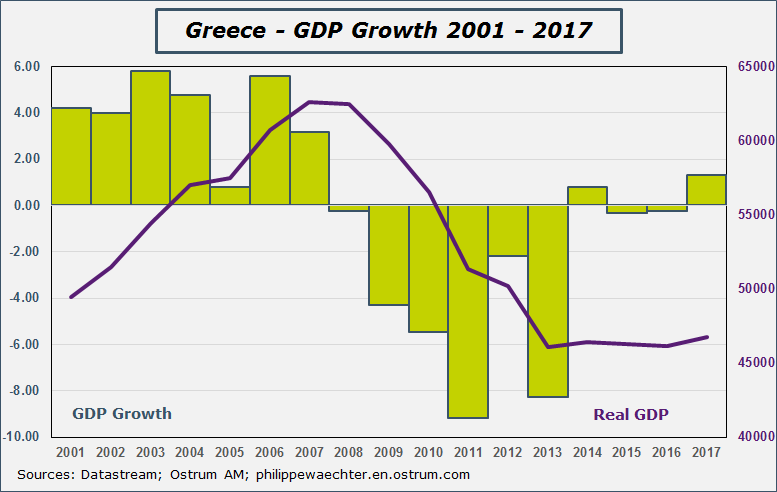

After years of recession, the Greek economy is back to growth as the first graph shows. But the 2017 figure is very low while the rest of the Eurozone was in a strong expansion. Despite this improvement, the GDP level remains, at the end of 2017, 25% below the 2007 peak. The adjustment, almost 10 years of recession, that has been imposed by the troika (IMF, European Commission, ECB) was extremely strong, persistent and brutal. It has broken the capacity of the Greek economy to recover endogenously.

An historical comparison shows that the duration of the Greek depression has been longer than that witnessed by the US during the great depression in the 30’s. Ten years after the start of the US depression the US economy was back to its pre-crisis level. After 10 years, the Greek economy is still 25% below this peak. That makes the difference and show how deep and strong was the adjustment.

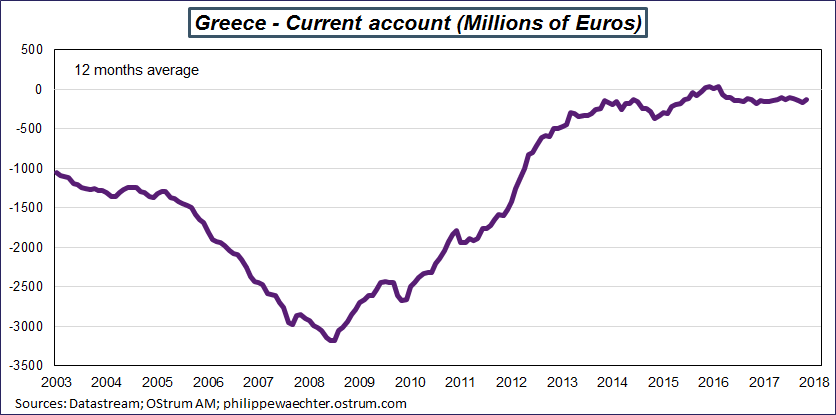

The second point is that the Greek current account is now in equilibrium. This reflects the fact that domestic demand has been dramatically constrained in order to limit imports. The capacity of Greece to export was limited by the supply which was and is still reduced. The other point is that Greece was penalized by the fact that EU, its main trade partner, was in recession in 2011 and 2012 and then followed a slow recovery. It was impossible for Greece to find a source of impulse outside its own depressed economy.

A balanced current account means that Greece no longer depends on foreign financing and that’s positive.

The first thing to expect for Greece is the possibility to escape from the bailout program and having, at last, the possibility to fund on the market directly.

There are two elements.

The first is the possibility to get the last tranche of the program. Greece will receive €11bn from the Eurogroup if this latter agrees with the efforts that have been done by the government. Measures have been taken on pension cuts, income-tax rises and privatizations to ensure the be in phase with what was expected.

The second step is arrangement on the repayment schedule for its debt. The idea is to postpone repayment in order to limit the constraint on Greece. 10 years could be a good postponement. This second part is important as debt represents 180% of the GDP.

In other words, after many efforts, the final point of the first part of the adjustment process is in sight. Nonetheless, Greece will have to recover rapidly to be able to repay its debt in the future even if these repayments have been postponed.

Which future?

The period that will start, assuming that there is an agreement, will be complicated and the risk of instability, notably political instability, is high.

The main question is: what will be the source of impulse that could boost growth.

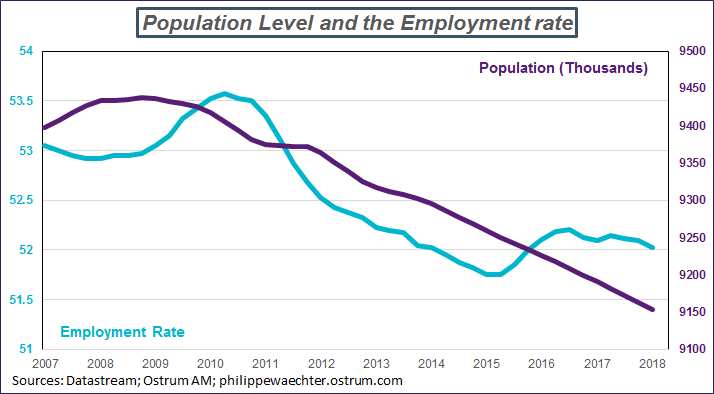

Investment has been low during the adjustment process and a lot of people has left Greece for other European countries. They will not come back spontaneously if growth prospects are not stronger. As a consequence, potential growth is low as productivity gains are feeble, labor force decrease and the employment rate is trending downward.

Greece will have a real problem of supply. Its manufacturing sector, which generates strong productivity gains, was not powerful before the crisis but it is now lower and weaker after a decade of adjustment.

Moreover, constraints on public finance will not let the possibility for the government to boost its growth with a strong Keynesian type program.

In other words, we cannot expect a strong impulse coming from inside as the government leeway to improve the economic environment will be reduced.

The impulse could come from outside and principally from the European Union. This latter is the main trade partner for Greece with almost 65-70% of Greek exports going to Europe.

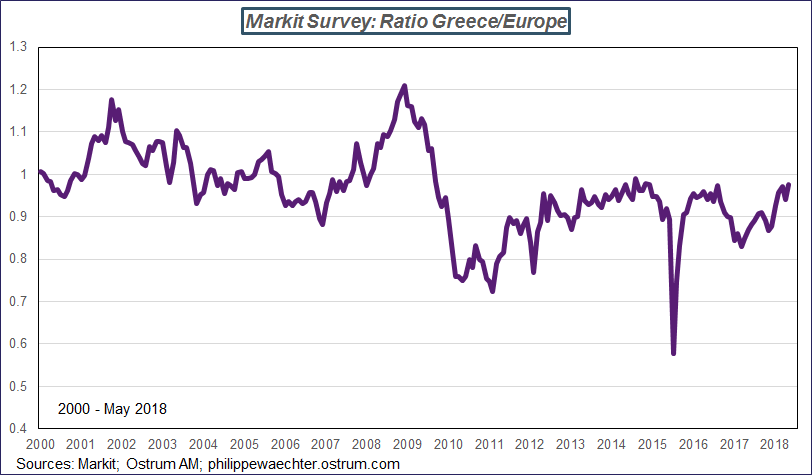

Our question relies on the fact that the European growth has been strong in 2017 but the contagion to Greece has been low. The peak of the business cycle has been attained at the end of 2017 in Europe but it was not sufficient to boost Greece. Then the lower momentum on the European activity since the beginning of the year will not help. .

The ratio of the Markit survey indices for Greece and for Europe is not improving rapidly during the last period as the graph shows. Greece has been pulled up by the European recovery but was not able to do more. What will happen with a slowdown in the European business cycle?

The adjustment seen in the past has been very harmful for Greece but after 10 years of adjustment that implies a low potential growth. Therefore, what will be the future for Greece? Until now, there was a program to comply with. This is no longer the case.

What can be the next target for Greece? What will be the sources for impulse and what can we expect with a low growth momentum? Tourism may be part of the answer but that will not be sufficient to satisfy all Greek citizens. The main risk therefore is political instability. Greece has been forced to tighten its belt but now is left with no hope because the program was too long.

Philippe Waechter's blog My french blog