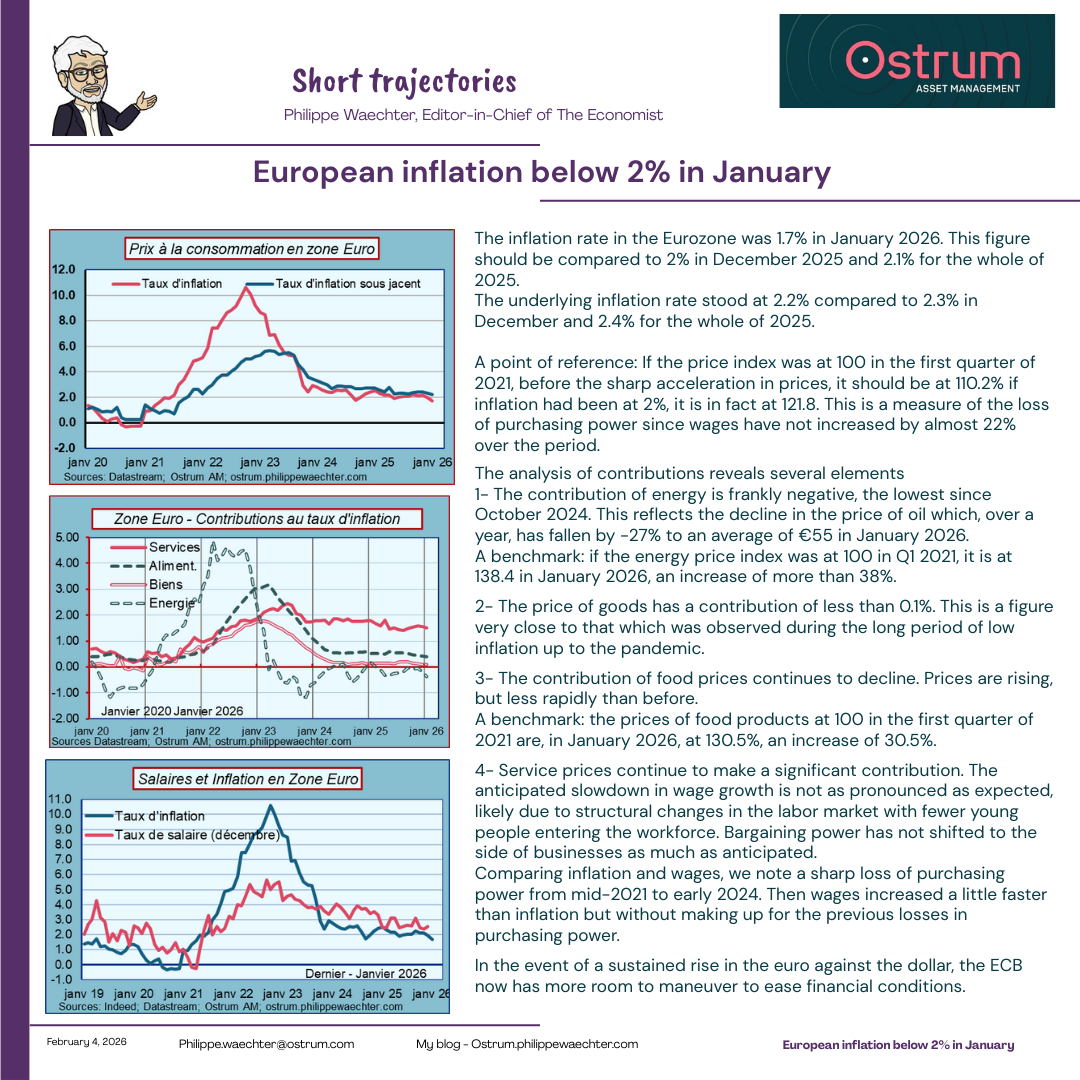

The inflation rate in the Eurozone was 1.7% in January 2026. This figure should be compared to 2% in December 2025 and 2.1% for the whole of 2025.

The underlying inflation rate stood at 2.2% compared to 2.3% in December and 2.4% for the whole of 2025.

A point of reference: If the price index was at 100 in the first quarter of 2021, before the sharp acceleration in prices, it should be at 110.2% if inflation had been at 2%, it is in fact at 121.8. This is a measure of the loss of purchasing power since wages have not increased by almost 22% over the period.

The analysis of contributions reveals several elements

1- The contribution of energy is frankly negative, the lowest since October 2024. This reflects the decline in the price of oil which, over a year, has fallen by -27% to an average of €55 in January 2026.

A benchmark: if the energy price index was at 100 in Q1 2021, it is at 138.4 in January 2026, an increase of more than 38%.

2- The price of goods has a contribution of less than 0.1%. This is a figure very close to that which was observed during the long period of low inflation up to the pandemic.

3- The contribution of food prices continues to decline. Prices are rising, but less rapidly than before.

A benchmark: the prices of food products at 100 in the first quarter of 2021 are, in January 2026, at 130.5%, an increase of 30.5%.

4- Service prices continue to make a significant contribution. The anticipated slowdown in wage growth is not as pronounced as expected, likely due to structural changes in the labor market with fewer young people entering the workforce. Bargaining power has not shifted to the side of businesses as much as anticipated.

Comparing inflation and wages, we note a sharp loss of purchasing power from mid-2021 to early 2024. Then wages increased a little faster than inflation but without making up for the previous losses in purchasing power.

In the event of a sustained rise in the euro against the dollar, the ECB now has more room to maneuver to ease financial conditions.