When I start writing this post, an agreement has been reached at the Euro Summit. We don’t have details yet but it’s probably close to the Eurogroup deal reached yesterday.

Following the Eurogroup’s press release, Greece will have no other choice than being under guardianship by the Eurozone. Its sole degree of freedom is to make default and to exit from the Euro Area.

Discussions during the week-end were violent at the Eurogroup meeting between the dove (France) and the hawks (Schauble). At the end, the hawks have won.

The main point is that Greece will be able to start discussing only after a large number of measures will have been put in place. These measures, see below, are just a condition to start discussions for a third bailout. It doesn’t mean that they are necessary to have a new plan; it is just a starting point.

Moreover, Greece will have to put the equivalent in assets of EUR 50bn in a fund to be collateral for privatizations. The jewels of the crown will be put in the fund and other members of the Eurozone will be able to buy them. It will reduce Greek’s growth autonomy as there is no reason to keep these activities in Greece after privatization.

At a moment there were discussions on a temporary exit for Greece. But it was not in the final press release (see here for a discussion of a temporary exit)

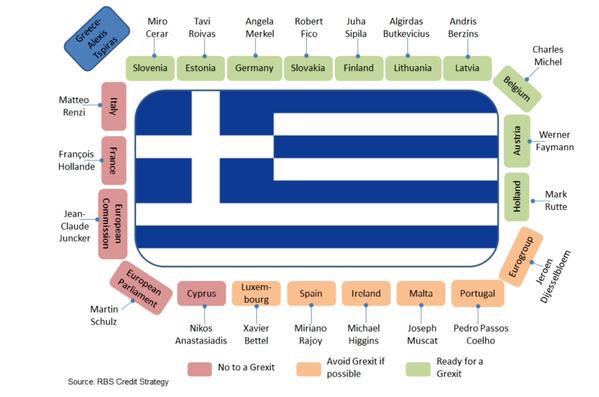

The starting point of the Eurogroup and the Euro Summit is the lack of confidence of Angela Merkel and Wolfgang Schauble in the commitments made by Greece. German had allies during the two meetings: Austria, Finland, Netherlands, Baltic countries, Slovakia and Austria. They all mentioned difficulties to go in front of their electorate and/or their parliament without a real commitment and a counterpart from Greece. Internal equilibrium of each country was perceived sometime as more important than the Eurozone equilibrium.

The chart below shows the strength during the negotiation.

If it goes to the end, the process will rapidly imply a new political equilibrium in Greece. We’ve already seen that when the plan proposed by Alexis Tsipras was voted at the Parliament. Many members of the government coalition haven’t voted it. This is something to take into account. In other words, may be a new majority will be seen at the parliament but will the street majority be the same? That’s an important point as the probable new agreement is more severe than the question that was asked at the referendum and on which a large majority of Greeks have said “no”.

If we follow all the measures that are in the Eurogroup’s press release, Greece will have its hands tied and be dependent on the Eurozone decisions. All of them, when they will be put in place, will just be the starting point of the third bailout. It means that new measures could be announced when negotiations will start.

Greece has not been virtuous during all these years but during the Eurogroup meeting it was perceived that the fear of a Grexit was stronger in Greece than in Germany. The balance of strength has deeply shifted during the weekend and the final blow could be brought.

We are currently waiting details of the Euro Summit agreement and the decision that the ECB will take today on liquidity for the Greek banking system.

The different measures are the followings

For Wednesday 15,

Greece to pass measures including simplifying VAT rates and applying the tax more widely.

Measures to cutting back on pensions

Making the national statistics agency (ElStat) independent.

A clear timetable is needed for these measures

An ambitious and consistent pension reform;

A market reform including Sunday trading, pharmacy ownership and opening of closed professions such as ferries;

Privatization of the electricity transmission network;

Review collective bargaining, industrial action and collective dismissals;

Strengthen financial sector, including action on non-performing loans and eliminate political interference.

Commitment to take

Privatization, possibly involving transfer of 50 billion euros of assets to external and independent fund;

Cut costs of public administration and reduce political influence over it. The first proposal must be provided before July 20.

Technical support demand to the Eurozone is expected to be asked before July 20

Seek troika approval for key legislation before submitting to public consultation or parliament.

Measures that must be taken before July the 20th, will allow a financing of Greek’s liabilities in July and August (notably the repayment to the ECB)

The whole framework has to be put in place for September in order to be able to start a new negotiation for the third bailout. The amount in discussion will be EUR 82-86bn for three years.