Economists said after the referendum on Brexit that a temporary spike in the inflation rate could be expected due notably to the British currency depreciation.

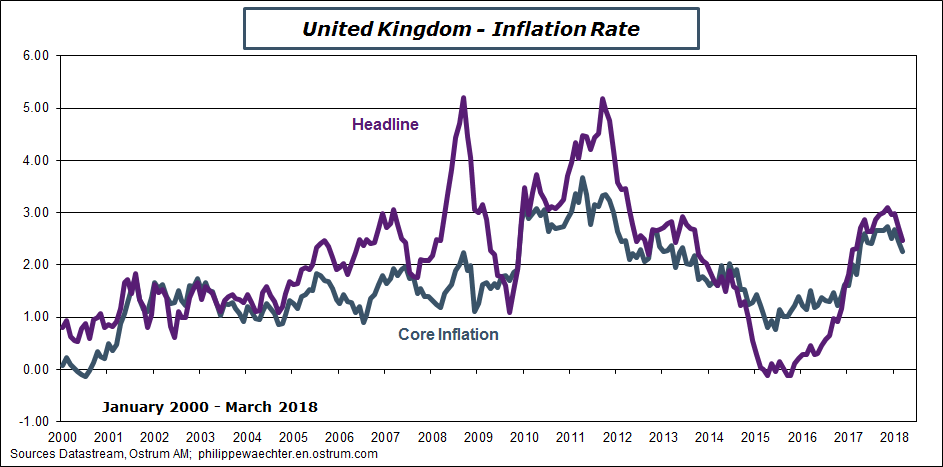

That’s what has happened with a peak in November 2017 at 3.1%. After this date, the inflation rate is receding at less than 2.5% in March 2018. The core inflation rate has followed the same profile with a current rate at less than 2.3%.

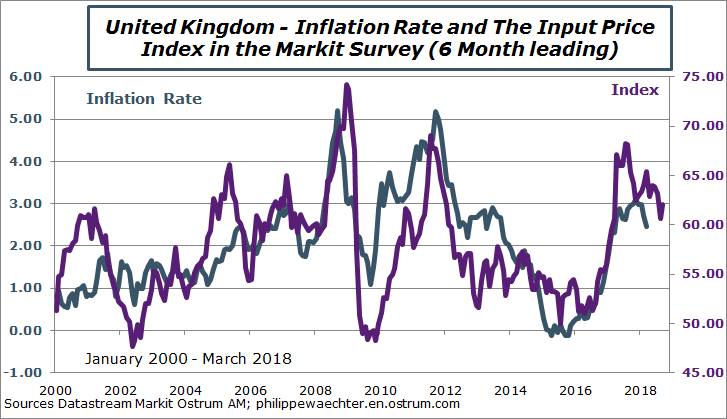

The price index in the Markit survey for the UK is a good leading indicator of the inflation rate. The index leads the inflation rate by 6 months. If we follow the relationship between the two indicators that has worked for the last 20 years then we can infer that the inflation rate will continue to recede.

What will happen on monetary policy side? As the inflation rate will converge to 2% during the year 2018 the best strategy for the BoE is to keep its current policy unchanged. It will also be positive for the economic activity.

Philippe Waechter's blog My french blog