In a post on the ECB blog, its Vice-President Luis de Guindos presents the three scenarios used in the stress tests to measure the resilience of the financial system during the energy transition.

The framework is that of Fit-for-55 which aims to reduce GHG emissions by 55% in 2030 compared to 1990.

Three scenarios are proposed.

In the first, the developments are complex but coordinated. All the players are working towards achieving Fit-for-55. The associated costs are limited but reflect the transformation of the production system, the shift towards less fossil fuels and the moderate financial needs of this transformation. The associated cost is moderate. We must act quickly but in an orderly manner.

In the second scenario, there is a rapid exit from brown industry to green industry (brown to green). In other words, there is an acceleration of the industrial shift, of decarbonization because time is running out and European countries are behind the desired trajectory. The associated cost is necessarily higher because the rupture has an impact on financial valuations which deteriorate.

The third scenario takes the second and adds the usual elements of the stress test, namely a recession and a fall in asset and real estate prices. The costs for the financial system, inevitably, increase. But the conclusion of the vice-president of the ECB is reassuring since the financial system has the capacity to absorb the shock even if it requires great attention to avoid skidding.

Comments:

The ECB’s baseline scenario assumes that the European economy is already on the right trajectory, the one that leads to the Fit-for-55 target.

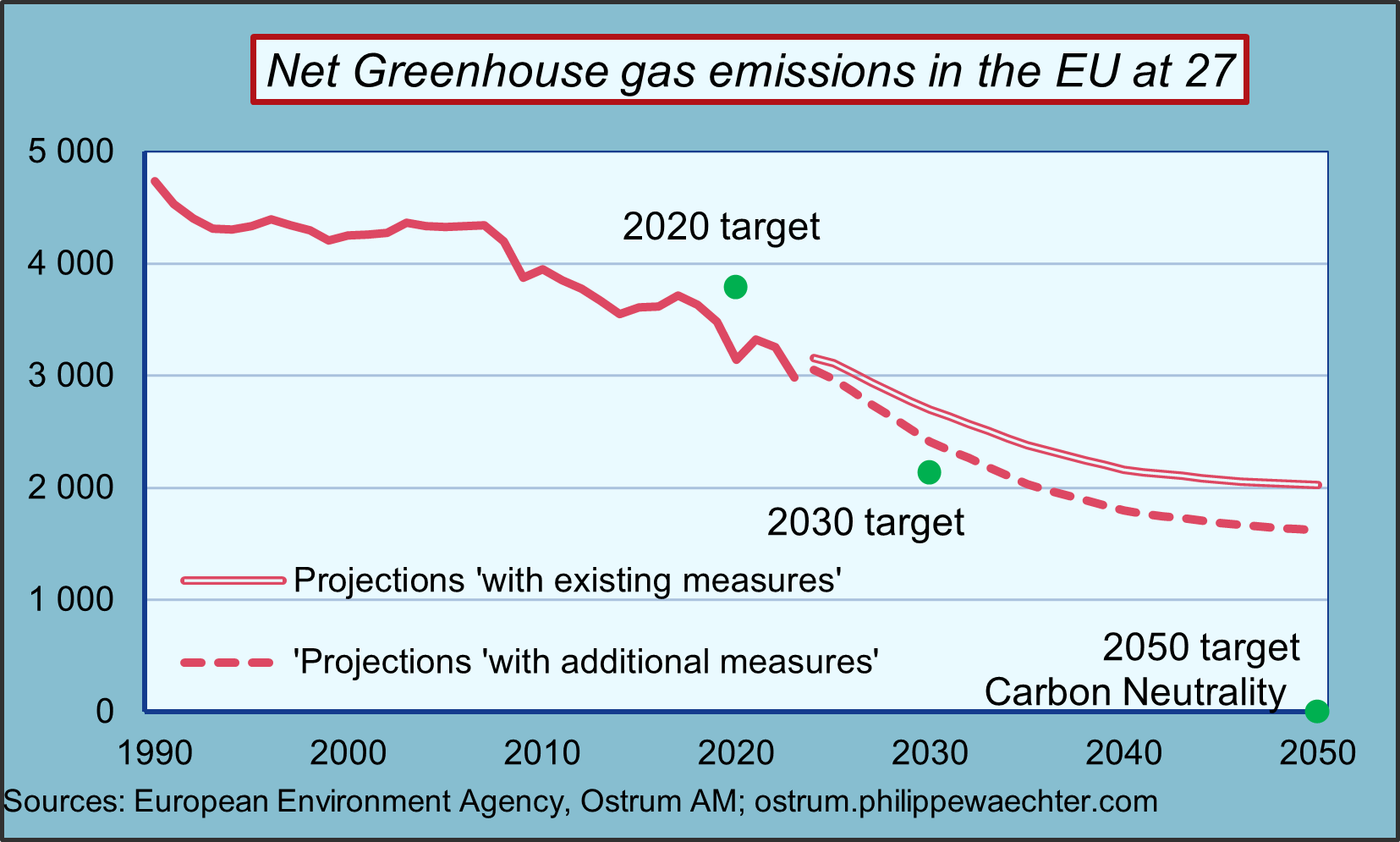

However, the data from the European Environment Agency do not validate this benchmark.

With unchanged policy, the EU is not heading towards the target and even with additional measures, such as commitments made under the Paris Agreement, this will not be the case.

To actually achieve the 2030 target, the economy would have to change; it would have to accelerate its transformations, disrupt existing systems and lose some of its dependence on fossil fuels. This cannot be done without marked and lasting shocks.

Faced with these revolutions, scenario 3 is probably the most realistic. But then de Guindos believes that the financial system is at risk. This suggests that due to uncertainties that may come from the global economy, the financial system will be further disrupted.

The ECB’s very reassuring message cannot ultimately be so. The financial system will have to face a more volatile framework and further disrupted by the energy transition.

It’s time to get started.

Sources: European Central Bank Luis de Guindos Lien https://bit.ly/3VdRpw7