The ECB has increased the size of the specific pandemic plan. The PEPP (Pandemic Emergency Purchase Program) which amount was 750 billion usable until December 2020 is increased to 1350 billion usable until the end of June 2021. A 600 billion jump which is however not fully convincing.

As Frédéric Ducrozet suggests, at the rate of current purchases (6 billion per day) the amount of 1,350 billion will be completely exhausted on February 21. Should we expect an extension of almost 600 billion again to go until the end of June?

This matter on calibration of the plan is also a source of questions when we look at the forecasts published today by the monetary institution.

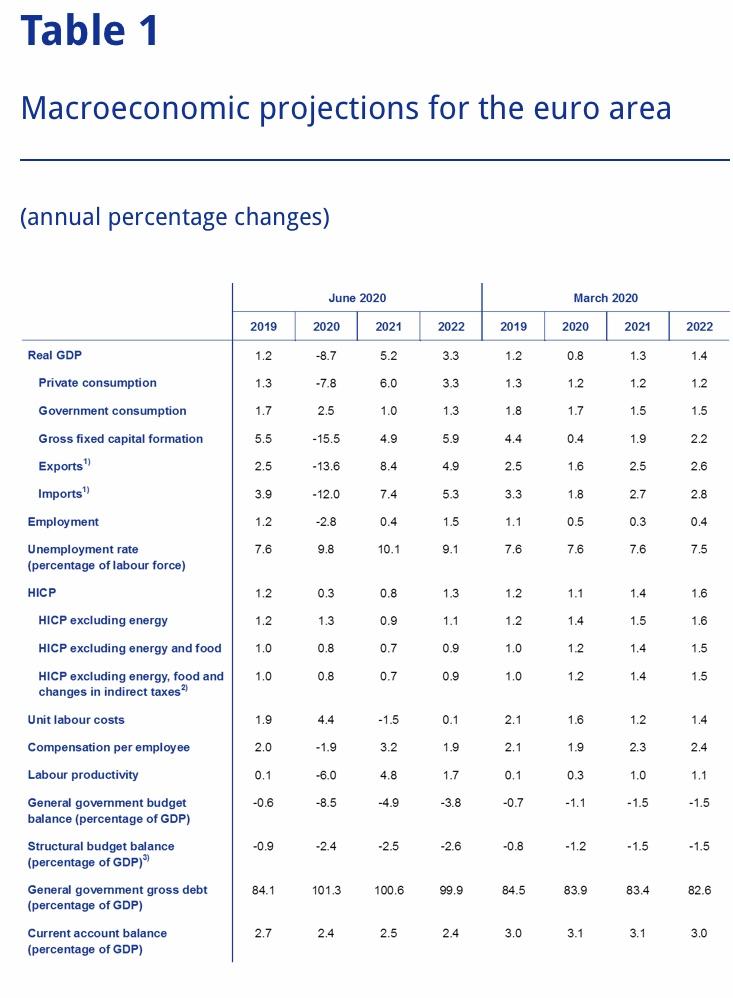

The June forecast takes into account the effects of the pandemic. GDP shrinks by -8.7% in 2020 and inflation is at 0.3%. Core inflation is 0.8% in 2020.

When I compare with the March 12 forecast (0.8%, 1.1% and 1.2% respectively), I wonder about the ability of the ECB to project itself. On March 12, Italy was already confined and France was actively preparing for it. Nothing in the forecasts reveals this particular phenomenon. What was then an epidemic was not seen as a macroeconomic phenomenon. These two confined countries were not seen as weighing on growth. We can wonder.

Communicating in limiting the possibility of upheavals is associated with a risk of loss of credibility.

If the ECB’s capacity to project is so limited, how can we understand and justify the size of the monetary policy measures implemented today? What is the rationality of the 600 billion? Why not more directly?