The first quarter growth was weak in the USA. The first estimate was a mere 0.2% at annual rate. The question now is about a possible rebound in Q2. Many observers have calculated that usually, in the recent past, the first quarter had a low growth number but was followed by a rapid rebound that corrects the GDP trajectory. Last year there was also a weak period during the first three months due to climate hazard. But the second and third quarters have shown a strong rebound in economic activity.

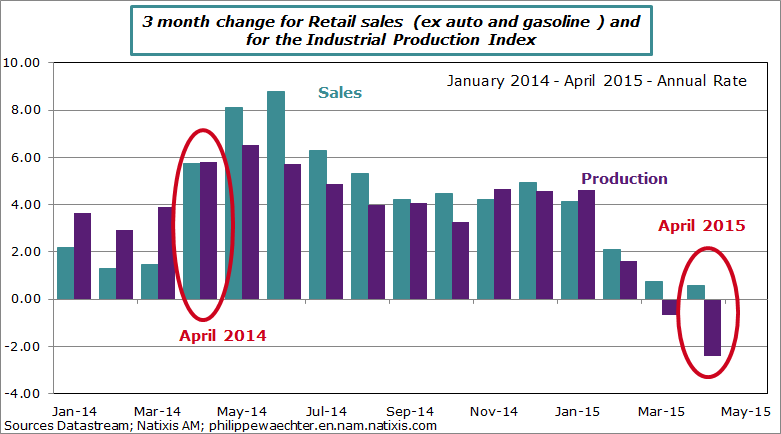

Last week, we have had April figures for retail sales and industrial production. The temptation is to compare the current momentum to 2014.

The graph below presents the 3 month change for the two indicators. I have drawn an ellipse on the two April episodes, in 2014 and 2015. We see that profiles do not look the same. There was a strong acceleration in 2014, not in 2015 during which industrial production has collapsed. This means that the probability of a recovery is low if 2014 is taken as a model.

This year, inventories were up in the first GDP estimate. As demand is weak, an inventory building if it exists will be mild. It will be another source of GDP weakness for the second quarter.

In its latest forecast, the Fed of Atlanta has reduced its GDP 2nd quarter estimate to only 0.7% at annual rate. If it is the case, for the whole 2015, GDP growth could be close to 2%.

The question then, is to know, if this new environment will reduce, or not, incentives for the Fed to lift-off its rates? Janet Yellen has mentioned that the dollar has recently hurt exports momentum and US companies’ results have been constrained by the strength of the greenback.

Higher Fed’s interest rates could push the dollar higher with a risk on the US growth momentum.

To avoid a supplementary weakness of the US economy, it could be better to postpone the lift-off. We know that almost all voting members support such a move but current economic conditions do not.