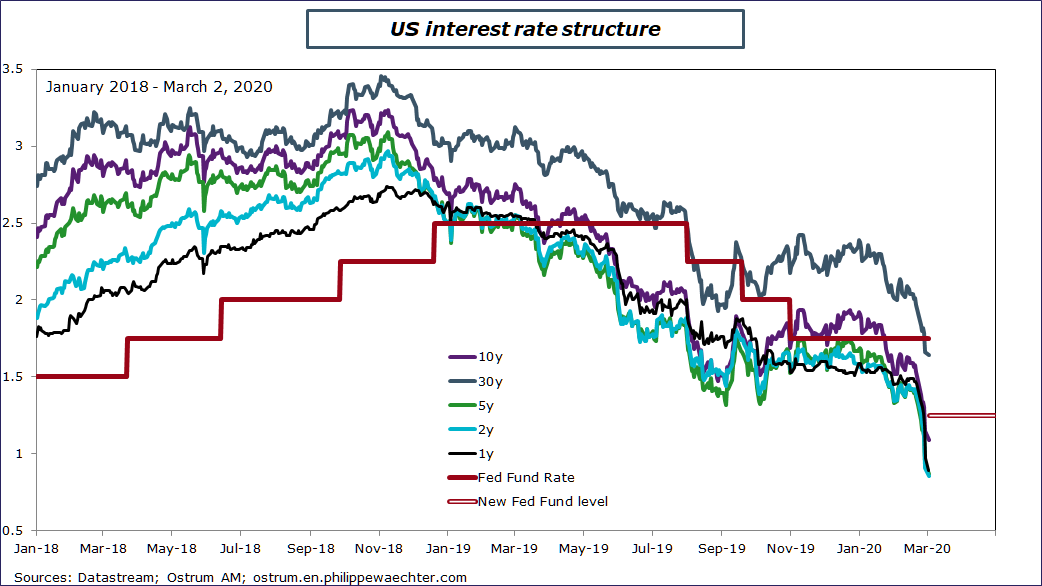

By slashing its benchmark interest rate by 50bp, the US Federal Reserve indicates its long term pessimism. The graph shows that before the move, all the US interest rates were below the fed funds rate (this is not the normal situation in which long term rates are above short term rates).

The deep drop to 1-1.25% (from 1.50-1.75%) says that the Fed doesn’t expect the rates to come back rapidly in a range that could be consistent with the former Fed’s benchmark level.

In other words, the US central bank thinks that all the interest rates will remain low for an extended period and adjust its monetary policy stance. This reflects the uncertainty associated with the coronavirus. We don’t know when a vaccine could be available and/or if the end of winter will end the epidemic. On both elements we have doubts, notably on the second as cases are declared in warm regions of the globe. It doesn’t seem to be specific to winter.

If we have this in mind, it means that the Fed fears a weaker economic outlook in coming months ( a recession ?) and its move is just to adapt to this new environment. This may stabilize financial markets in the short run but if uncertainty remains, no long-term U-Turn can be expected.

Therefore it is not a boost for demand, it’s just a way to avoid bankruptcies of many US companies.

If this large uncertainty remains, we have to expect lower rates in the future and a new drop in the Fed’s benchmark rate. The story is not over.

The interesting point is that in this environment, the situation cannot be managed by the US central bank. As far as the vaccine doesn’t exist or as far as the virus has not disappear the Fed will be a follower not a leader. The main question is how the US health system will manage the epidemic. Will quarantine be necessary ? or how this health system will be able to gather all its strength to fight the virus? That’s out of the Fed’s perimeter.