Matteo Renzi has well and truly lost the referendum that took place on December 4.

Turnout was very high at 70%, and the referendum showed a considerable difference in the number of voters for the no and yes camps. The no campaign clearly won a clear majority with 59.1% of votes vs. 40.9% for voters in favor of constitutional reform, so it is certainly not a close call that fails to garner attention.

However, the markets’ reaction was not extreme. The euro fell below the 1.06 mark against the dollar, while the equity markets in Asia saw only on a moderate drop, with Tokyo closing down 0.8%. Yields on Italian bonds rose, wiping out the drop seen at the end of the week.

Investors are adopting something of a wait-and-see attitude, which is reassuring in one sense as there is no major backlash following the result. But the whole affair is far from over.

Matteo Renzi will present his resignation, which will very probably be accepted, and in the meantime, the current government can no longer operate effectively following yesterday’s result.

Italian president Sergio Matarella will have to consult and appoint a new prime minister to form a new government, and this could be Matteo Renzi. This whole process will take several weeks.

We would raise a number of points:

1 – A general election does not look very likely. It would not be in the interests of any of the parties in the current parliamentary majority. The most extreme parties, such as the Five Star Movement, would gain greater clout and this would shift the balance of power in Parliament. The electoral reform that was at the very heart of this referendum will be even more difficult to implement in this case. The current coalition majority will have to find a political answer quickly in order to limit the risk of a seismic shift for Italy and a breakdown of European integration as a whole.

The Italian referendum is not the same situation as Brexit at all, but it does reflect a call for change, and it is up to Italian politicians to make sure that this change does not strike a fatal blow to European integration.

2 – In the short term, the Italian banking sector is very weak. It is suffering from the Italian economy’s sluggish growth and the absence of inflation, which acted as a convenient method of regulation in the past. Banks are still in a very tricky position as the proportion of non-performing loans is very high, and the process of recapitalization that was meant to give them back some leeway will no doubt be disrupted: this is the most worrying issue, as there can be no lasting recovery in the Italian economy without a robust banking system.

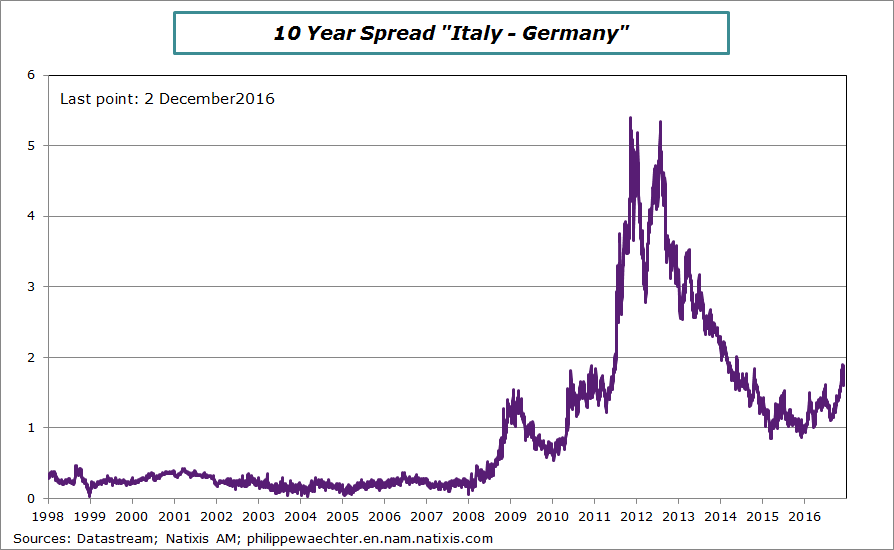

3 – The ECB will obviously take particular care to try to ward off a situation that is both badly managed and unmanageable. The institution is set to announce an extension of the quantitative easing program beyond the current March 2017 deadline at Thursday’s meeting, following on from comments made by ECB officials last week. The spread between Italian and German bond yields is wide, but this morning it returned to levels witnessed during the middle of last week, but while the pace of this trend is admittedly less problematic than during the 1992 sovereign debt crisis, the recent increase is substantial and reflects doubts over the situation in Italy.

4 – Market momentum will depend on whether a political balance can be struck swiftly. The situation in the banking sector will serve as a reminder to all involved of the pressing need to find a feasible and sustainable solution.

5 – The political dimension is problematic. Setting aside the issue of choosing a new prime minister and government, if we look at a breakdown of the result, the under-35s largely voted to maintain the status quo with a no vote (80% of 18-34 year olds according to exit polls), the large majority of the 35-54 age group also voted no (67%), while a majority of the over-55s voted yes (53%). So we see that the most dynamic age group in Italian society voted to maintain the political status quo.

This is the most worrying aspect. Renzi called the referendum to continue reforming an Italian economy and society that are not operating effectively. In light of this vote, what progress can we now expect on the Italian “renaissance” in the current institutional framework? Should this framework be changed, thereby increasing the risk of a systemic crisis? Is this what the younger generation is seeking to achieve with their vote?

6 – The economic aspect also played an important role in the breakdown of votes. Across the 100 electoral districts with the lowest unemployment rate, 59% of voters opted for yes, while in the 100 electoral districts with the highest unemployment, the no camp won with 65.8%. Meanwhile, in the south the majority also voted no.

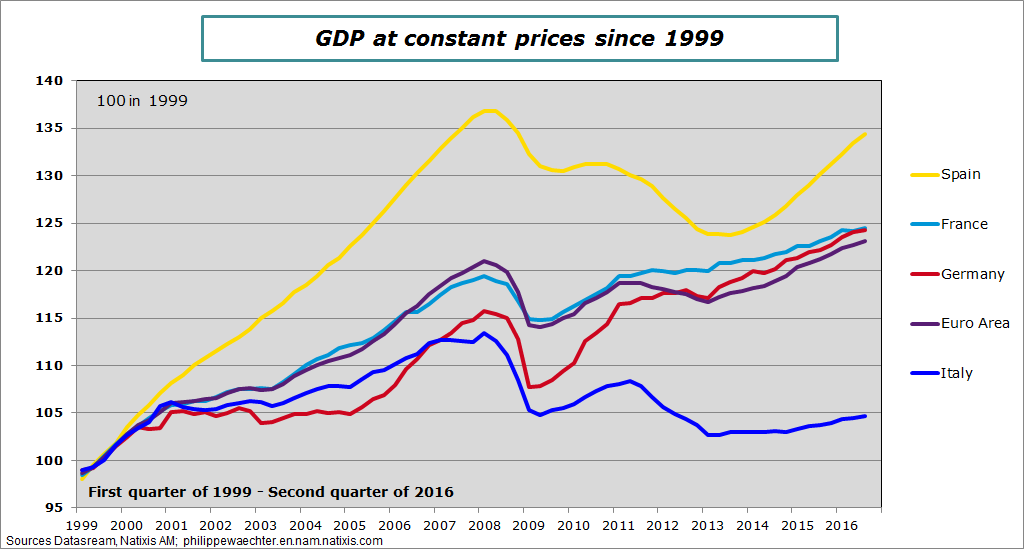

No-one actually seems satisfied with the current situation in Italy and this is reflected in the referendum result. The chart below highlights this deep-seated economic malaise. Italy will not match the profile of the main Eurozone countries in the short or medium term, and the country definitely needs to find some shared momentum within Europe as a whole to regain its ability to innovate, which is what made the country great not so long ago.

So in the short term, here’s hoping that the politicians manage to cut back political risk and find an answer to the challenges that Italy faces.

Philippe Waechter's blog My french blog