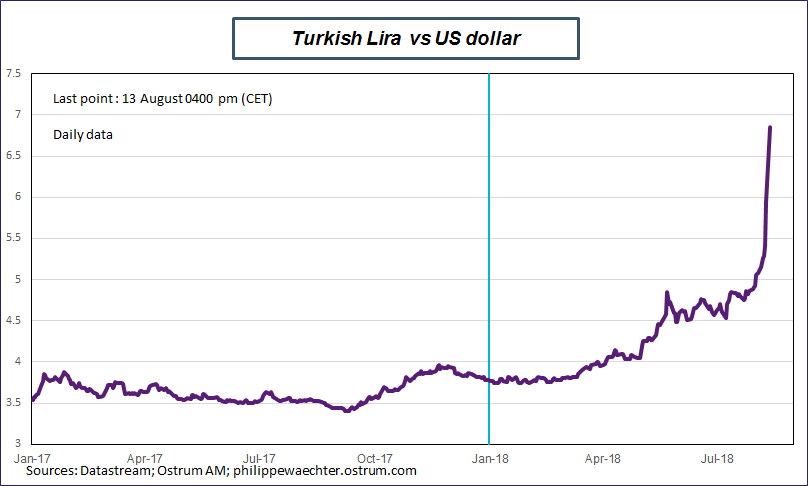

The sell-off on the Turkish lira continues. The exchange rate against the dollar was above seven (7.2 in Asia) last night, it it now at 6.85 (just before 0400 pm, Paris time today) while it was at just 5.15 a week ago.

The graph is impressive and shows that the situation has dramatically changed in recent days.

On Turkey there are many things to look at to understand the recent weakness.

1 – In many other emerging countries, the situation has changed in April when the US dollar went up as expectations on the Fed’s monetary policy changed. Emerging currencies became weaker.

2 – The direct consequence was capital outflows from emerging to the US and lower liquidity on fixed income markets. In many emerging countries interest rates, short and long, went up rapidly. I have written on this topic here and here.

3 – The story stopped there in many countries notably in Asia. The situation is less comfortable but manageable. For countries with deficit in the current account and large indebtedness in dollar the situation went worse. This was notably the case for Turkey but also for other countries like Argentina or Indonesia. I have written on Turkey here and here

In other words, the Turkish lira weakness seen after mid-April was just the result of a stronger dollar leading to an emerging crisis. The specific Turkish momentum came from large disequilibria (current account and dollar indebtedness) that reflect the economic policy of recent years.

The recent exchange rate profile came after tensions with the US but the currency was already weak for reasons explained above. Tensions have created a run, leading to a rapid depreciation.

Some remarks on the situation

1 – One interesting point is the possible new political statute for Turkey which used to be a strategic NATO country. With the White House retaliation measures, after the US pastor detained in Turkey and after the new tariffs on steel and aluminum, we can perceive that the US is ready to weaken the Turkish economic situation. This would not be consistent with a strong expected role in the western defense organization.

Turkey is probably not in the White House plan for the Middle East. As Turkey is partly European it is also a way for the White House to undermine the European construction. We know that Turkey is a source of strong disagreement within Europe and the possibility to create new divergences between Germany and France may not be a concern for Washington.

Erdogan has perceived that. He wants to develop Asian links to accelerate the stabilization of his country.

In other words, Turkey is facing a new equation to solve as its ally, the US, is no longer supportive enough and as Europe will not find an agreement on a rapid and possible integration into European institutions.

2 – This may be a deep change in the geopolitical equilibrium, the Middle East new equilibrium no longer goes through Turkey. This will necessarily imply new political goals for Turkey that could imply new risks for this party of Europe, with European countries unable to react collectively.

3 – Nevertheless, the Turkish reaction has not been convincing.

On one side the President Erdogan has a strong political view on what has happened and his different speeches are focused to his electoral basis. On the other the government’s plan has still to be announced.

In a crisis, a government must adopt measures that may deeply constrain investors while at the same time, there is the definition of new targets. Nothing of this has been shown by the government in Ankara. Expectations have not change.

During the week end, the finance minister has announced a plan for today (Monday). It is still to come. We can fear that the plan will be announced tomorrow, will be announced tomorrow, will be announced tomorrow…….

The President Erdogan doesn’t want to increase interest rates and has a message focused on the Turkish population, not on investors. He can’t change investors’ expectations which such speeches so these latter have no reason to change their attitude.

4 – In other words, in a crisis, the government role is to try to convince investors that they may lose money.

That’s the role of technical measures which can constrained investors and that’s the role of a new definition of the government target. If none of them is convincing it’s impossible to change investors’ mind then there is no reason to see a sudden stop in the crisis.

In the current case, the government plan has to be announced one day and Erdogan doesn’t speak to investors. Therefore, there are no reasons to see a rapid change.

That’s the real source of concern, the government doesn’t seem to know how to handle it.

5 – The central bank has decided to limit swaps to avoid speculation. That’s a measure that can work if it is complementary to other government measures. But alone, it can’t reverse expectations

6 – The sole way to stop such a crisis is a temporary capital control. In that case, rules can be changed without the market pressure. After this short period of time, new rules change investors’ behavior and if the calibration is correctly done, the crisis can end with the capital control period. The main problem is that the finance minister doesn’t want to use capital control. Therefore, such a measure may not be taken rapidly. The crisis has still some good time in front of it.

7 – The current crisis will have a large cost for Turkey as the currency depreciation will feed a higher inflation rate which will impoverish Turkish people, these people who has no dollar to swap for lira. Whatever the decision taken in Ankara the cost will be high and persistent.

Philippe Waechter's blog My french blog