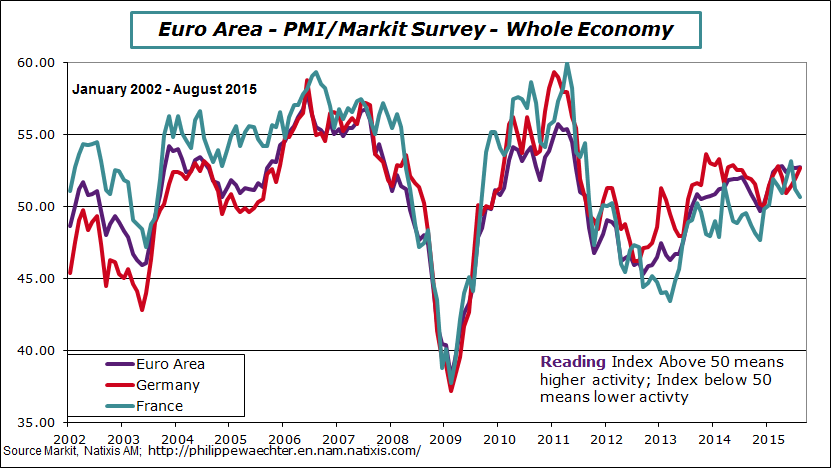

Since February 2015 the Markit synthetic index for the Euro Area remains at the same level. At the end of 2014 to February this year there was an acceleration of the index, but since then, it is in a corridor between 52.4 to 52.7.

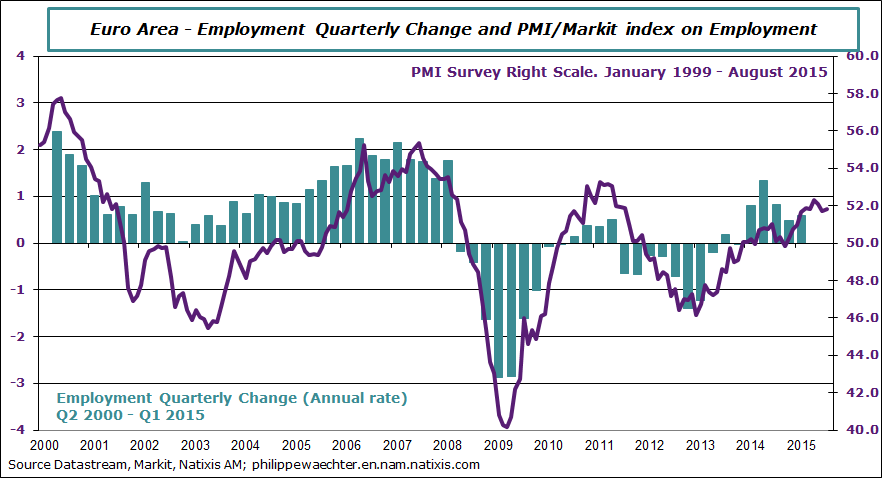

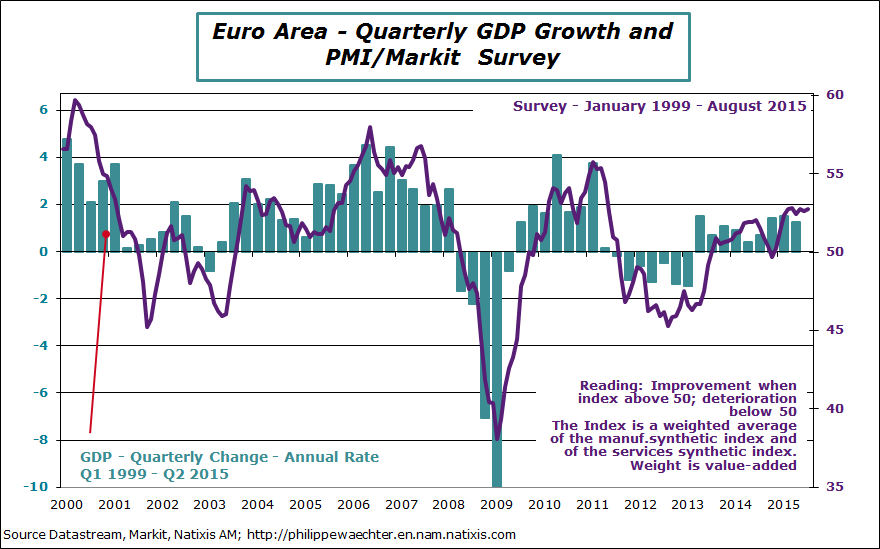

This index level remains consistent with a 1.5% GDP growth in 2015. Signals from sub-indices (new orders, employment) give the same information.

In other words, growth is robust in the Eurozone but doesn’t accelerate.

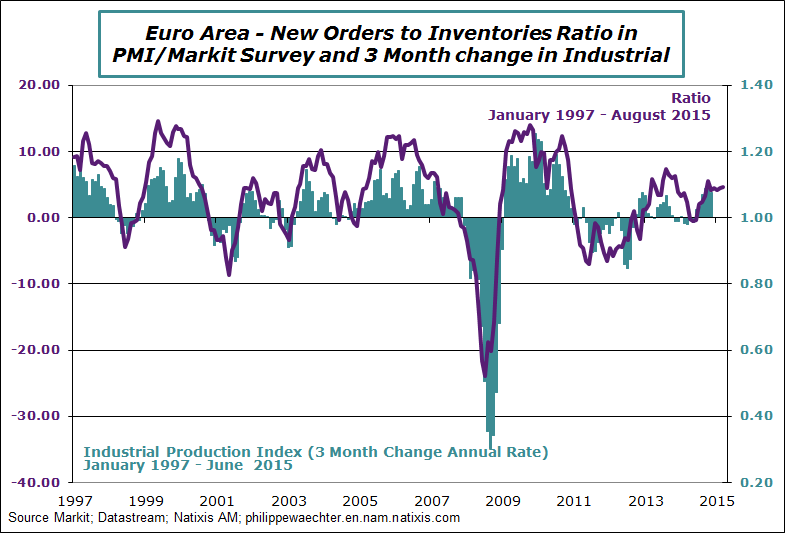

The first is the ratio of New Orders to Inventories. Its profile is consistent with the 3 month change in industrial production. The ratio is stable showing an improvement in industry but it doesn’t show a rapid and strong acceleration: robust but not leading to a rapid improvement in the industry throughout Europe.

Philippe Waechter's blog My french blog