This weekend’s Italian elections failed to provide an answer to address the risk of political instability that has characterized the country since the Second World War.

The vote saw a surge in populism that the pre-election polls had not fully taken on board. The Five Star Movement looks set to win 34% of votes and the League (formerly known as the Northern League) is poised to carry off 16%, while Silvio Berlusconi’s party should gain only 14% and Matteo Renzi’s Democratic party just 18%. This marks a huge decline for the traditional governing parties as compared to 2013.

Based on the outcome expected as counting continued today, a hung parliament looks likely. There is a small amount of proportional representation, so a 40% score would be enough to secure a majority.

This potential outcome raises a number of questions:

Based on the numbers, a coalition looks possible between the Five Star Movement and the League, with a total of close to 50% for the two parties combined. They also share some common ground, such as their anti-European stance and, for a number of members of parliament, the aim of taking Italy out of the euro area. However, when we look at the geographical breakdown of voting, we can see that the northern area of Italy voted primarily for the League and Forza Italia, while the south voted for the Five Star Movement (the Democratic party won votes more in the center of the country). In view of long-standing tension between north and south, we cannot assume that the two populist parties would be naturally inclined to join forces. Another point worth remembering is that the procedure for appointing a prime minister takes a long time.

Italian President Sergio Mattarella must appoint the prime minister between March 30 and April 6. It is hard to know if the parties will manage to forge a community of interest by then, but it is certainly a possibility that must be kept in mind.

Meanwhile, a Forza Italia/League tie-up would not be sufficient to achieve the 40% threshold, so a government cannot be formed by these two parties alone. During pre-election polls, Berlusconi’s party led the field, which gave him more weighting in the negotiations to appoint a prime minister, but the League has shot ahead, so a link-up now looks more difficult.

We can also expect a technocratic government with an agenda to reform electoral law and achieve political stability. This possibility would postpone the arrival of a populist government for 6 to 12 months.

Beyond this whole electoral circus, the real question now is how to stem the populist tide witnessed at this weekend’s election. We cannot expect more than 50% of the Italian electorate (we must also include the Brothers of Italy with 4% of votes) to be silenced by a reviewed voting system. This would be pie in the sky.

Voter participation came to 72.9%, which is the lowest since WW2, and compares to 75.2% in 2013 and 80.5% further back in 2008. This voter apathy has emerged against a backdrop of existing populist risk, so a fresh vote looks unlikely to spur non-voters into action, and it certainly wouldn’t be enough to rule out the possibility of another victory for populist parties.

So we should expect a populist government in Italy over the months ahead, as the traditional governing parties have failed. It is important to take on board the economic reasons behind this election result. GDP at end-2017 was still almost 15% below pre-crisis levels (1H 2008) and unemployment as measured by Eurostat came to 11.1% in January vs. on average 6.6% before the financial crisis (1H 2008). Meanwhile, the Italian economy has a fast-ageing population that is politically affected by the refugee crisis.

It cannot rely on the solutions of the past to drive fresh momentum: soaring inflation following by currency devaluation is no longer an option for Italian politicians to steer the economy.

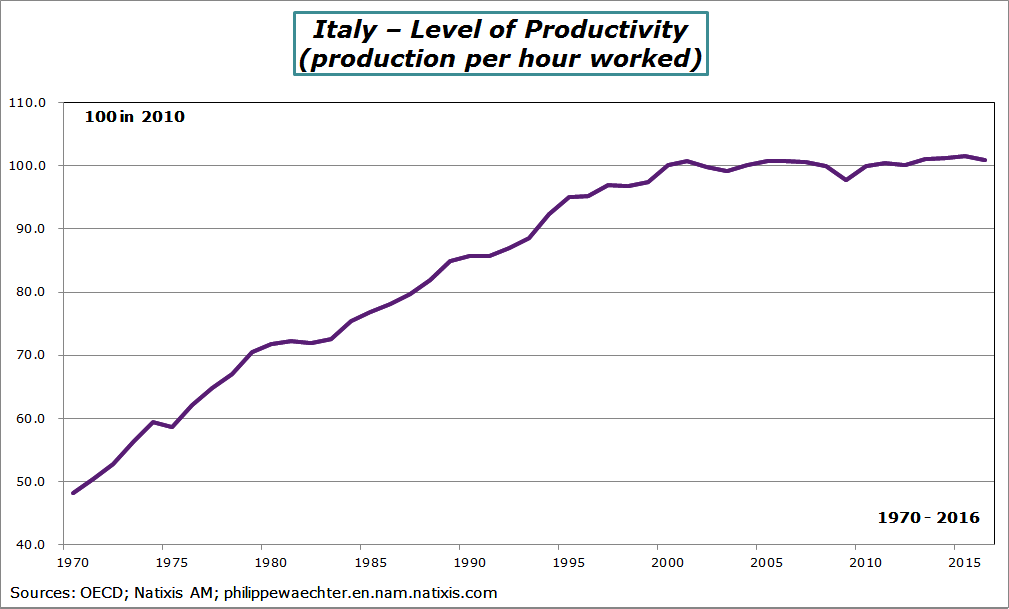

One explanation for this Italian malaise is productivity (production per hour worked), which has been lackluster since 2000 and the country has been unable to recover leeway in the way it manages the economy since then.

The key issue now concerns the ECB and the consequences on investor behavior. We should assume that the ECB will continue to safeguard the euro area in the short term as it has for a long time now, so near-term risk is low. But it will be a different kettle of fish if a populist government comes to power with the potential aim of taking the country out of the euro area.

The effects of this election on Europe and its institutions could be huge, as Italy is the third largest economy in the area and a populist government would have a massive impact on the future of European integration. Proceed with caution.

The implementation of import tariffs on steel (25%) and aluminum (10%) in the US reflects a poor grasp of the fundamental mechanisms of the economy within the White House.

By way of example, this kind of border tax was implemented during the Bush administration at the start of the 2000s and helped save 3,500 jobs for steel producers but led to between 12,000 and 43,000 job cuts in companies that required steel for their operations. The government at the time therefore backtracked as a result of the negative effects on companies and jobs.

Meanwhile, this hike in duties is set to have three effects: the first will be to protect local steel and aluminum producers as the tax will safeguard them from competition; secondly, this rise in duties for companies using steel and aluminum input in their production processes will however wipe out part of the tax cuts from Trump’s tax reform bill; lastly, it should have a negative effect on production for downstream sectors.

But the most astounding aspect of this move is that tariffs on steel and aluminum are set to hit a large proportion of the industrial and manufacturing sector where these products are required for production, pushing up costs with the risk of denting business and jobs in these areas. Yet Trump’s aim is just the reverse, as he wants to shield industrial jobs at all costs.

This is a further reflection of Trump’s view of the economy as a zero sum game i.e. one country’s loss is another’s gain. But the economy has never worked that way and expecting a tariff hike to automatically reallocate resources to the US is naïve. Trump sees the economy the way a company sees market share, but the economy does not operate like a company.

This view also fails to see that the US economy is part of a wider set-up, and assumes that all countries produce the same goods. This may have been the case in the past, but it is no longer true. In the past, taxing an imported foreign good manufactured from foreign materials rather than locally manufactured merchandise made from local materials looked like a feasible approach, and gave local products a competitive advantage. But no-one thinks the economy works this way today.

The danger of this type of move is that it can trigger retaliatory measures from the countries affected, but a trade war has no winners as it is damaging for all parties. Trump has threatened European carmakers with tax hikes if Europe retaliates, which would be ridiculous as all the large European carmakers have production facilities in the US, so once again this would be the wrong move to make. Let’s hope that the current administration will follow in Bush’s footsteps and backtrack.

Lastly, the cost per job saved is vast, estimated at $230,000 in the US, with sometimes higher amounts. The Obama tax on Chinese tires cost an estimated $900,000 per job, which is excessive and totally counterproductive.

Philippe Waechter's blog My french blog