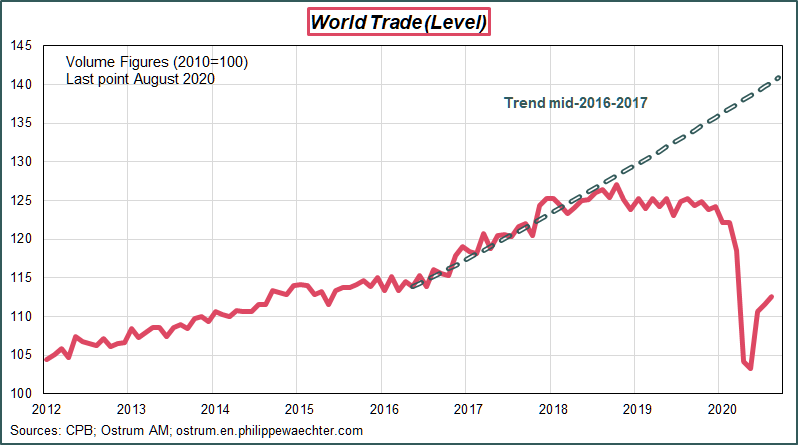

The world economy was first affected by the American sanctions, in particular with regard to China, but also by the impact of the health shock. This is what we observe on the graph. From 2018, world trade no longer progresses, a reflection of international tensions, especially those coming from the USA, then collapses with the health crisis.

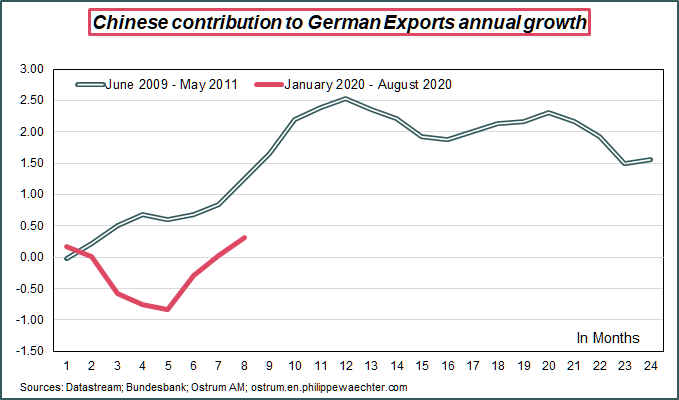

The important change is that the Chinese dynamic is no longer a source of impetus for the rest of the world. Chinese imports are progressing little. The pace of trade with Germany bears witness to this. In 2009/2010, Germany had emerged from the recession, in particular because of its trade with China, which is not the case at present.

China now has a growth model more focused on its own market. This translates into the development of a greater capacity to produce substitutes for imports. The rapid growth in employment and the slow increase in imports reflect this new framework.

It is a radical change in Chinese dynamics, which now relies on the capacity of its own market to grow rather than on an increase in its trade at all costs.

For Europeans, and Germans in particular, this translates into a lack of momentum from China and Asia more generally. We can see building a dynamic specific to Asia but which does not really extend to the rest of the world. The Eurozone cannot count directly on China for a new growth impulse.

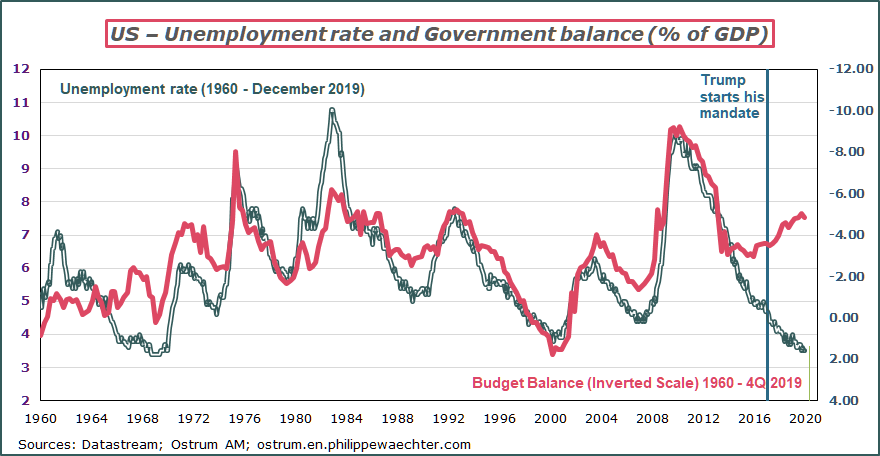

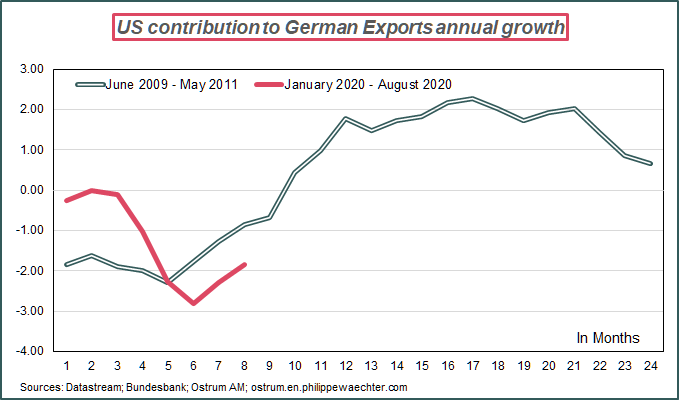

The United States, which has long been a source of impetus for the European economy, has a priori lower potential growth than in the past. Since the start of Donald Trump’s mandate, at least, growth has been supported by a systematic increase in the public deficit. US growth has been fueled by a permanent increase in the fiscal deficit, notably through tax cuts. Such a situation is not sustainable in the medium term since the balance of public finances no longer represents the pace of the economic cycle. This is shown in the graph on the left below.

It will be one of the challenges of the Biden presidency to extend this trend, the big stimulus plan that would accentuate the current situation, or to have a more orthodox attitude. The other point is that so far trade with the United States has not been a source of rapid growth in German exports. It may be too much to wait for an American impulse.

This is why the Euro zone must seek to be more autonomous in the management of its growth. It can no longer wait for help from the rest of the world as it did in the period of globalization. This period is completed in the form we knew. This is why the deflationary dynamic is worrying because it does not stimulate activity.

The crisis will be persistent

he recession programmed to fight the coronavirus was thought to be reversible. It was enough to put in place the necessary measures to support the activity in order to freeze the situations at a given moment and allow it to return to the previous situation as soon as the health threat subsided. This is the reason for the furlough schemes, the loans guaranteed by the State or the deferral of charges.

This shock of the recession had two dimensions. The first is that of the negative shock on activity, the second is associated with the structural change caused by this crisis.

The macroeconomic shock was very violent. Everywhere, the disruption of activity was beyond what appeared to be anticipated. However, the measures taken were sometimes insufficient because their scope was too small. The furlough schemes on the labor market have well protected employees but much less non-employees whether they are students, temporary or self-employed. This is what the surveys of NGOs such as Secours Populaire (French NGO) suggest. In fact, unemployment has increased despite the measures taken. This suggests that the poverty rate will increase with this crisis with a particular alert for young people who for some find themselves in difficult situations if they do not have family support (clearly an issue in France).

The second lockdown, within the Euro zone, will accentuate this phenomenon and further weaken the productive fabric and the labor market.

As a result, the convergence to the activity level of 2019, which is the benchmark, will be longer than anticipated. The labor market is going to be battered for longer. The population will continue to grow with the arrival of young people on the market, while employment will remain below its 2019 level. This imbalance will have to be corrected over time.

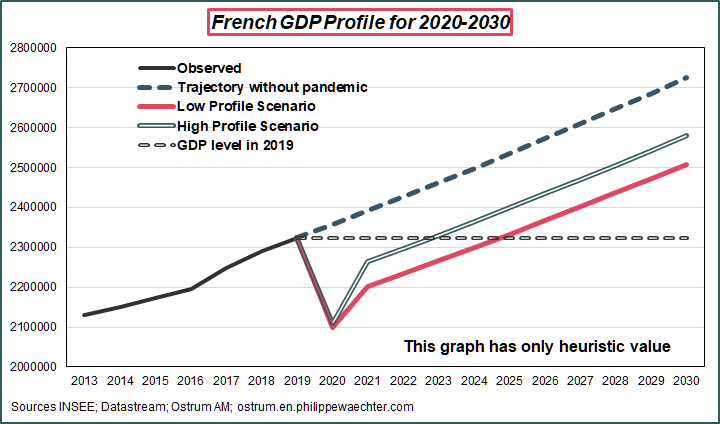

To understand the profile of the activity, we can define a framework of evolution by taking a measure of the extent of the containment of the fourth quarter and the rebound that will follow. By taking several scenarios, we have a bundle of possibilities for the years to come by assuming that there is no third confinement and that growth then returns to the trend observed between 2013 and 2019. This is shown opposite in the case of France. Convergence towards 2019 GDP could take place between 2023 and 2025. It is this effect of persistence on activity and on the labor market that must be keep in mind. The labor market situation will have to be taken into account, thus requiring a very active economic policy.

The other dimension of the health shock is that several sectors of activity will be penalized in the long term while others will appear to support the activity of the future. The contribution of the price of services to the rate of inflation has clearly declined. This reflects a lack of activity and probably sectors that will be in difficulty. This is also the case for aeronautics, penalized by the temporary cessation of tourism. Other sectors will develop, particularly in relation to the energy transition and land transport.

This break will cause a significant reallocation of resources. This will be the case in particular with regard to employment with the need to train more towards these new sectors of activity.

These changes will take time. It is the role of economic policy to take charge of these developments. This transition also fuels the persistence of the shock.

As a Temporary Conclusion

Beyond catching up, what will be the source of economic stimulus, the one that will allow the economy to settle on a sufficiently robust trajectory in the medium term.

The less global economy suggests that the impetus will not come from the rest of the world. This has changed, openness to the world is no longer considered a sufficient condition for growth. This is the signal from the Chinese and I will not bet on too drastic a change from the Americans even after Joe Biden’s victory. He wants an economic policy for the middle classes, first of which centered on its internal development.

The agreement in Asia signed this weekend (Regional Comprehensive Economic Partnership (RCEP)) and aimed at creating a large free trade area with China, Japan, South Korea and the countries of Asean (15 countries in total) reflects the polarization of the global economy. The world will not go back to its previous configuration. Each will do what is necessary to first promote regional development.

The growth of the euro zone will therefore depend on its private demand and economic policy. After taking over as head of the ECB, Mario Draghi triggered an increase in private demand by pushing down the entire structure of interest rates. Households then no longer had the incentive to transfer their wealth over time since incomes were very low. Monetary policy had been very effective by then. The ECB no longer has this card up its sleeve and the deflationary nature of the euro zone makes it difficult to imagine very dynamic private demand. Fiscal policy therefore has an essential role in the coming years. It must push demand but also be sustainable to support the reallocation of resources necessary to increase the increase in potential growth.

Isn’t that asking too much to this policy?

_____________________________________________

This post is available in PDF

_____________________________________________

This infographic of this post is available and downloadable