“To reduce the European unemployment rate, the ECB must copy the Fed’s behavior”

Growth in the euro area picked up considerably in 2017 coming out at 2.5% vs. 1.8% in 2016, and hitting its highest point since 2007. The ECB played a lead role in this economic improvement: its policy of keeping interest rates very low by maintaining the main refinancing operations rate at 0% and via its asset purchase program on longer maturity securities was very effective.

These moves helped encourage Europeans to spend now by reducing the incentives to hang onto their wealth and spend it later, and in this respect, ECB President Mario Draghi skilfully steered the situation. The growth we are currently witnessing is driven by private domestic demand i.e. household spending and investment.

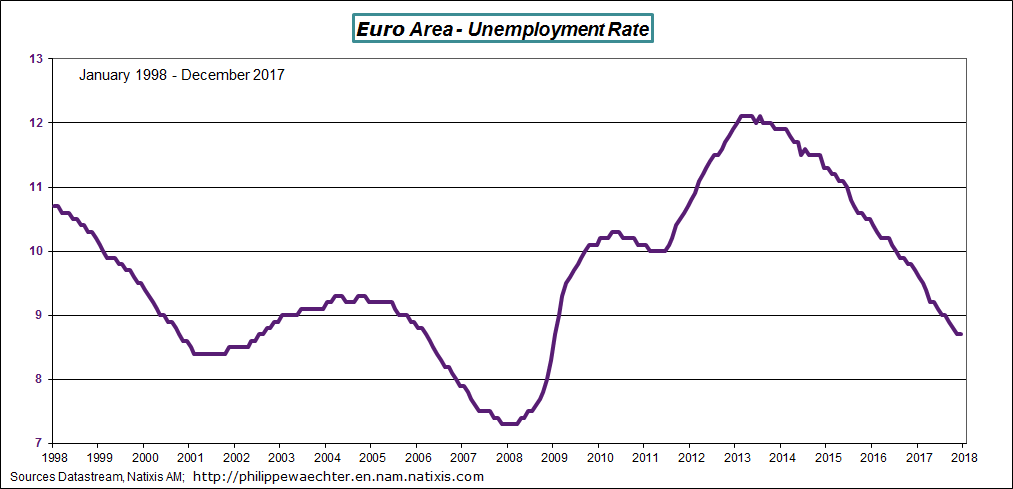

Unemployment trends

Yet unemployment remains high in the euro area, standing 1.4 points above end-2007 figures, when it came to 7.3%. This means that growth has not yet fully completed its upward adjustment.

Similar situation in the US

On Wednesday January 31, 2018, outgoing Chair of the Board of Governors of the Federal Reserve Janet Yellen took her bow, her legacy a buoyant US economy. Over the last four years, she has steered the US economy to full employment with jobless numbers at 4.1%.

Many observers encouraged her to take a harder line on monetary policy due to strong pressure on the country’s production capacities and inflationary risks. But Yellen went down the monetary accommodation path and stayed on it, with the clear target of achieving full employment for the entire US economy, and stuck to her guns despite some States achieving unemployment figures well below the overall US-wide rate.

The Fed’s recent interest rate hike looked more like a move to claw back some leeway in its economic cycle management rather than an attempt to interrupt the cycle. This was visible in the very transparent stance in explaining decisions made and those that would lie ahead.

The ECB is currently in a similar situation to the Federal Reserve. Unemployment is still too high in the euro area, and the ECB needs to stay on course to push it down further and draw closer to the 7% mark. Just as in the US, unemployment in some countries is lower than the euro area average as a whole, and we hear a great number of observers discussing the need to take a tougher stance on monetary policy. But the ECB’s target must apply to the area as a whole, and this monetary policy target is all the more plausible as inflation is still well below the central bank’s 2% goal.

The ECB must hold steady and push jobless figures in the euro area towards full employment. The central bank needs to continue to drive demand as it has done since Mario Draghi took over at the helm. It worked in the US despite the doomsayers who said that the labor market could not return to full employment for structural reasons.

Mario Draghi must be equally resolute at the ECB. At the same time, each country wants to improve the responsiveness of its labor market and the ECB President regularly refers to this, but he must maintain his aim to keep demand strong and monetary accommodation is the key.

In other words, for such times as unemployment does not converge and move towards the 7% threshold, the ECB will have to maintain its strong monetary policy accommodation, and this may continue well beyond the expected September 2018 deadline for the end to the asset purchase program.

The ultimate goal of economic policy must be activity and employment. The ECB must create permissive conditions to achieve full employment, each country must put in place the conditions for an efficient and productive employment dynamics.

Philippe Waechter's blog My french blog