Since the referendum on Brexit in June 2016, the dynamics of the British economy have been shrinking. Evidenced by the slowdown in growth in 2018 to 1.4%, the slowest pace since 2012 and a pace, as in 2017, slower than the Euro zone and France.

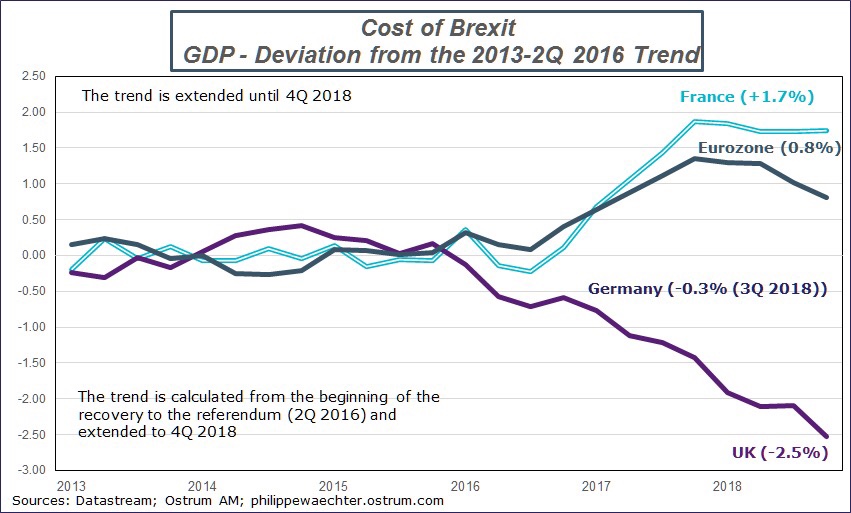

To fully appreciate the divergence between the United Kingdom on the one hand and France and the euro zone on the other, I calculated a trend starting in 2013 (beginning of the recovery everywhere) and ending in the second quarter of 2016 at the moment of the referendum.

The trend of each country is then extended while retaining the initial parameters. I then calculate the deviation (in%) of GDP to this trend. These are the three curves on the graph.

The UK curve is 2.5% below its pre-referendum trend. The cumulative difference since the choice of the British reflects the cost associated with it even before the Brexit is formally established (March 29, 2019 theoretically).

At the same time, the acceleration of growth in the eurozone and in France throughout 2017 marks these two countries, above their trend. France is 1.7% above the trend and the euro zone 0.8%.

Despite being the UK’s largest trading partner, European expansion has not benefited the UK. This is a very disturbing element.

Nevertheless, the expected slowdown in eurozone growth, beyond the effects of Brexit, should weigh on the economic situation across the Channel and increase, ex post, the cost of the referendum.

Philippe Waechter's blog My french blog