The number of new jobs, 271 000, is strong in October. In absolute terms this is remarkable. The question we must ask is the following: is it a change in trend or just a catch up after two mediocre months?

If this is a change in trend with a November figure consistent with that of October then this increase, for sure, the likelihood of Fed rate hike in December. This is the reasoning that one often reads, at least implicitly, this afternoon. If it’s just a catch then the question of a change of Fed’s strategy remains.

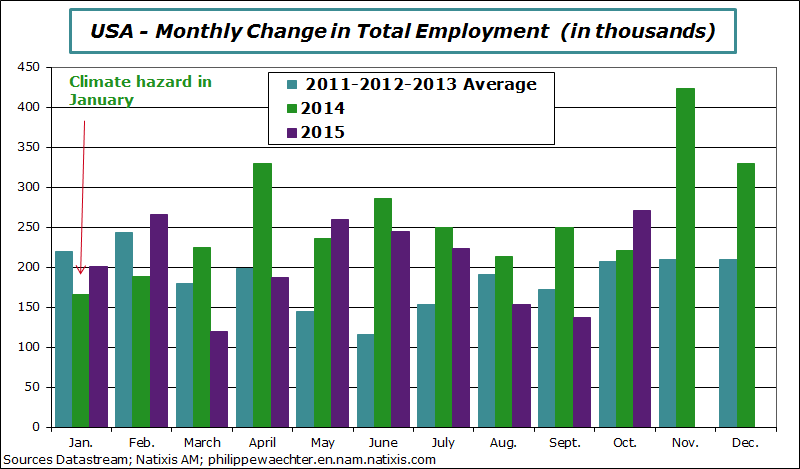

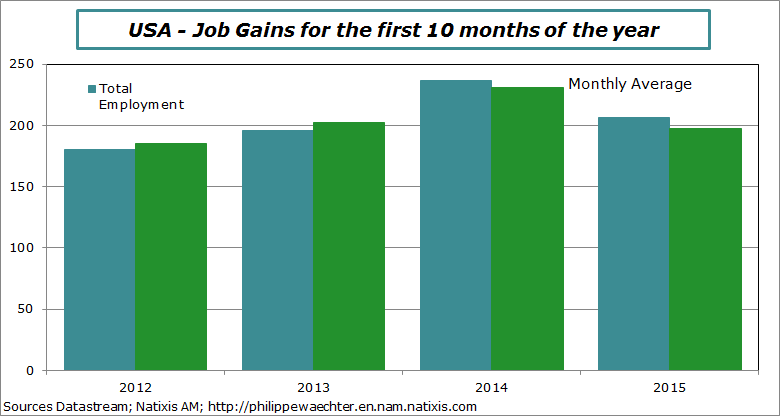

The problem is this: In the last three months (August, September, and October 2015), average job creations were 187,000 after 243,000 in the previous three months. In 2014, for the same 3 months the figure was 228,000 and that of the previous three months was 257 000. The profile is similar but at a lower level than in 2014. There are no additional tensions spontaneously when we look at the data.

This can be seen in the following graph, the purple bars were significantly weaker in August and September this year than last year.

This means that the October figure remains isolated for the moment and does not reflect a change in trend. This change in the trend is considered as the replication of another good figure, similar to the one seen in October. It’s too early to say that.

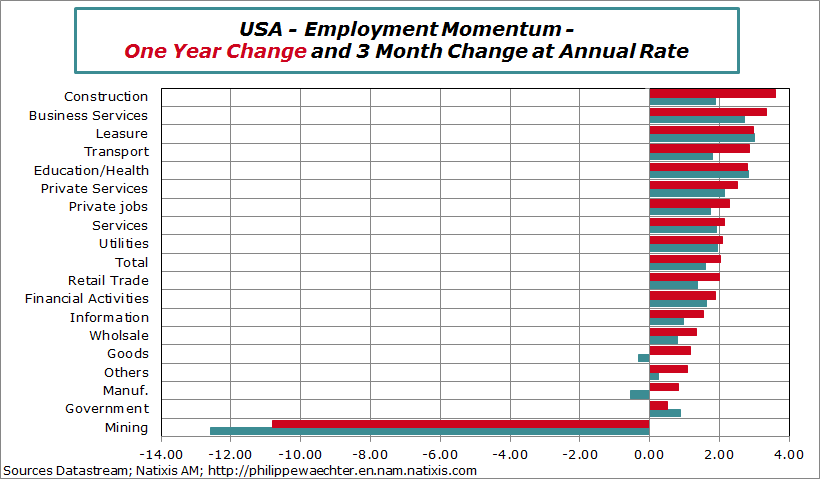

(The goods sector includes manufacturing, mining and construction; private services represent less public employment services)

Two very positive points of the report on employment

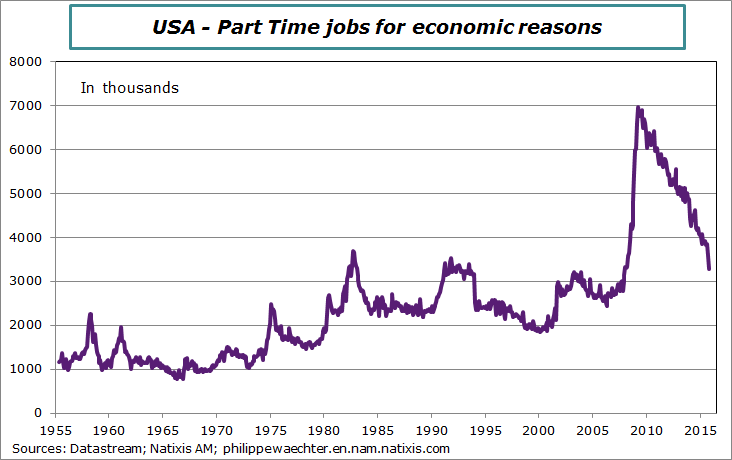

1 – The reduction of part-time work for economic reasons. The decline is strong in October but the level is still well above the average level observed in the previous cycle. This decline reflects a significant reduction of inefficiencies in the labor market and is an important and positive element.

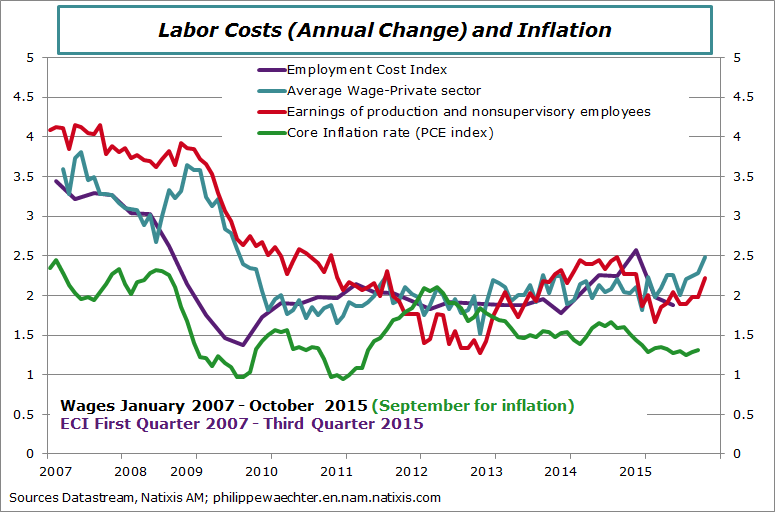

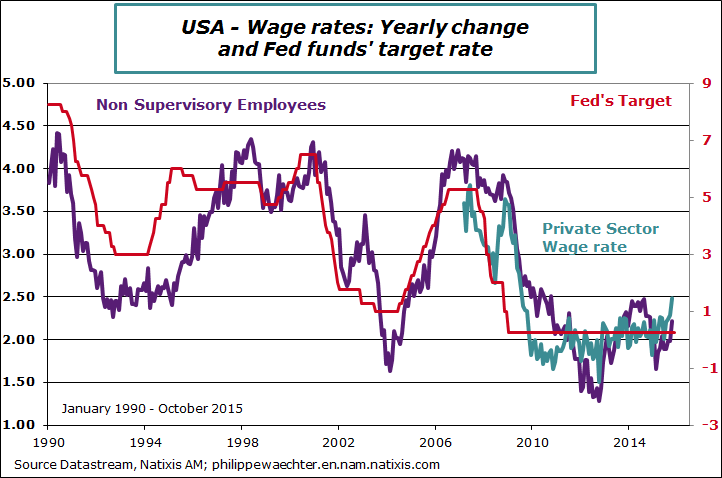

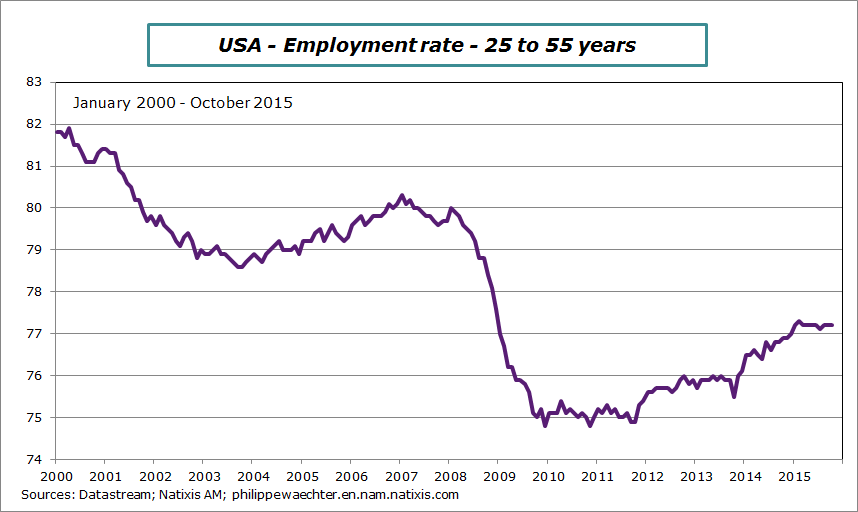

This still does not give an inflation signal (a figure should converge to 4% for this) but it means that tensions finally appear on the US labor market. That’s a positive signal.

If this upward trend was confirmed in November then the Fed may change its monetary strategy at its December meeting.

Conclusion

The number of jobs creation was strong in October, but it appears as being primarily a catch-up after two months with low momentum. The short-term dynamics is limited since the evolution of the past three months is moderate, less intense than in previous periods.

Nevertheless tensions may have appeared on the labor market through the evolution of wage rates or reduction of the number of involuntary part-time jobs.

In other words, the figures show catch-up; if these data are confirmed in November then the probability of a rise in the Fed’s rate at its next meeting would be high.

For now I think that this is primarily a catch up rather than a change in trend. This means that future data will be good but without translating into a trend change. The Fed will have the possibility to choose without pressure.

Philippe Waechter's blog My french blog