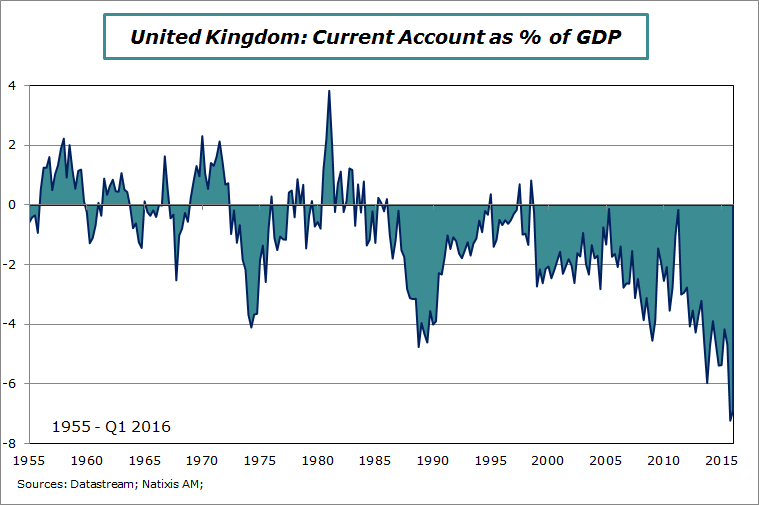

The current account of the United Kingdom was in deficit by -6.9% of the GDP during the first quarter of 2016. It was -7.2% during the last three months of 2015. For the UK this is an historical negative level. Even compared to other developed countries it’s huge.

Why is it important?

The most important issue at this moment is the financing of this current account deficit. It is usually done by financial inflows in the UK and by direct investment (real assets bought by non residents). Since the UK was inside the EU and due to the role of the City (European Passport), this financing was not a concern.

With the Brexit, the question is simple. Who will invest in the UK in this period of high uncertainty? Who will buy financial assets or who will increase its direct investment? As far as the situation and the relationship of the UK with the EU are not fixed, the probability of lower inflows is high.

In that case, the current account level is not sustainable.

Two options:

1-A lower sterling: in that case the drop of the British currency is not over. It would a way to increase the UK competitiveness in order to reduce the external imbalance.

2-It could be also through an austerity policy in order to curb imports trajectory by reducing internal demand (HH consumption or government expenditures).

In both case it will be damaging because we can expect higher inflation because of the drop of the currency (and higher long-term interest rates) and lower economic activity. We’ve seen with Spain and Italy that a strong austerity policy to reduce external imbalances led to a deep recession. It could not be different for the UK

That’s the risk.

Philippe Waechter's blog My french blog