The rise in the price of gold was halted by improving prospects for the US economy and society. Last summer price of $ 2000 was probably excessive. But this is reassuring about expectations for the US economy, which shows more resilience than what was anticipated.

German exports were depressed in the spring with the containment of the Euro zone. The drop in trade with the zone also shows the need for Germany to implement the European recovery plan.

The improvement of the US economy will no longer be supportive for gold

During the summer, the price of gold had risen very sharply. By early August it had even gone above the price of $ 2,000 an ounce. The road was so fast that some already imagined a target of 4000.

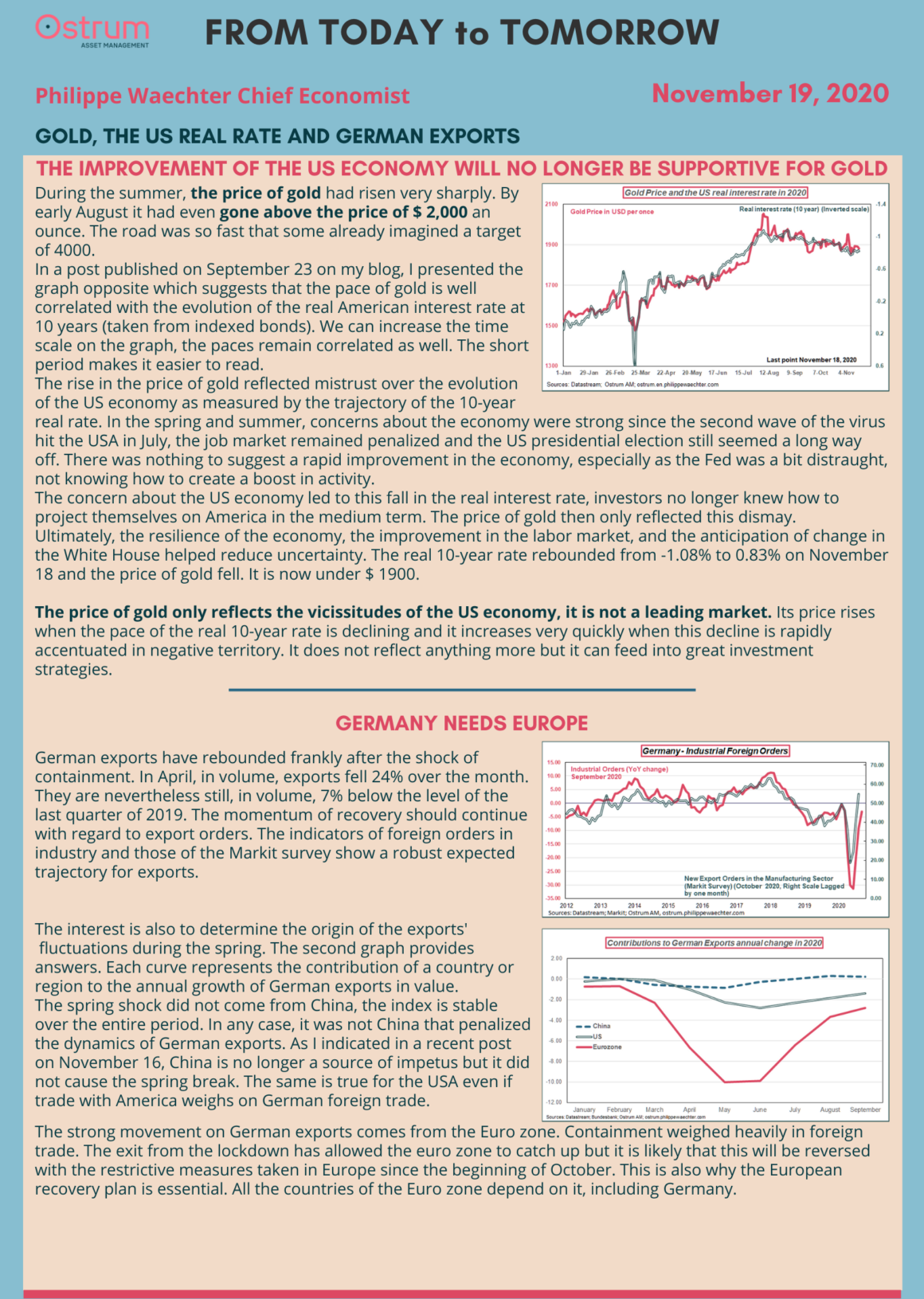

In a post published on September 23 on my blog, I presented the graph opposite which suggests that the pace of gold is well correlated with the evolution of the real American interest rate at 10 years (taken from indexed bonds). We can increase the time scale on the graph, the paces remain correlated as well. The short period makes it easier to read.

The rise in the price of gold reflected mistrust over the evolution of the US economy as measured by the trajectory of the 10-year real rate. In the spring and summer, concerns about the economy were strong since the second wave of the virus hit the USA in July, the job market remained penalized and the US presidential election still seemed a long way off. There was nothing to suggest a rapid improvement in the economy, especially as the Fed was a bit distraught, not knowing how to create a boost in activity.

The concern about the US economy led to this fall in the real interest rate, investors no longer knew how to project themselves on America in the medium term. The price of gold then only reflected this dismay.

Ultimately, the resilience of the economy, the improvement in the labor market, and the anticipation of change in the White House helped reduce uncertainty. The real 10-year rate rebounded from -1.08% to 0.83% on November 18 and the price of gold fell. It is now under $ 1900.

The price of gold only reflects the vicissitudes of the US economy, it is not a leading market. Its price rises when the pace of the real 10-year rate is declining and it increases very quickly when this decline is rapidly accentuated in negative territory. It does not reflect anything more but it can feed into great investment strategies.

Germany needs Europe

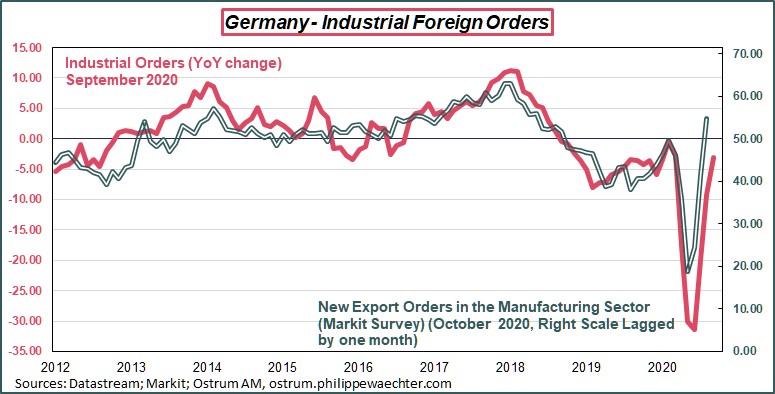

German exports have rebounded frankly after the shock of containment. In April, in volume, exports fell 24% over the month. They are nevertheless still, in volume, 7% below the level of the last quarter of 2019. The momentum of recovery should continue with regard to export orders. The indicators of foreign orders in industry and those of the Markit survey show a robust expected trajectory for exports.

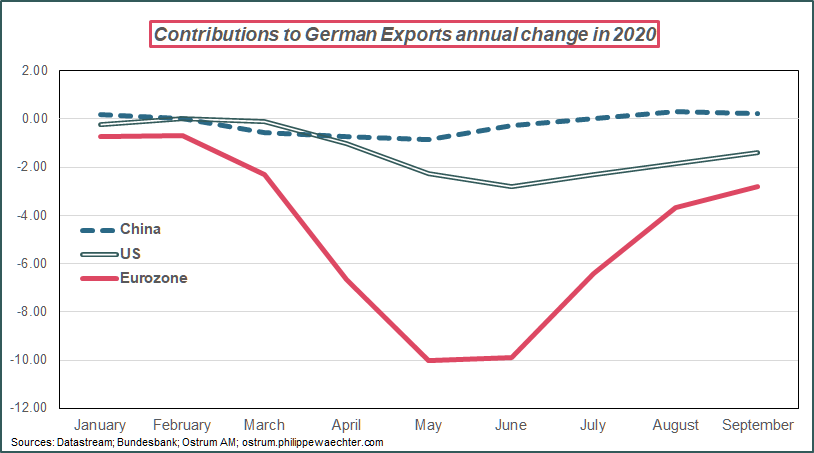

The interest is also to determine the origin of the exports’ fluctuations during the spring. The second graph provides answers. Each curve represents the contribution of a country or region to the annual growth of German exports in value.

The spring shock did not come from China, the index is stable over the entire period. In any case, it was not China that penalized the dynamics of German exports. As I indicated in a recent post on November 16, China is no longer a source of impetus but it did not cause the spring break. The same is true for the USA even if trade with America weighs on German foreign trade.

The strong movement on German exports comes from the Euro zone. Containment weighed heavily in foreign trade. The exit from the lockdown has allowed the euro zone to catch up but it is likely that this will be reversed with the restrictive measures taken in Europe since the beginning of October. This is also why the European recovery plan is essential. All the countries of the Euro zone depend on it, including Germany.

__________________________________________

This post is available in pdf format and in infographic