Baltic Dry Index and Trade War, Coronavirus, US Employment, Business Surveys and German Orders – Coming this week (Feb3-Feb9) – Brexit, US GDP and US Euro Area – What to keep in mind from last week

Highlights

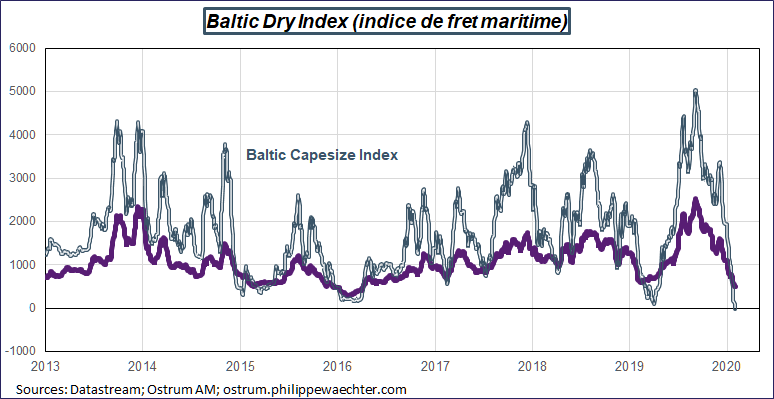

World trade is at risk with the Coronavirus

Day to day measures of the world trade momentum are on the downside. This reflects the impact of the coronavirus leading to a sudden stop in trade.

The global economic outlook is at risk. One source of concern is the absence of help from the US. The White House doesn’t want to postpone the trade agreement and the White House that the epidemic will encourage US companies to repatriate their activity in the US. That’s a new side of the trade war.

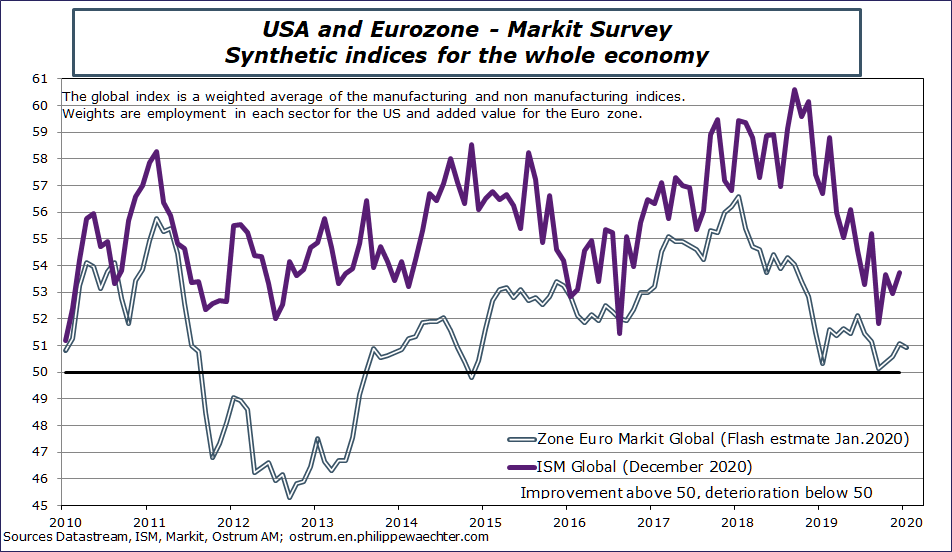

ISM and Eurozone Markit global indices (February 5)

Recent data suggest that a stabilization is nigh. This will start with the manufacturing indices (as show by the ISM). But risks are still on the downside as corporate investment is weak everywhere, showing that non one is able to reduce the uncertainty.

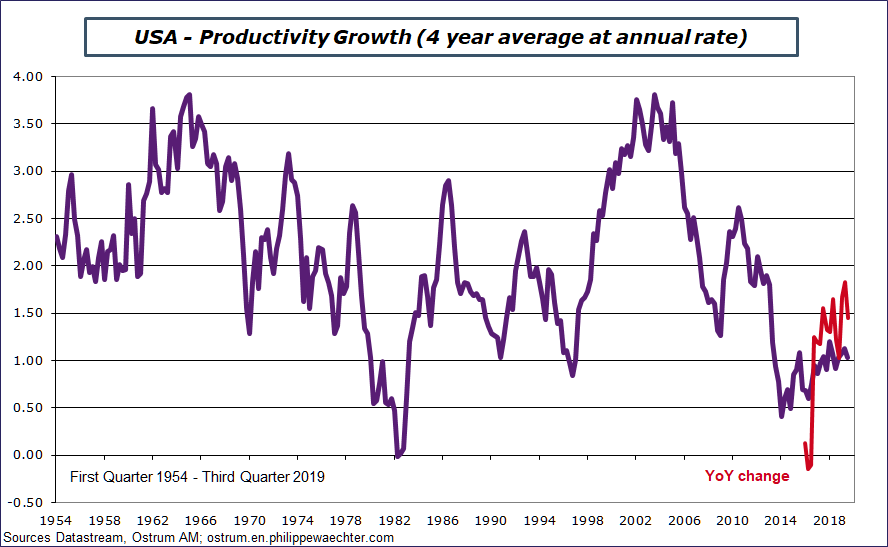

Productivity in the US for the fourth quarter (February 6)

The US productivity trend is the lowest since WWII. This weakness explains the low trend on GDP growth. As immigration is limited now and in the future, the capacity to grow for the US economy is lower than in the past (Growth is productivity plus employment)

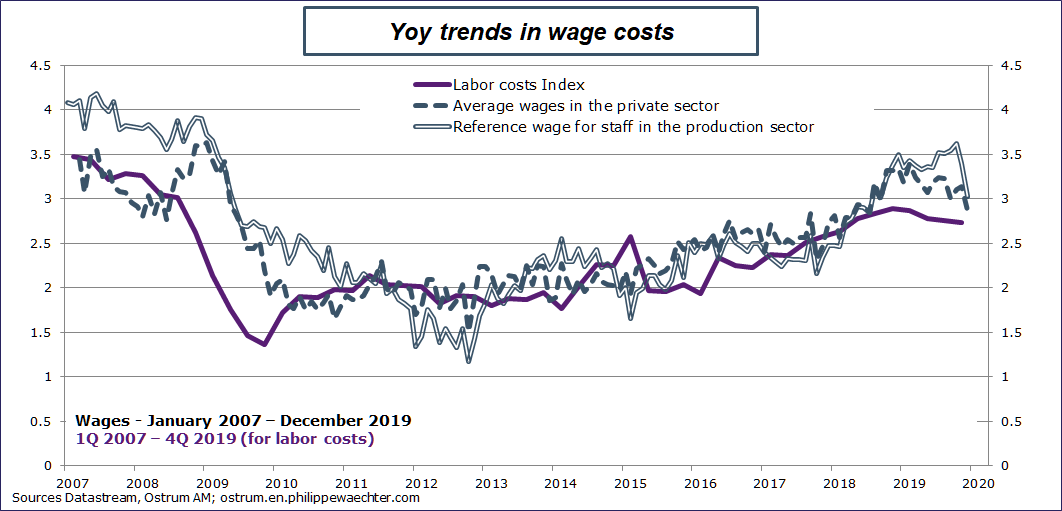

Employment report for January in the US (February 7)

Data on jobs will remain robust in the short run but this will not push wages on the upside. That will allow the Fed to drop its rate if necessary

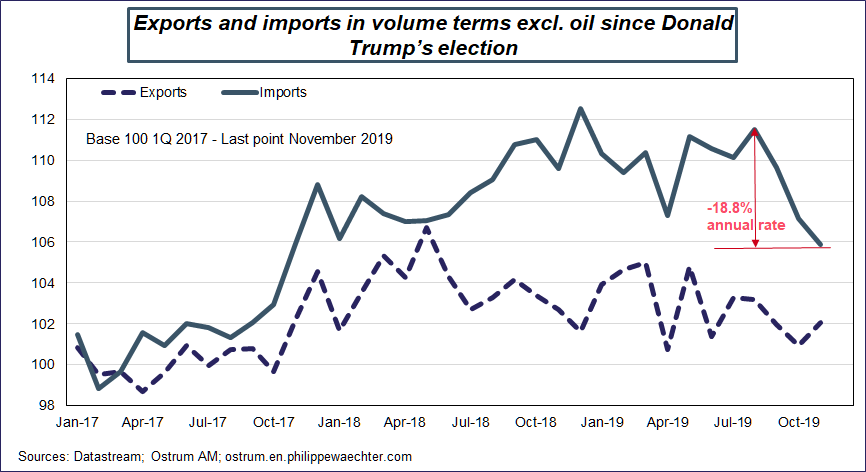

US external trade for December and for the whole year (February 5)

Recent improvement came from the rapid and deep contraction of US imports.

During the last available three months, real imports excluding oil dropped by 18.8% at annual rate. The only word is huge

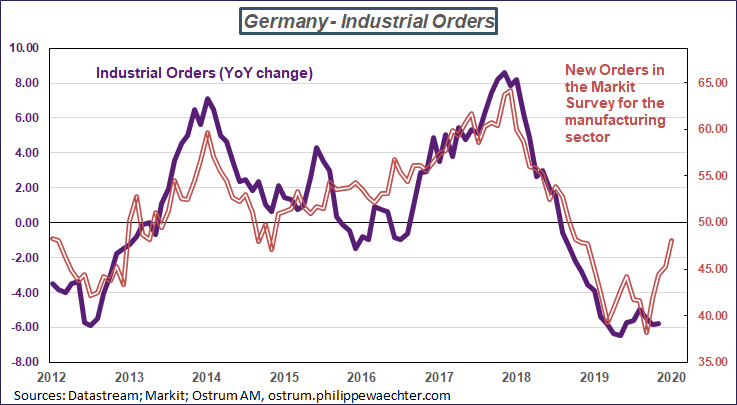

German industrial orders for December (Feb.6) and external trade and industrial production (7)

The last 12 month drop in industrial orders is probably over. The strong rebound on the Markit new orders index is good news on this front.

Other statistics:

Retail sales in the Euro Area for December (Feb.5), industrial production indices in France and in Spain (7). French employment for the 4th quarter (Feb.7), Chinese external trade for January (7). This latter will show how the Chinese trade has been affected by the epidemic.

What to keep in mind from last week ?

The Brexit is done

The main question after the launch of the Brexit, last Friday, is to know how things will change and at which speed. In a recent post on my blog I said that political polarization was the most important point. It says that in a heterogeneous society, economic decisions will be depend mainly on political choices. It means that the most rational choices are necessarily those to be chosen.

It also means that excess will probably be seen in the coming weeks and months. The strong political support for Brexit may lead some Brexiters to anticipate what they expect after the effective and definitive exit at the end of the year. For the moment, it’s just anecdotal as Guernsey that doesn’t allow French boats in its fishing perimeter.

The starts of negotiations has shown that Michel Barnier for the European Commission and Boris Johnson do not share the same vision of the expected agreement. On the one side, Michel Barnier wants the UK to respect rules to have access to the single market, rules that are rejected by Boris Johnson. It’s too early to have a judgement on this negotiation but a long lasting disagreement would allow many Brexiters to expect that the divorce could be without agreement. In that case, the real Brexit would start before the end of the year. The smooth transition will no longer exist and the hard Brexit will be the real story.

On the Coronavirus

Two issues here: one is associated with the risk on the world trade momentum as seen with the Baltic Dry Index. The other point is the Chinese central bank reaction to limit risks on the economy and on financial markets. The Pobc has added huge amounts of liquidity (USD bn175) and dropped its main rate by 10bp. At the same time, the Chinese government try to contain the epidemic.

US GDP growth was at just 2.1% in the fourth quarter (annual rate) and at 2.3% for the whole year (vs 2.9% in 2018)

The contribution from domestic demand is weaker at 1.7% (vs 2.3% in Q3 and 3.7% in Q2. Consumption expenditures have had a lower momentum but the main source of concern is non residential investment which now has been down for the third consecutive quarters. After the fiscal boost in 2018 that pushed the economic activity on the upside, the domestic demand is converging to a low trajectory as large uncertainty constraints behavior. Most of this uncertainty comes from the US trade policy and its consequences. The recent epidemic could push the economy on a lower profile.

The carry over for 2020 at the end of 2019 is 0.8% comparable to last year carry over.

Euro Area GDP: weak almost everywhere even in Spain

The Euro area growth was just 0.4% in Q4 (at annual rate) and will be 1.2% for 2019 while it was -0.33% in France (1.2% in 2019); -1.35% in Italy (0.2% in 2019) and +2.1% in Spain (2% for 2019). But in Spain the main contribution is external trade with positive exports but very negative imports. At the same time consumption expenditures dropped to 0 and investment was negative. The internal demand contribution was negative. In France, the internal demand was lower on lower investment and the global figure was negative as inventories’ contribution was deeply negative. It means that a rebound can be expected in the first quarter. Nevertheless growth for 2020 will probably be lower than 1% while the government expectations are at 1.3%. It will have a cost on budget (EUR bn7)

The document is available for download