Summary of an interview with Radio Télévision Suisse

So far, the effects are still moderate. There are several reasons for this. Donald Trump’s recent announcements setting tariffs at 18.3% (Source: Yale Lab) won’t take effect until August 7. Companies imported many products before these tariffs increased. It will take time for them to clear before having an impact on prices. Households have also changed their purchasing dynamics, particularly for automobiles.

Customs duties will increase the price of incoming products in the United States. The distribution of the associated costs will be long-term. Exporting companies in the US, wholesalers, and retailers may want to absorb some of the costs before shifting them to the consumer, who will ultimately be the big loser. This distribution over time and between the various stakeholders is not yet clearly perceptible. This explains the lack of acceleration in inflation. However, we can see that an adjustment will take place. For example, in the automotive industry, the taxes (50%) on steel and aluminum borne by manufacturers will eventually be reflected in prices to maintain company profitability. The Fed’s hesitation stems from this.

Demand will be penalized by these upward adjustments, and it can be estimated that by the end of 2026, the negative impact on activity would be around 1% compared to a scenario without customs duties. This is not negligible. The tax revenues associated with customs duties will not benefit all households, since the future reduction in social assistance does not appear to be negotiable, while taxes for the wealthiest will be reduced. Customs duties will not reduce inequality in American society.

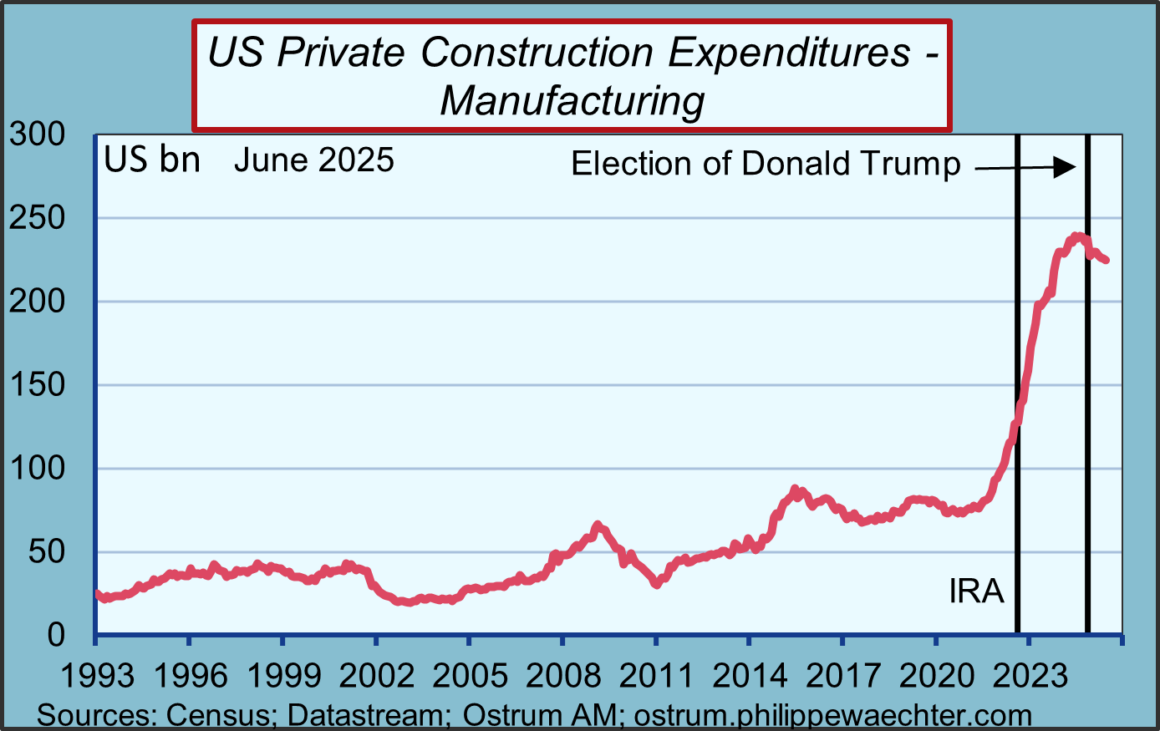

Another interesting aspect concerns business investment. When Joe Biden implemented the Inflation Reduction Act in August 2022, a significant increase in spending on factory construction was observed. Since the summer of 2024, the upward trend has been broken. Uncertainty about economic policy is encouraging businesses to be more cautious.

Who are the winners?

Network companies: in the discussion on the deal with the European Union, the GAFAM tax was not mentioned. They will be able to continue operating without being penalized.

From a European perspective, the military sector will be the winner. EU countries have committed to increasing their military spending and, for reasons of capacity, to purchasing American equipment.

This will strengthen the military-industrial complex that was already the strength of the Americans in the 1950s and 1960s.

The United States has broken the international trade system by profoundly changing the rules. It will have to be rebuilt differently, perhaps without them.