UK leaving the EU, Federal Reserve, US GDP, Euro Area GDP, French GDP, IFO,

ECB, Coronavirus

Highlights

The UK will leave the European Union next Friday. It’s sad news for Europeans

Federal Reserve meeting (FOMC Jan.29) and Bank of England monetary policy meeting (Jan.30)

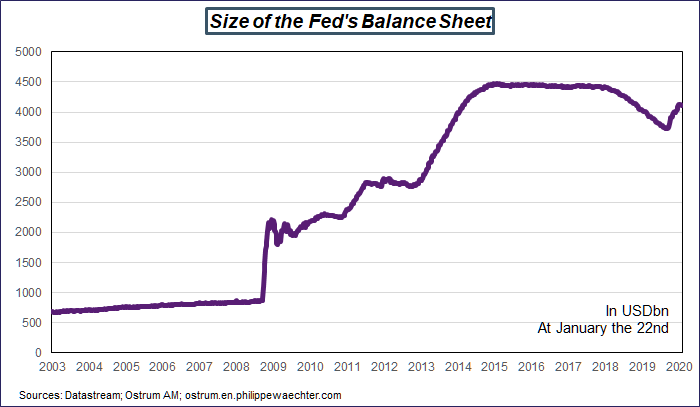

The Fed is not expected to change its monetary policy stance as the GDP stabilized around 2%. The main question will be on the size and dynamics of its balance sheet. Too much liquidity may force the Fed to lower its benchmark rate in the future.

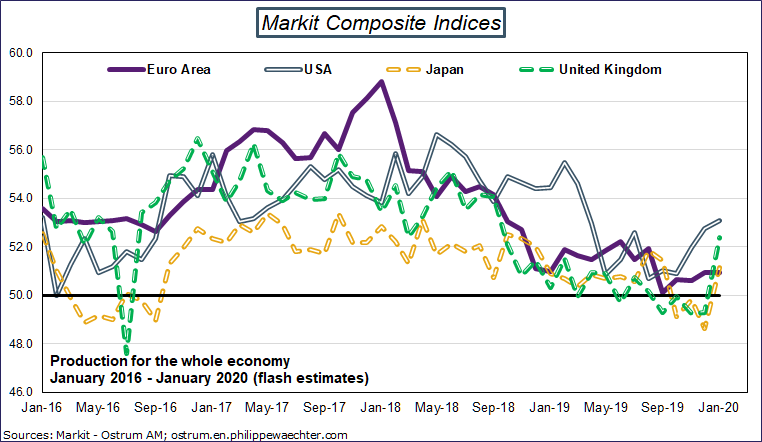

In the UK, the Bank of England will reveal its hierarchy as there is a risk with Brexit but recent data are stronger than expected (The Flash estimate for the composite index of the Markit survey is above 50in January)

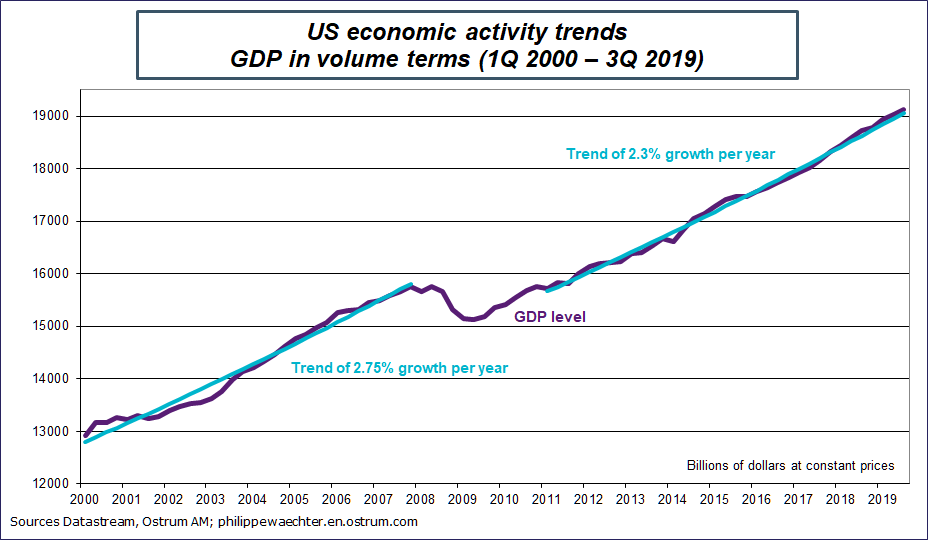

US GDP growth for the fourth quarter (Jan.30)

It should be close to 2% at annual rate leading to a 2.3% growth for the whole year on average. It’s in the continuity of the trend.

The carryover at the end of 2019 for 2020 will be circa 0.8%, the same magnitude than at the end of 2018.

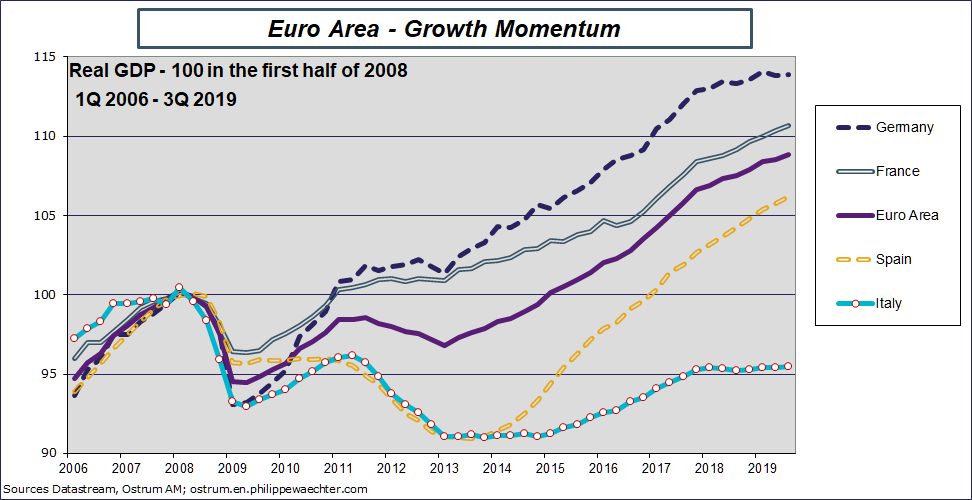

Fourth quarter GDP in the Euro Area, in France, in Italy and in Spain (Jan.31)

All these numbers will be in the continuation of those seen during the third quarter. No break expected that could show a strong surge or a rapid slowdown. For the euro area, the growth number for 2019 will be 1.2%, it will be 1.3% in France, 0.2% in Italy and 1.9% in Spain.

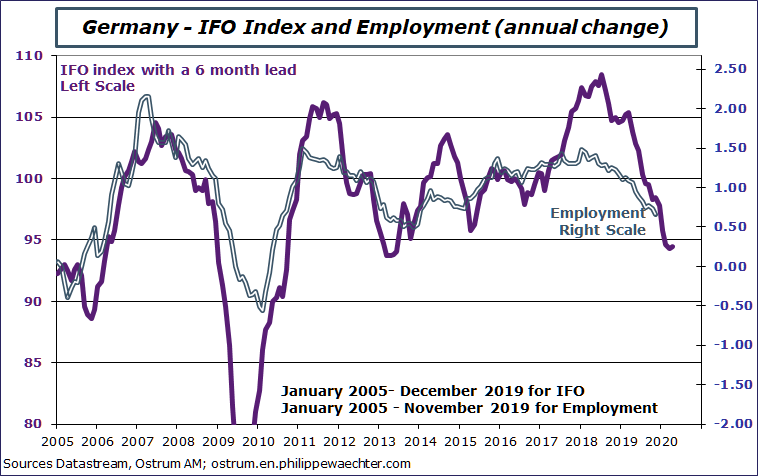

IFO survey for January (Jan.27)

Recent surveys have shown a rebound in Germany in January. The ZEW and more recently the Markit composite index were positive surprises. The IFO will follow the same dynamics. This doesn’t mean that the slowdown is over in Germany. We still have a downside adjustment on the labor market.

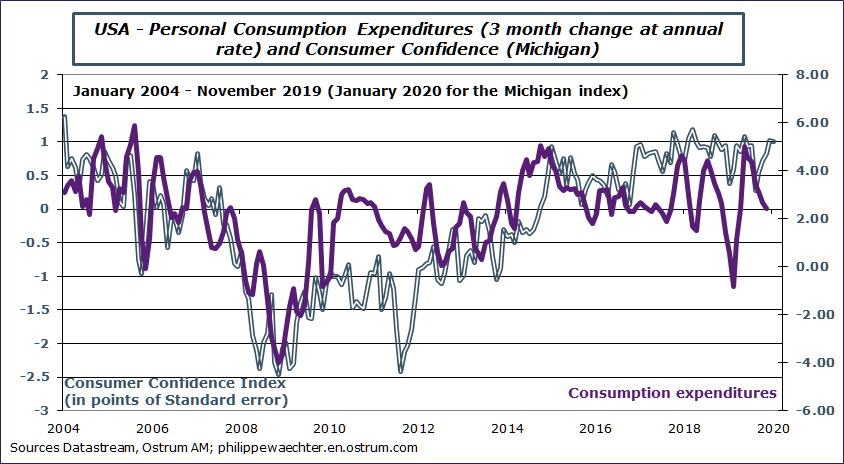

Consumption and income for December in the US (Jan.31) Confidence index of the University of Michigan (Jan.31) and Conference board confidence index (Jan 28)

Confidence indices remain high and as the real disposable income continues to grow rapidly, consumption will improve.

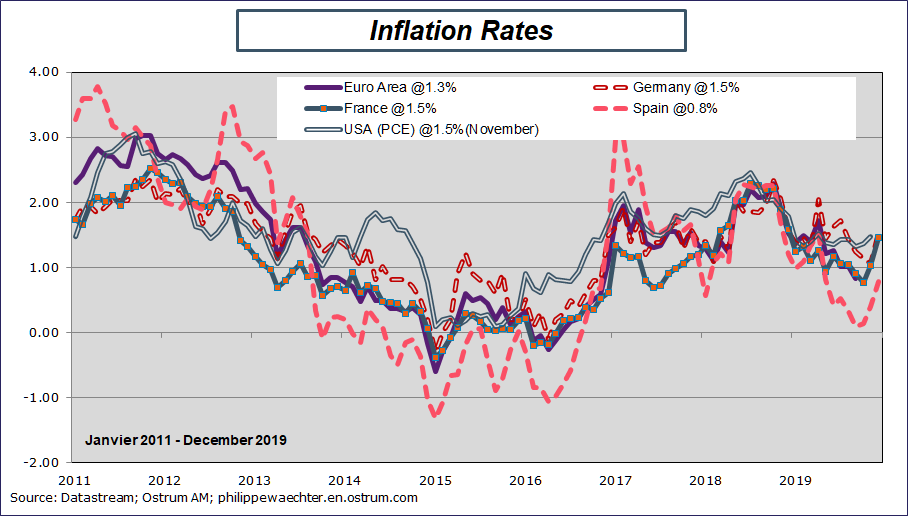

Inflation (flash estimate for January) in the Euro Area (31), in Germany (30), in France (31), in Spain (31) Inflation rate for December in the US (PCE measure jan31)

The inflation rate for January will remain high as the oil price will continue to contribute positively. We expect a lower core inflation rate.

Other statistics: New Home ales in the US for December (27), the Case Shiller index on housing price in the US for November (28) and US durable goods orders for December (28). Consumer confidence in France for January (will the current strike have an effect on households’ behavior) o(29), advance trade balance in the US (interesting after the recent improvement) t29), the Euro Area unemployment rate for December (30), French households expenditures for December (31)

What to keep in mind from last week ?

The ECB and the strategic review

During the ECB meeting, the monetary policy stance was unchanged as was the message associated. The interest rates will remain low as long as the inflation rate doesn’t converge to the ECB inflation target. The asset purchases will continue and end shortly before the change in interest rates. The principal payments from maturing securities purchased under the QE will continue for an extended period even after the interest rate’s hike. The other message from the ECB president was that the economic outlook was still weak albeit stabilizing at a low level but risks were still tilted on the downside.

The ECB has launched its “strategic review”. It will examined how to improve the efficiency of the monetary policy. The Euro area has deeply changed since the last review in 2003. The trend growth is weaker now than in 2003, productivity gains are lower and the inflation rate has a tendency to remain below the current ECB target rather than above as it was the case in 2003. Moreover, the current ECB rate is lower than in 2003 and is expected to remain low for an extended period. Therefore, the monetary policy efficiency is in question in the current situation and also in the case of a market crash. That’s the reason of the strategic review that will take the whole year (on this point, Christine Lagarde has indicated that, if necessary the ECB monetary policy may change. In other words, the strategic review will not paralyzed the ECB).

Christine Lagarde has indicated that the strategic review will take into account new features such as financial stability, employment and environmental sustainability.

China, the coronavirus and Wuhan

The most important discussion this week was on the coronavirus that comes from China. This type of virus can be very contagious and is a source of angst everywhere around the world. In the past, the impact of this type of epidemic was nonetheless limited. In 2003, the SRAS was severe but the contagion effect was limited (even if 800 deaths is too much) and it was the same for the H1N1 flu in 2009/2010. These risks must be taken seriously and measures have to be taken to limit the contagion effect. The previous episodes of this kind of epidemic have been temporary.

On the economic side, Wuhan is an important country in an important province (Hubei). It is the headquarter of major domestic car and steel producers. To be convinced of its importance, more than 300 of the world’s top 500 companies have a presence in Wuhan. It’s a transport and industrial hub that has been boosted by the recent boom of the car market in China.

Its growth was 7.8% in 2019 , 1.7% higher than the national average. It’s a very dynamic province and town as the rapid growth of its imports shows. A long epidemic with the impossibility to leave Wuhan and other towns in the province of Hubei would have a strong impact on the Chinese economy. It would lead to a weaker GDP growth for China in 2020.

The main source of weakness in the short term will come from retail sales. The Chinese new year celebrations have been drastically reduced or cancelled and people will limit their travels to celebrate the year of the Rat with their family. It means that the first quarter GDP growth will be lower than expected.

The international contagion effect will be limited.

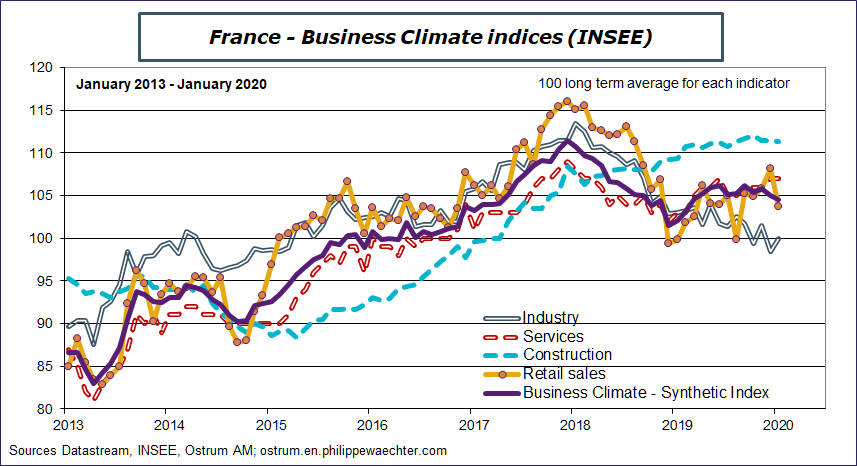

Robust momentum in the French economic activity (January surveys)

Measured by the Climat des Affaires index, the state of the economy is good. The index is way above its long term trend (the index is at 104.5 and the average at 100). Construction and services are strong but the manufacturing sector is back to 100. The global manufacturing recession has, at the end, an impact on the French economy. This situation at odds with all the other European countries reflects a economic policy focused on domestic demand and on the labor market. The recent strike has had a marginal impact. Two reasons: the strike was mainly located in Paris, not in the rest of France. The second reason is the flexibility of the French labor market. People have changed their habits and worked from home (in Paris, many jobs are in the services sector and can be done from home). The Banque de France has an estimate of the strike impact at -0.1%. It’s a maximum.

The Markit survey for January – Flash estimates in the US, Japan, UK, Euro Area, Germany and France

Surveys were quite strong in the manufacturing sector. All the indices are trending on the upside but remain all in negative territory. In other words, the manufacturing sector activity is contracting but at a slower pace. The exception are the US where the index is in positive territory. It was a bit weaker than in December. Services sector indices were strong, explaining the good shape of the composite indices. The global perception is that it’s more a stabilization than a reversal.

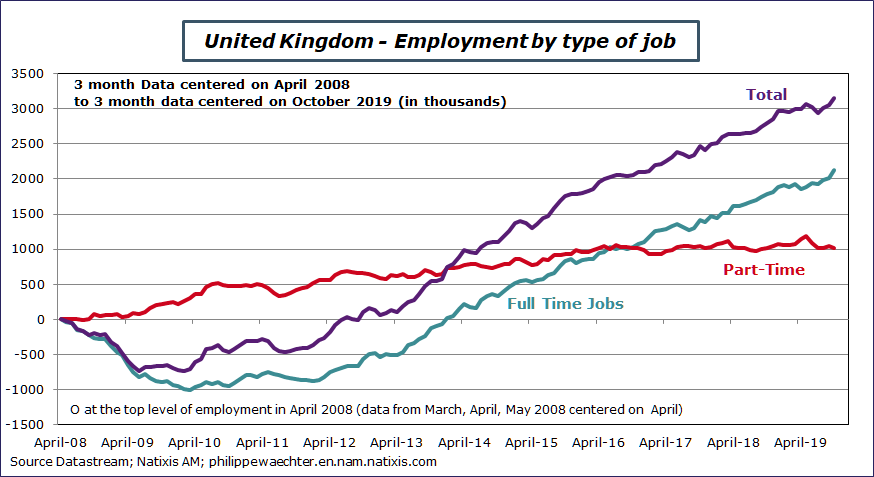

Robust labor market in the United Kingdom.

The Bank of England has probably looked very carefully at all the economics news that were released. Its meeting will be the day before the Brexit. In order to smooth a possible impact of this exit, the BoE may have a downside bias in its monetary policy. The robust labor market, the purchasing power gains at the end of 2019 and the good manufacturing Markit survey suggest that it will not move.

Existing home sales in the US

The number was strong and prices were up. The impact of lower interest rates is tangible. The important point is that the supply is at an historical low. This is consistent with research showing that American people are more sedentary than in the past. Internal migrations are no longer a strong source of macro adjustment.

The detailed document can be downloaded