The French GDP growth in 2017 has accelerated to 1.9% on average after 1.1% in 2016. The quarterly sequence of the GDP expansion was steady at 0.6% per quarter except 0.5% in the third quarter.

The carryover growth for 2018 at the end of 2017 is 0.9% which slightly higher than a year ago. At the end of 2016 it was at 0.4% for 2017. The effort that has to be done to converge to 2% in 2018 on average will be lower than in 2017. It is just a 0.42% increase per quarter (versus 0.58% in 2017).

The very positive part of the fourth quarter report was the strength of corporate investment.

The government budget for 2018 has been defined with a 1.7% growth (or 0.33% per quarter). This means that we can expect higher receipts compared to what was forecasted. The government credibility will be measured by its ability to use these extra receipts to reduce expenditures not to increase them. In the past these type of temporary receipts were systematically spent in permanent expenditures leading to a persistent budget deficit. We can expect a different strategy from the president Macron.

A reduction in expenditures and therefore lower demand would be consistent with what we currently perceive on the business cycle. A recent survey has shown that it was quite impossible for companies to increase their production. The production capacity utilization rate is at a peak, production bottlenecks are growing and there are difficulties in hiring.

With these constraints in mind, a boost in demand through higher government expenditures would be a mistake. The target is to reduce these constraints through incentives on investment (through public investment) and education. That will be the main government task in 2018.

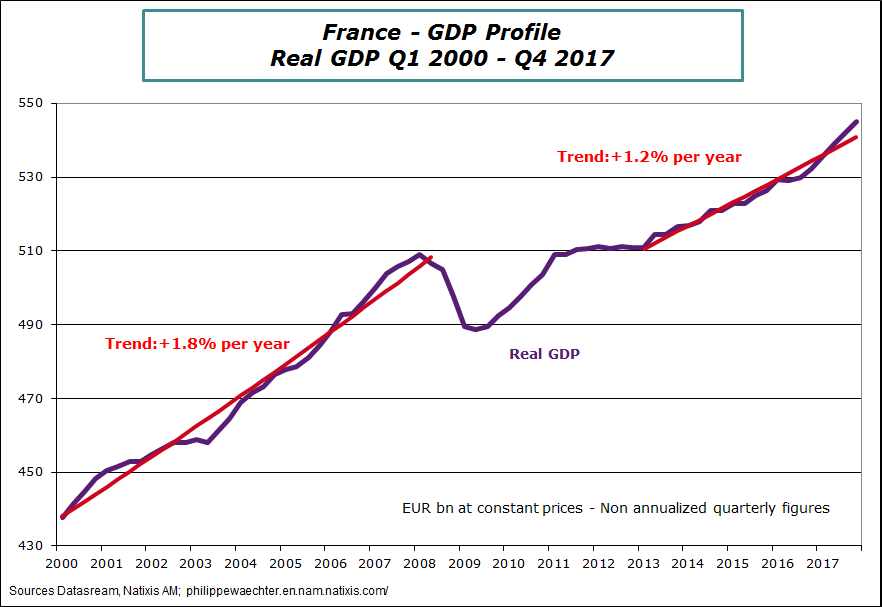

The graph below shows that the current growth trend is slightly lower than before the 2008 crisis. It means that there will be no catching up and that the cost of the crisis is permanent. The gap between the current GDP level and the trend from 2000 to 2008 is -8%. The GDP level would have been 8% higher without the crisis. This is quite big and this gap will widen in coming years as I do not expect a catchup of growth.

Philippe Waechter's blog My french blog