Markit surveys in the EA, UK, Japan and US for February, ZEW in Germany, Retail sales in the UK

The PMI Markit survey for February (flash estimate for Japan, Euro Area, Germany, France, UK and US) on February the 21st.

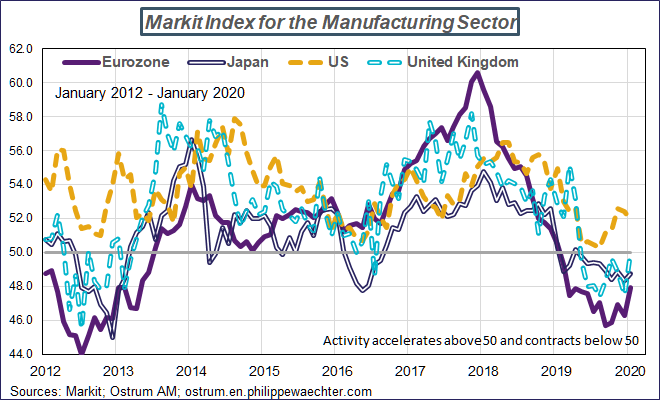

There is a kind of stabilization since last fall. The Eurozone index is still in the negative territory but it doesn’t deteriorate anymore. In details, Germany has improved even the manufacturing activity still decreases.

Apart the Eurozone, the situation will be interesting in the UK as the Brexit has really started. Is the January rebound a mirage or a real change ?

The other point will also be with the US where the strong dynamics in January has to be confirmed. The Markit survey was good but also the ISM which jumped over the 50 threshold (50.9).

The Japanese situation will also be scrutinized as the end of 2019 was a catastrophe. The GDP shrank by -6.3% during the last 3 months of the year and in January the Markit index for the manufacturing sector was still way below 50 and without any movement comparable to other developed countries.

The GDP was released on Monday the 17th and the analysis can be read here

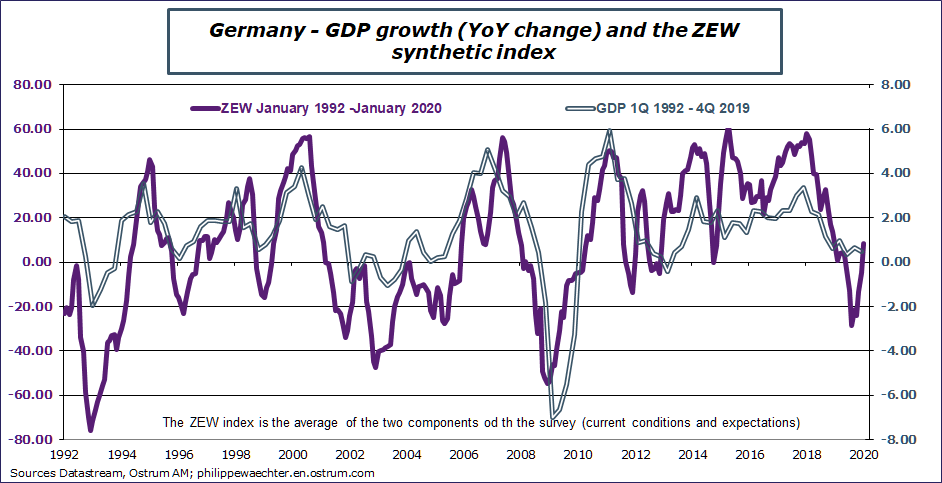

The ZEW survey will be released on February the 18th in Germany.

The rebound seen since the through of August 2019 is impressive but is just the correction of an excess of pessimism after Trump’s decision in early August to tax all the Chinese products imported in the US. The GDP has had a smoother trajectory even after the 0 % growth seen in the fourth quarter. The margin on the upside for the ZEW appears to be limited as uncertainty is still increasing with the immediate impact of the coronavirus and with the negative shock linked with slower growth than expected in China.

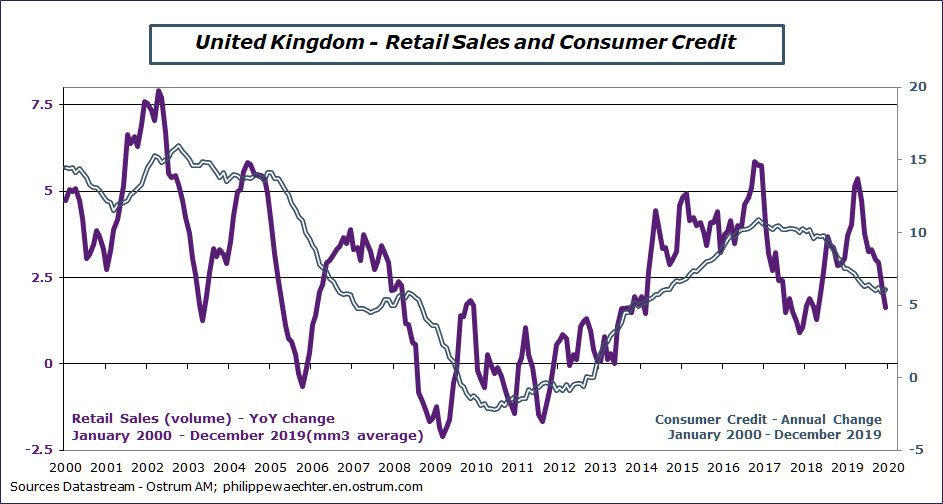

Retail sales in the UK for January (February the 20th)

Despite the strong momentum on the labor market (December figures will be released on Feb.18), the retail sales dynamics is faltering.

It may change in January as the first part of the Brexit is now over. This doesn’t remove uncertainty at all as negotiations with the European Union do not start on a strong agreement. The good question will be the adequacy of households’ expenditures and the Markit index that improved a lot in January. I’m not sure that companies and households have exactly the same economic and political prospects.

The CPI for January will be released on February the 19th. It will increase as oil price is more expensive in January 2020 than in January 2019. Its contribution will increase.

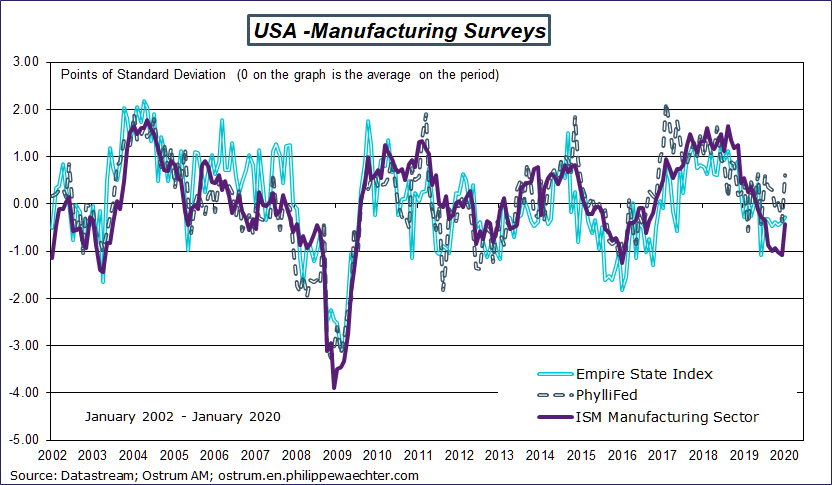

Manufacturing surveys from the Fed of New York and from the Fed of Philadelphia will be very helpful to gauge the short term dynamics of the sector before the publication of the ISM on March the 1st.

The NY Fed index will be released on February the 18th and the Phyli Fed will be out on February the 20th.

The minutes of the ECB will be out on February the 20th and those of the last Fed’s meeting will be out on February the 19th.

It will be interesting to read the Fed’s minutes in contrast with what Powell said last week at the Congress.

Other statistics:

National Association of Home Builders (NAHB) for February (18), Housing starts for January (19) and Existing home sales (21).

CPI in Japan for January (21) and definitive data for inflation in January for France (20), Euro Area and Italy (21)

What to keep in mind from last week ?

GDP figures for the 4th quarter were weak in Europe last week. It was just 0.06% (non annualized) for the Euro Area, 0.03 % in Germany and 0.02% in the UK. This means that the 2019 average growth was at 1.2% in the EA, 0.6% in Germany and 1.4% in the UK. The carry over growth for 2020 at the end of 2019 is 0.2% for the EA, O.06% in Germany and 0.2% in the UK. In other words, growth will remain close to 1% in Europe in 2020. This will have strong political implications.

The Chinese inflation was at 5.4% in January. This will not fall in a foreseeable future as coronavirus can be associated with a negative supply shock as people do not go to work in many towns. The role of economic policy is to avoid corporate bankruptcy. Improving demand is useless as supply is currently limited. A persistent supply shock would have a terrible impact on global growth as all value chains are affected by it. Products that are no longer manufactured in China will not be able to be included in developed countries’ products. A proactive economic policy will be needed everywhere.

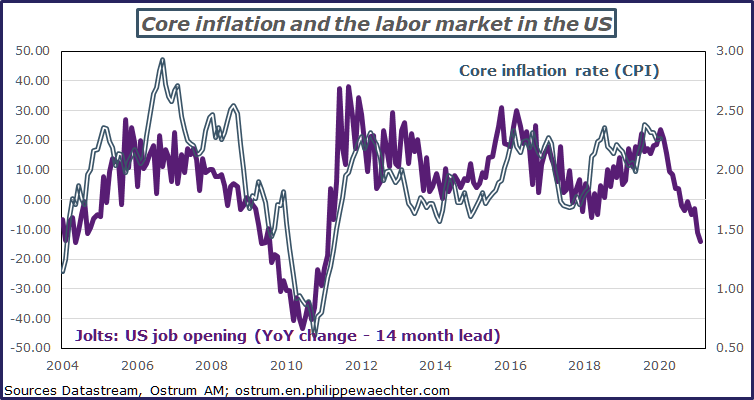

The question of the disinflation in the US is not behind us.

The labor market adjustment may lead to lower core inflation in coming months. The Fed will certainly not have to increase its rate but will probably have to lower the fed funds.