Venezuela is in crisis. Its economic activity is collapsing, its inflation rate is skyrocketing and the value of its currency is falling like a stone. People are leaving the country as soon as possible as they perceive that there is no future.

People are starving. The average weight of the population is lower year after year. According to a Survey on Living Conditions (ENCOVI), the average weight of the Venezuelans was 11 kilos lower in 2017 than in 2016 and in 2016, 8 kilos lower than in 2015. That’s a real measure of a deep crisis. According to this survey, in 2014, people out of poverty represented 51.8% of the population. In 2017 it was just 13%. In other words, 87 % of the population was considered as poor.

When the oil price is high, as it was the case before mid-2014, the situation is manageable but as soon as it falls there are no capacities to create new revenues.

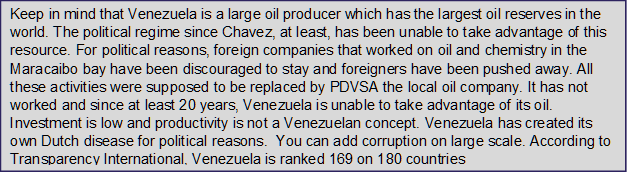

The real GDP level is now 40% lower than in 2015 and the inflation rate has an hyper-inflation profile. The cup of coffee with milk, reported by Bloomberg, shows how prices are slipping. The inflation rate is already forecast at 1 000 000% this year.

The Venezuelan currency was 10 for a dollar at the beginning of the year and is now almost 250 000 (official rate). During the week end, it has been devalued drastically by 95% against the US dollar. The new sovereign bolivar has a value of 6 000 000 for a dollar. At the same time, the currency (notes) has been re-denominated by lopping off five zeros and renamed as the sovereign bolivar vs the strong bolivar.

To compensate the devaluation, the minimum wage was increased by 3 500% to the equivalent of 30 USD per month. The VAT rate was up by 4%.

The question is about the efficiency of Maduro’s plan.

To sum up, there is a huge devaluation that will dramatically increase import prices and add up to the current inflation. That’s the road to hyperinflation.

The minimum wage increase is useless as the production has collapsed and the shops are empty. Therefore Venezuelans will not be happier even with a 3 500% increase of the minimum wage.

The two main weaknesses of the plan are related to the monetary policy and to a kind of commitment with the rest of the world.

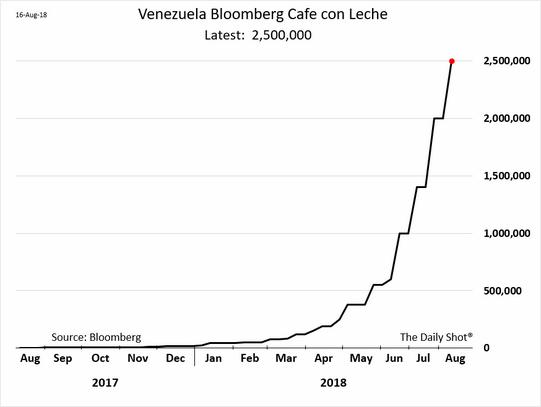

The amount of currency in circulation has jumped since the beginning of 2018 and is a real source of the hyperinflation. The equation is easy to understand. The central bank prints more and more a currency that no one wants to hold. As there is no productive counterpart, the internal price of the currency decreases rapidly producing hyperinflation. That’s a dynamics that is always seen during hyperinflation episode.

I haven’t seen any commitment from the central bank or from the government that could change expectations on their behavior. Since the beginning of 2018 the amount of currency in circulation has increased dramatically as it is shown on the graph. There are no commitments to a reversal of this trend.

The most relevant conclusion is that no one will want to change his behavior and no one will want to hold this currency. The hyperinflation regime will continue.

In previous episodes of hyperinflation, the necessary instrument to stop such a negative dynamics is to commit with external institutions. Commitments can be a source of credibility if the economic policy is conditioned by these commitments. It’s a source of macro stabilization and that’s the reason of its usefulness.

In other words, if commitments are credible and enforced by the government then expectations change and behaviors change. If the economic policy becomes credible then we can expect new trade relations with other countries that will constrained the country that have the hyperinflation episode. Seeing that the government respects its commitments, foreign investors and people can change their perception of the country leading to a new profile and a stronger trajectory.

Thomas Sargent has discussed a lot of these episodes of the 1920’s in Europe. In his analysis, these commitments were essential to stop hyperinflation. With Venezuela there is no such commitment. Maduro has even said that he didn’t discussed with the IMF and that he didn’t want it to be involved in the process.

The fact that the new sovereign bolivar will be backed by a cryptocurrency (the petro) is not credible. We just have to wait that the exchange rate change between the two currencies.

The Venezuelan government has created conditions to mimic Germany in 1923 and the measures announced this week-end will not end the current crisis, they can rather accelerate it. We can expect more people leaving Venezuela and a new episode of hyperinflation. Poor Venezuelans.

Philippe Waechter's blog My french blog