This is the question we could well raise the day after Mario Draghi’s press conference that followed the monetary policy meeting.

The President of the ECB was emphatic in convincing his audience and the entire investment community that there is no question of the central bank changing the way it operates for now, even though it has adjusted the way it communicates on its policy. Any reference to a possible cut in interest rates was deleted from the press release, but according to Mario Draghi, this is not enough to indicate the announcement of a change in policy. The ECB is neither ready nor willing to change policy.

Insufficient inflation, which lags well behind the 2% target set out by the ECB, is the main factor behind this status quo. The President of the ECB again insisted that inflation volatility was solely due to oil price fluctuations. The other components of inflation are much more stable and increased by only slightly less than 1% per year on average over the past three years. This is low and still below the target. The ECB therefore has no reason to rush to change its stance.

We can take a different approach in analyzing the logic behind monetary policy in order to obtain a rational explanation as to what the central bank does or will do.

My view of monetary policy in the euro area has primarily been dictated by the lack of a growth driver in the zone, and the key feature for growth is private demand.

When Draghi took over as President of the ECB on November 1, 2011, private demand looked lackluster. Consumer spending was low and investment inadequate. At the same time, uncertainty was high, which encourages all players in the economy and individuals to hoard their cash rather than spend it. This is fairly rational behavior: against an uncertain political and economic backdrop, we all try to hang on to what we’ve got by saving and these savings are kept safe for a rainy day. Yet this behavior hampers the economic outlook as demand to companies declines. This situation is further exacerbated by the implementation of austerity policies, which create additional uncertainty and significantly cut back demand to companies further. The combination of all these factors led to a long recession in the euro zone between mid-2011 and end-2012, i.e. six quarters of recession.

Faced with this situation, Mario Draghi wanted to alter the investment choices economic players make: he was willing to do anything it takes to push up spending and hence shore up economic activity. So the interest rate cuts seen since Mario Draghi took over at the helm of the ECB fit with this logic. The drop in interest rates aims to reduce the incentive to save wealth to be used at a later date. When interest rates are low, investors faced with the choice between a low-return investment and leaving cash in their current account with no interest will often opt for the latter. Banks’ demand deposit accounts therefore expanded and consumer spending got a kickstart as we all have a tendency to spend available cash when we have it.

So the lack of yield on savings products promoted consumer spending, and this is a major factor in explaining the recovery in growth in the euro zone: the ECB played a key role.

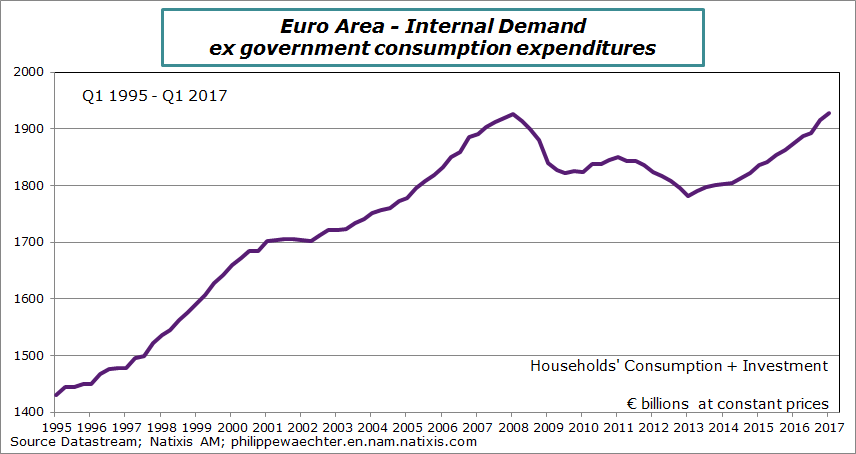

The important point to bear in mind is that this private domestic demand has at last returned to pre-crisis levels in the first quarter of 2017, as shown in the chart.

Private demand fell continuously from the first half of 2008 through to the end of 2012. Since then there has been a real change in trend, which has driven the revival in the euro area.

It looks here like a first stage has been completed. Private demand regained a more robust pace and has been propping up the growth we have witnessed since 2013.

The ECB must consolidate this trend and avoid recreating any potential uncertainty on economic activity by acting too quickly. In view of the asymmetrical nature of monetary policy, the central bank should take action too late rather than too early.

The right timing would be to let the cycle gather speed, fuelled by this domestic demand. Private demand needs to exceed its 2008 peak and get back on a similar uptrend to pre-2008 levels. This improvement would lead to additional jobs and revenues, and companies would therefore continue to invest to meet this demand.

We have already seen this trend in action as the euro area has created more than 4.8 million jobs since the start of 2013. It now needs to pick up the pace and trigger the emergence of pressure on the labor market and wage negotiations that push up salaries.

Only then will core inflation rise and only then should the ECB think about changing its monetary policy. This ought to take place in 2019 and not before.

Monetary policy is a key mechanism for managing growth, and inadequate inflation merely acts to respond to the lack of growth and pressure on production. By maintaining its accommodative policy, the ECB is playing an integral role in promoting this virtuous cycle that encourages growth and jobs, and contributes overall to a more self-sustaining euro area. This fits neatly with Angela Merkel’s stance that Europe “really must take our fate into our own hands” against the current complex international backdrop. The ECB will contribute to this, and that is exactly what we expect from the central bank.

This is my weekly column for Forbes, it is available here in French

Philippe Waechter's blog My french blog