Will the recovery of the French economy be undermined by the murderous attacks in Paris on November 13? Beyond the dramatic aspects and explanations that are not directly our responsibility, it is the question we must ask.

For the French economy this negative shock arrives while it is emerging from a long period of very low growth. In recent months, elements for a more sustainable and favourable trajectory were progressively put in place. The attack could challenge this change in trend. The risk would be to see the economy converging to a slow growth profile that couldn’t generate net jobs creation.

Spontaneously the immediate answer to the question suggests a “wait and see” behavior. The uncertainty engendered by a series of attacks creates a significant blur on the future situation. From the consumer side, additional uncertainty could be perceived through an expected fragility on the labor market. In this case, it would be rational for him to reduce his consumption and save more today to face a weaker situation in the future. As for companies we can imagine that the uncertainty caused by the terrorist attacks could lead to more cautious behavior especially in investment decisions. This would be very damaging because the economic cycle is built over time around the investment.

Therefore one could imagine a negative impact on the activity with an increased risk of recession.

Yet it is not so simple.

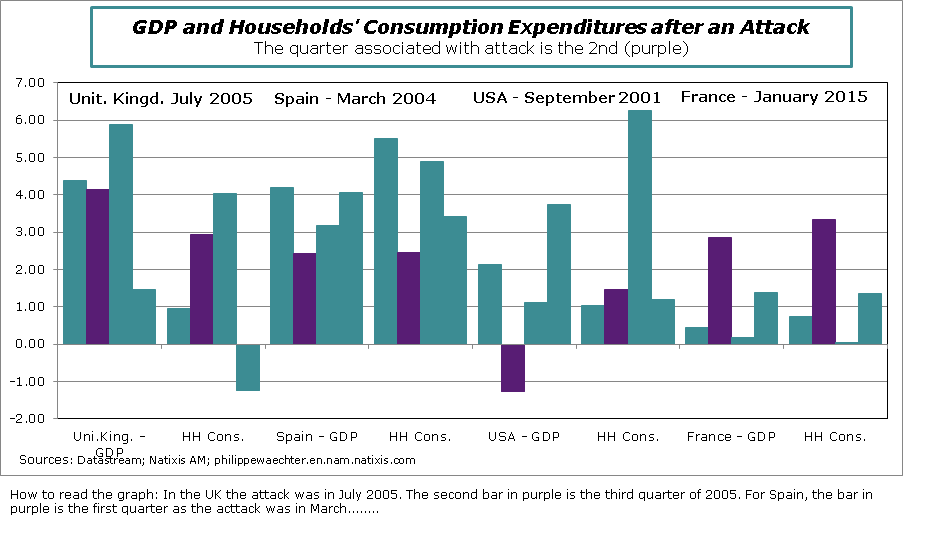

Past episodes of attacks have not plunged the local economy into a sharp slowdown. This was not the case in the United State after September 11, 2001. At that time the economy was already in recession . The trough of the business cycle was touch in November. So rapidly after the attack the economy was back to expansion. In Spain, after the attack at Atocha Station (Madrid) in March 2004, the growth trend was not changed; the sustained expansion of Spain was not questioned. The London bombings in July 2005 did not change the trend of the growth of the British economy. Finally after the attacks in Paris on 7 and 8 January, consumption remained robust throughout the first quarter.

Given these four dramatic events, the negative effects on the GDP momentum are not persistent. One must imagine that in the days following the attack, behaviors are more on a “wait and see” mode but it has no persistent effect. A robust consumption dynamics remains a support for companies’ investment decisions. The shock did not result in a rupture and has no persistent and permanent effect on economic behavior.

The return to the French economy recession is unlikely even that beyond the effects mentioned, France is part of a European dynamic that is strong and which will pull up.

This lack of persistent impact seems difficult to imagine when the events happen because of the emotion aroused by the attack. That’s the reason why past experiences are interesting and useful. In these periods a strong collective dynamics emerges and helps to deal with adversity. This common dynamics gathers around the historic values of the country. The communication of government and politics in general should promote its implementation in order to bring a stronger cohesion. The collective dynamic is the answer to a situation that goes beyond each individual citizen. It seems unlikely a priori but on the economic ground past events show that it is set up and the economy does not add to the confusion.

Graphic

The graph shows profiles of GDP and household consumption around the time of the attacks. These are quarterly change at annual rate. I took 4 quarters, one before the quarter in which the attacks took place and 2 after the attacks.

We observe that there is no break; it is this point which is important because it determines the dynamics of investment.

Philippe Waechter's blog My french blog